The Fed and Inflation

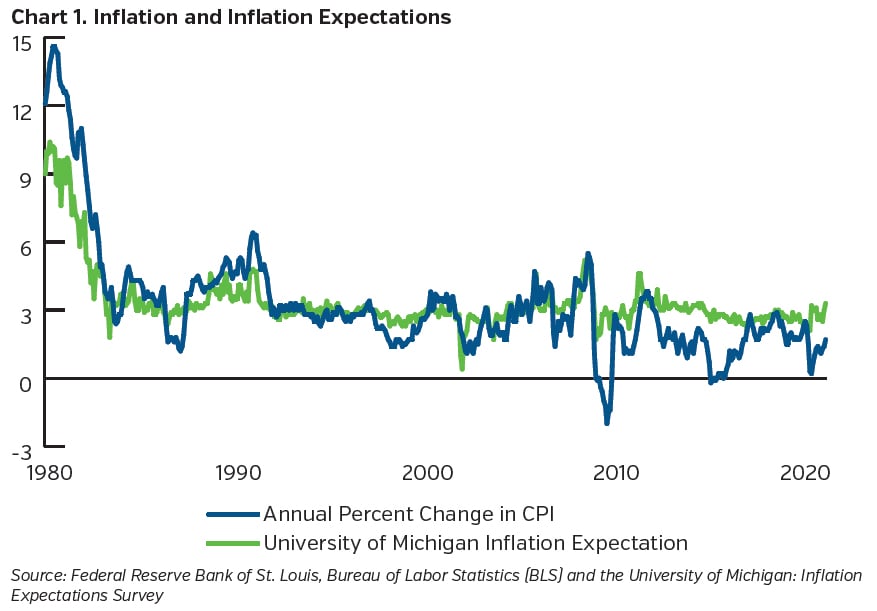

In 1979, annual inflation rates were north of 10% and rising when Paul Volcker, then Chairman of the Federal Reserve Board, took action to attack the problem. On the heels of an unscheduled Federal Open Market Committee meeting, Volcker announced a change in Federal Reserve policy designed to rein in inflation. By early 1980, the Fed Funds rate peaked at a record high of 20% and inflation crested at just under 15%. This series of Fed actions confirmed the Fed’s independence, firmly established its inflation fighting credentials and ushered in an era of low and stable inflation rates.

The forces of globalization and productivity improving technology have helped to extend this disinflationary period and to keep inflation and inflation expectations well anchored to the current day. Should insurance companies be concerned that the pandemic and its aftermath will upset the benign inflation environment we have grown accustomed to?

The Pandemic’s Impact on Inflation

The COVID-19 pandemic has caused seismic shifts in our economic landscape, bringing changes to the way we work, shop and live along with significantly influencing the evolution of monetary and fiscal policy. At this point, it is hard to discern what, if any, long lasting impact on inflation there will be but the risks of higher inflation are mounting.

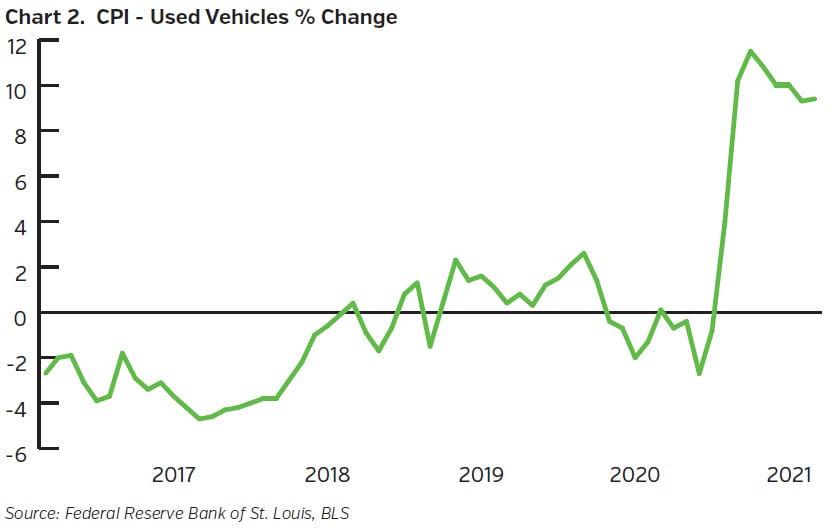

In the near-term, the current state of the pandemic is certainly going to exert upward pressure on inflation readings. The combination of base effects (easy comparisons to last year’s deflationary numbers in the first few months of the pandemic) and altered supply-demand balances are likely to translate into Consumer Price Index (CPI) figures well above the Fed’s 2% target in 2021. The base effects are clearly temporary (and transitory to use the Fed’s language) but altered supply-demand dynamics are more concerning. The accelerating reopening of the economy is creating an environment where surging demand is colliding with pandemic related dislocations in supply chains, resulting in many product markets characterized by order backlogs, slowdowns in supplier deliveries and low inventory levels - a recipe for rising prices.

Consider the auto sector where inventory levels were especially lean even before the supply of new vehicles was disrupted by semiconductor shortages. With urban flight and a shift away from public transportation, demand for new and used vehicles is robust. These conditions have translated into rapidly rising prices, particularly in the used vehicle market.

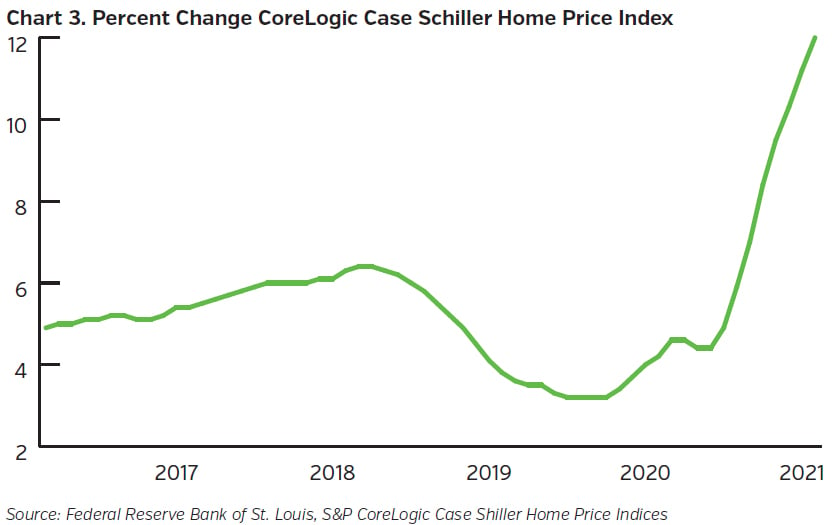

Another market sector that has been heavily impacted by the pandemic and has the potential to bring pressure to CPI figures is the housing industry. Coming into the pandemic, the inventory of single-family homes for sale was already in a steep decline, having peaked at 3.7 million units in 2007 and declined to just over 1.0 million units by 2020. This supply situation was exacerbated by the halt in construction in many locations and the shortage of materials brought on by the pandemic. With renewed demand and an increase in household formations, the supply demand-imbalance in the housing market has become particularly pronounced and house prices nationwide are increasing at double digit rates. While home prices are not directly included in CPI, the rental equivalent is, so the price increases we are seeing today will ultimately flow through to CPI as “shelter” expense and this accounts for approximately 30% of total CPI.

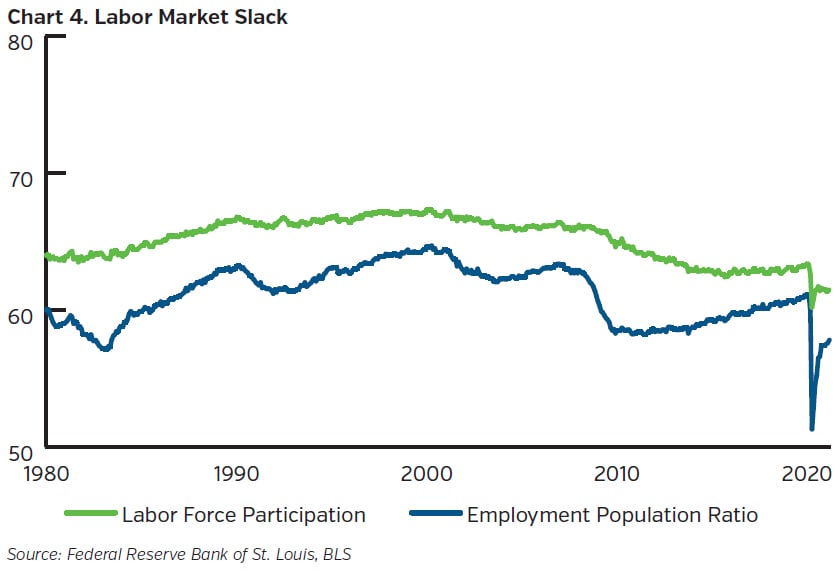

While these supply-demand imbalances are concerning, they are not likely to permanently alter the overall inflation dynamic in the economy. Producers will respond to the surging demand with additional supply. Price changes may be elevated for a period of time as higher input prices are passed through to consumers but as supply chains are opened up and order backlogs are worked down, we are likely to see price stabilization set in. It is more likely that labor market dynamics and wage growth will determine whether inflationary pressures rise more persistently. On this front, there is still a significant output gap as measured by the percentage of the population employed or in the labor force. The U.S. currently stands at multi decade lows on each of these metrics, indicating plenty of capacity for additional supply of labor and reason to believe that sustained wage increases are an unlikely catalyst for persistent inflation for the time being.

An additional implication of the pandemic with the potential to upset the prolonged era of inflationary calm is the evolution in the approach to both monetary and fiscal policy that we are seeing from our government authorities. With the adoption of a flexible average inflation targeting policy, the Fed has expressed a willingness to experiment with above target inflation rates while pursuing more broadly defined employment objectives. This is a meaningful shift from a regime that has generally been proactive with respect to inflation risk to one that will be more reactive. In addition, U.S. lawmakers are poised to push the envelope in terms of acceptable levels of fiscal deficit spending. This has not gone unnoticed by markets as inflation expectations have ticked up, but overall, inflation expectations remain well anchored.

In summary, our view is that the current inflationary impulse will be temporary as base effects recede and the supply side of the economy recovers to meet the renewed demand. However, the longer-term probability of inflation has risen. Over time, the fiscal and monetary policy shifts along with structural changes in our economy (slowing growth in working age populations, reshoring of supply chains, etc.) have the potential to transform the inflationary tendencies of the economy to the upside.

Inflation Risk and Insurance Company Investment Strategy

Within the context of an insurance company, the potential for rising inflation is problematic as it could degrade an insurer’s ability to generate an attractive return on equity by pressuring loss costs higher while, at the same time, eroding the real return on core fixed income assets which are the largest portion of a typical insurer’s investment portfolio. The appropriate strategy consideration in the face of this mounting risk is to evaluate the existing asset allocation to insure there is an appropriate commitment to assets that may benefit from higher levels of inflation. In particular, common stocks have shown a negative correlation with bonds during periods of rising inflation.

Key Takeaways

- The reopening of the economy will pressure inflation readings in 2021 due to base effects and supply demand imbalances but these pressures are likely to be transitory.

- Labor market dynamics are more likely to drive persistent inflation pressures but significant labor market slack exists today.

- The changing approaches to Fiscal and Monetary policy are contributing to conditions that raise the risk of a resurgence of inflation over time.

- Insurance companies should evaluate their asset allocation to ensure a commitment to assets that may benefit from higher levels of inflation.