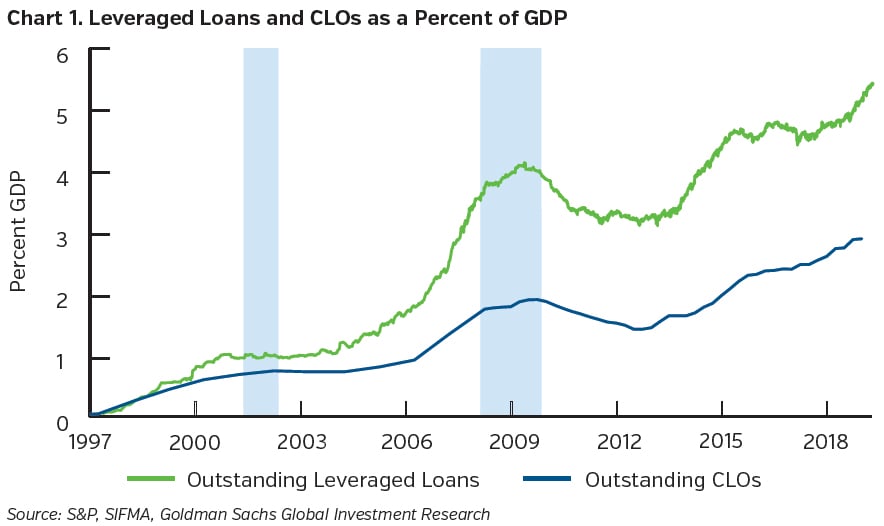

Observed trends in leveraged loans and their securitized counterpart (Collateralized Loan Obligation or “CLO”) have garnered the attention of the financial press, politicians and rating agencies. While leveraged loan terms and quality have weakened, references to a potential repeat of the Great Financial Crisis (GFC) exaggerate the risk of contagion to the broader financial markets and underestimate the protections afforded to investors in senior CLO debt tranches.

As we sit in the later stages of the economic cycle and market prognosticators try to anticipate the next culprit that will plunge the U.S. into recession, leveraged loans emerge as an easy target:

- Rapid growth in issuance fueled by CLO creation, mutual funds and ETFs

- Deterioration in lending standards, including a preponderance of “cov-lite” loans (those lacking financial maintenance covenants), EBITDA* add-back adjustments and “asset stripping” provisions

- Decline in the rating profile of the leveraged loan universe (proportion rated “B2” or lower at 64% in 2018 vs. 47% in 2006, according to Moody’s)

- Debt proceeds increasingly used to fund LBOs, dividends and share buybacks

- Rising percentage of companies issuing debt at a 6x or higher leverage ratio

- Increase in “loan-only” structures with less subordinated debt thereby reducing the loss cushion for senior secured lenders

- Changes in the market structure (from banks to institutional investors) could reduce regulators’ ability to address financial system risks; CLOs own ~60% of the loan market

*Earnings before interest, taxes, depreciation and amortization

Taken together, these trends do not bode well for the next default cycle. A study by Standard & Poor’s concluded that cov-lite loans recovered an average of 72% versus 82% for non cov-lite loans for entities that emerged from bankruptcy between 2014 and 2017. Additionally, a future default cycle could be more protracted if these weaker covenants fail to bring borrowers promptly to the negotiating table.

CLOs, in their own right, comprise a large and growing market. We are reminded that complex, illiquid and highly-leveraged securitizations contributed to (or caused) the GFC. How should we view the prospect for CLOs in the context of a potential major market credit reversal?

- CLOs represent a stable source of term funding (typically 6+ years); the assets are not marked to market.

- CLO structures are dynamic, with numerous protective provisions and limits. Overcollateralization tests, if breached, cause subordinate cash flows to be redirected to senior note redemptions.

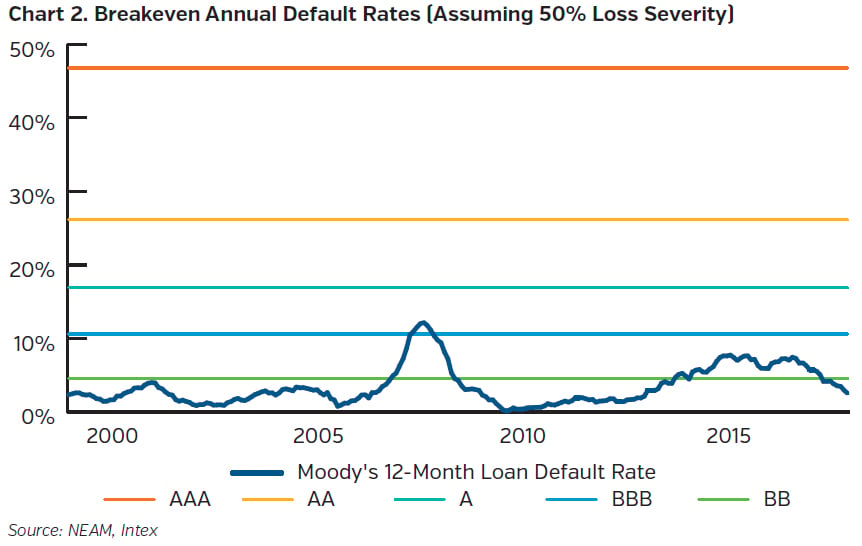

- As a result of these features, there were no losses of principal to CLO classes rated AAA and AA during the financial crisis. Furthermore, interest on classes rated AAA and AA is not PIK-able (paid-in-kind).

- Structural protections have improved compared to pre-crisis levels. The average percentage of credit enhancement has increased by 5 and 10 percentage points for AAA and AA rated classes, respectively. Quality and exposure limitations are also tighter.

- As compared to peak defaults in 2009, CLO classes rated AAA and AA can withstand multiple levels of loss (see chart below).

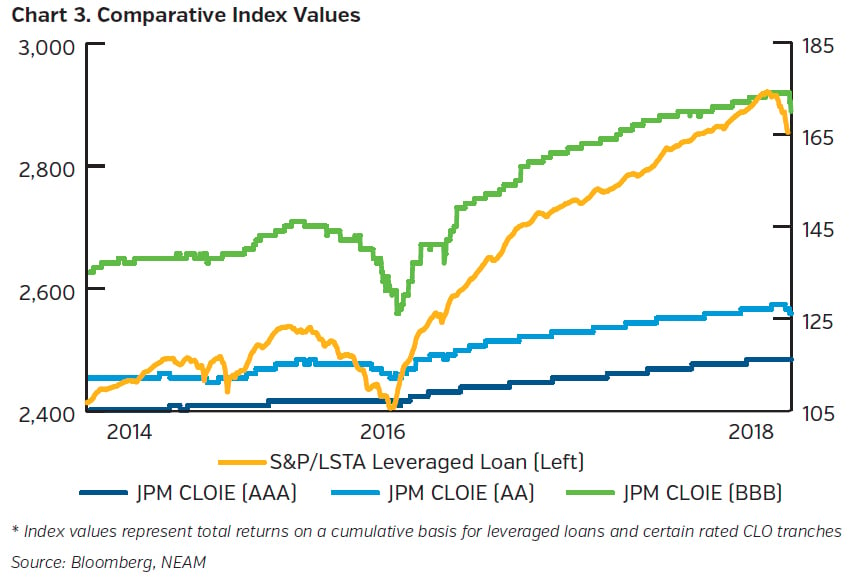

Total returns for both leveraged loans and CLOs have been impressive in 2018, driven by demand for floating-rate instruments in a rising rate environment (see index returns in Chart 3 below). Future returns will depend on the path of, and expectations for, interest rates, economic growth, inflation, and timing of the next recession. Those expectations can change quickly. Leveraged loan prices fell sharply during the month of December as the market perceived the Fed as shifting to a more dovish stance. Large loan fund outflows followed. In contrast, the more highly-rated portions of the CLO structure have been far less volatile than loans historically, though BBB rated CLO tranches have exhibited even higher volatility than leveraged loans. We should also bear in mind that, while CLOs are a short interest duration asset, they nonetheless have spread duration reaching 5+ years.

Relative to risks to the financial system, bank holdings of leveraged loans are relatively small (estimated at ˂5% of outstanding leveraged loans). Upwards of 90% of leveraged loans are held by institutional investors. While banks invest in CLOs, their participation is concentrated in the AAA-rated portion of the capital structure. Importantly, both Tier 1 capital and capital-to-asset measures for banks in developed countries have been substantially bolstered since the financial crisis.

Key Takeaways

- Negative trends in the leveraged loan market could lead to a more protracted default cycle and lower recovery rates than in the past.

- Post-crisis CLO structures have improved quality tests, exposure limits and credit enhancement. Historically, there have been no losses of principal to CLOs rated at AAA and AA rating levels and these tranches can withstand substantial default stress scenarios.

- NEAM has positioned portfolios in favor of the more senior (non-PIKable) tranches in the CLO capital structure. Relative to more junior tranches, these securities exhibit lower volatility, lower spread duration and credit enhancement structures that have been tested through multiple credit cycles.

- Financial system risk due to leveraged loans and CLOs appears to be limited and will most likely be felt by the more subordinated classes in the CLO capital structure.

- CLOs have performed well as interest rates have risen, and we remain comfortable with their current credit protections. Going forward, however, we are likely to allow CLO exposures to run off in favor of other fixed rate opportunities as the credit and interest rate cycles mature.