The wait is finally over. After prolonged deliberations, the National Association of Insurance Commissioners (NAIC) adopted new Risk-Based Capital (RBC) C1 investment risk charges in June 2021. These factors are being implemented for year-end 2021 filings for life insurers. For property and casualty as well as health insurers, their current RBC investment factors continue to apply until further guidance from the NAIC.

These new C1 capital charges are developed based on the historical default probability and loss recovery experiences of corporate bonds; however, they will apply to other fixed income securities including municipal bonds, structured securities, and private placements as well. In addition to these base C1 factors, there continues to be portfolio adjustments to reflect company-specific portfolio characteristics. Our capital efficiency illustration below focuses on the base C1 factor without applying company-specific portfolio adjustments.

NAIC RBC C1: New vs. Current

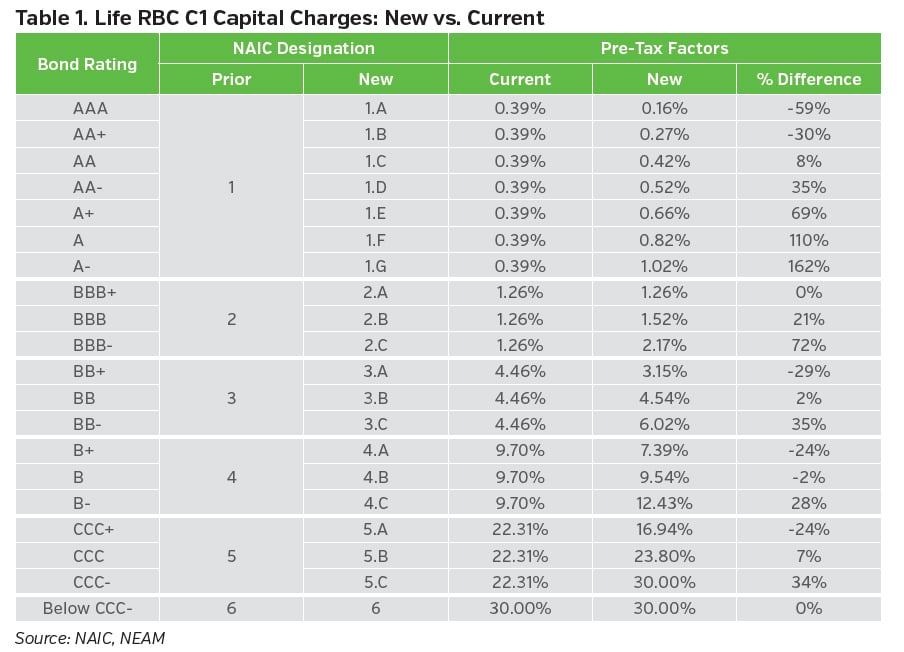

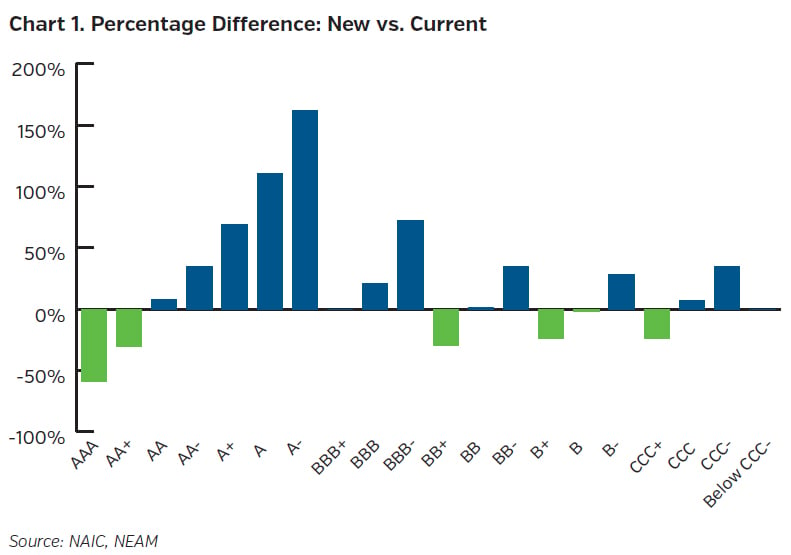

Table 1 shows how the new RBC C1 charges have expanded from 6 to 20 rating categories. The new C1 factors distinguish the underlying default risk at a more granular rating level than before. Chart 1 demonstrates the percentage differences between the current versus new C1 charges. The most notable changes are within the NAIC 1 category (i.e., AAA, AA, and A ratings), where the charge for AAA was reduced by 59% while the A- charge increased by 162%. Given the wide variations of capital charge changes within the NAIC 1 category, there could be opportunities to potentially enhance capital efficiency through repositioning bonds among the AAA, AA, and A rating categories.

CAPITAL EFFICIENCY IMPROVEMENT OPPORTUNITY?

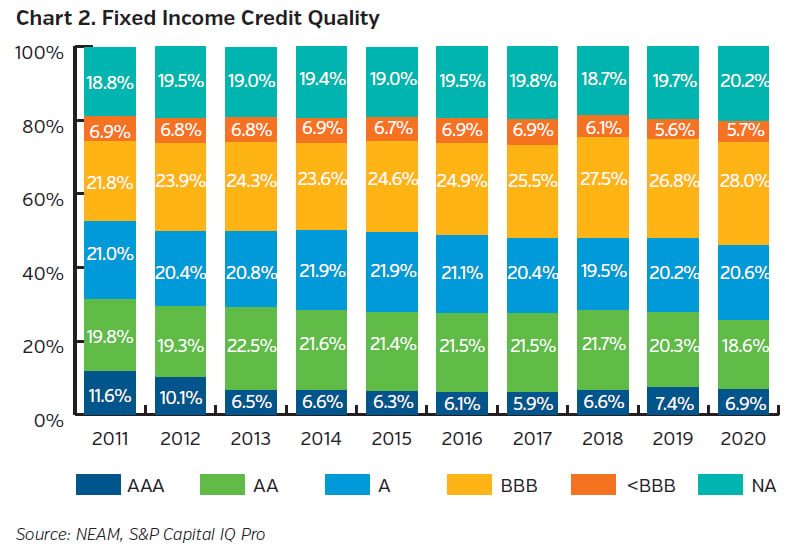

The U.S. life industry invests nearly 70% of its assets in bonds. Within the fixed income portfolio, A and BBB rated bonds account for the majority, while AAA rated bonds represent a relatively small percentage (see Chart 2). The NA category here consists of mostly “true”1 private placement securities and about half these bonds fell into the BBB (NAIC 2) rating category.2

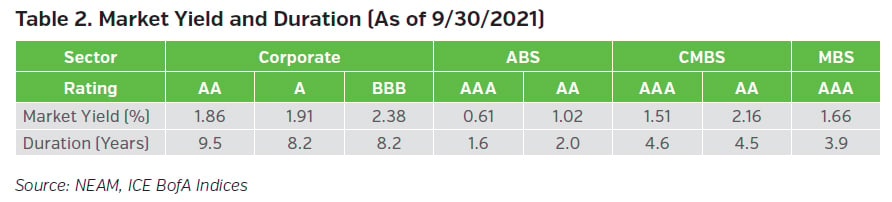

To illustrate opportunities to potentially enhance RBC capital efficiency for life insurers’ bond portfolio, we consider the impact of repositioning between corporate bonds and structured securities given their unique profiles. Structured securities, relative to corporate bonds, tend to exhibit higher credit quality and shorter durations. Within the broad category of structured securities, Asset Backed Securities (ABS), Commercial Mortgage-Backed Securities (CMBS) and Mortgage-Backed Securities (MBS) are the main sub-sectors, and each has distinctive return and risk characteristics. In the following analysis, we use the average rating, market yields and durations of the broad market indices (ICE BofA) for the respective corporate bonds, ABS, CMBS and MBS as of end of September 2021 (see Table 2).

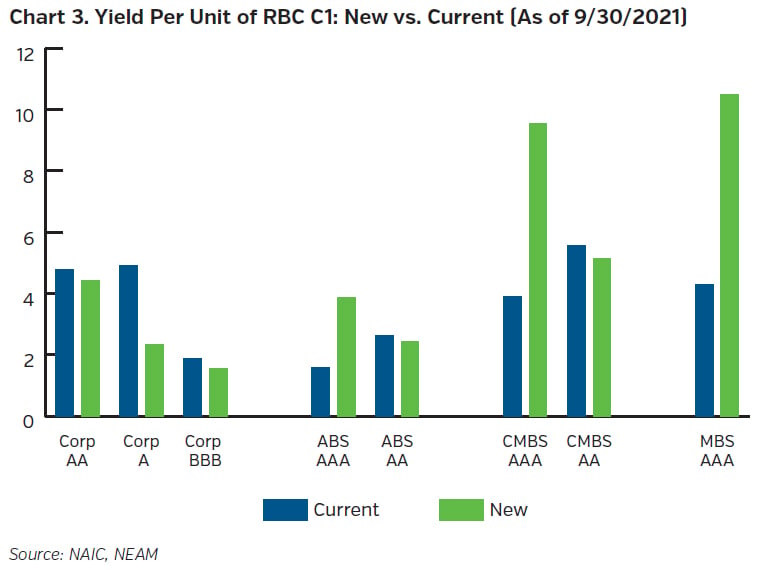

Based on the prevailing market yields and credit ratings (Table 2), we calculate the current vs. new “yield per unit of RBC C1 charge” for these four sectors (Chart 3). As indicated in the capital charge percentage difference summary shown in Chart 1, AAA rated bonds appear to offer the largest opportunity to improve capital efficiency. ABS AAA, CMBS AAA and MBS AAA all show significant improvement of the yield per unit of RBC under the new C1 charges (Chart 3).

Although MBS show a relatively higher yield per unit of RBC, their negative convexity risk needs to be assessed within the context of a life insurer’s asset liability management strategy. Generally, life insurers’ liabilities tend to exhibit “positive” convexity and the consequence of utilizing “negative” convexity MBS to support its “positive” convexity liabilities should be carefully assessed.

Another important ALM consideration is that structured securities typically have shorter durations than corporate bonds (Table 2). Given the current economic and monetary policy backdrop, interest rates are more likely to rise rather than to fall in the near future. It may make sense for insurers to marginally allocate to short duration fixed income securities in order to preserve flexibility in the event of a rising rate scenario.

KEY TAKEAWAYS

- Newly adopted RBC C1 factors differentiate capital charges by 20 instead of the current 6 rating categories. They are being implemented for the year-end 2021 filings for life insurers while health and P&C insurers are subject to their current RBC factors until further guidance from the NAIC.

- Structured securities, under the new RBC C1 charges, might offer potential capital efficiency improvement opportunities for life insurers. ALM implications and consequences, however, need to be understood.

- The current low rate and tight spread environment might warrant diversification of corporate bond portfolios and marginal asset allocations to short-duration and high-quality fixed income securities for life insurers.

We welcome your feedback and comments. NEAM believes a holistic EBAA™ process, in conjunction with ALM optimization analysis, would help insurers to evaluate the implications of the new RBC C1 while identifying opportunities to potentially enhance their risk-adjusted returns. Please contact us for more information and a customized analysis.

Endnotes

1 “True” private placement category excludes any 144A securities that are publicly traded.

2 Please see NEAM Perspectives – 2020 U.S. Life Industry Investment Highlights. August 2021.