As news of the Omicron variant spread the day after Thanksgiving 2021, it was hard not to have flashbacks to the 1993 Bill Murray movie Groundhog Day. “This can’t be happening again,” was a popular phrase heard throughout the world. As disappointing as it is to see another highly contagious Covid variant emerge, it does set the stage for what could become the norm in 2022. The (hopeful) transition from pandemic to endemic in 2022 may coincide with a series of rolling Covid variant outbreaks. With that in mind, how does one position investment portfolios for insurance companies when the next round of volatility and uncertainty could be right around the corner? Are there portfolio strategies in a Covid world that historically would not be inflected in insurance company portfolios? First, let’s take a quick look at our economic outlook for 2022.

2022 Economic Outlook

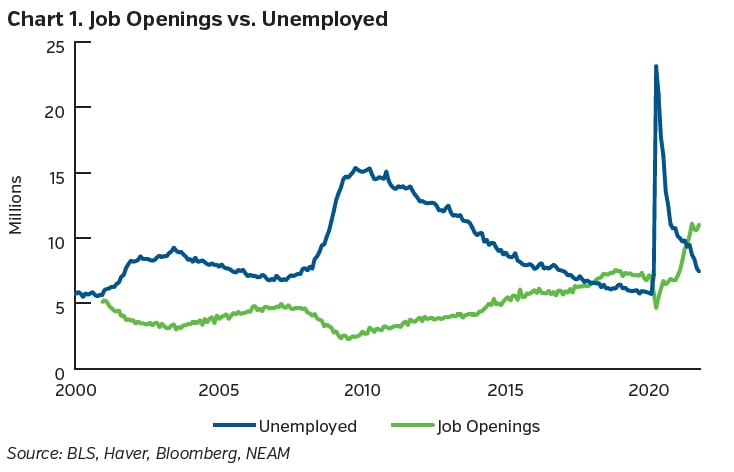

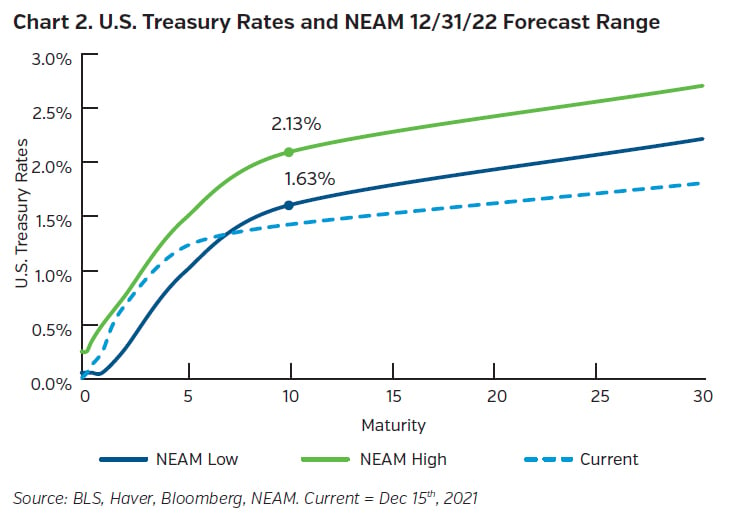

As we turn the calendar to 2022 we find ourselves confronted with the highest inflation rate in 40 years, a very tight labor market reflected in the fact that more jobs are available than unemployed people to fill them (Chart 1), and a more hawkish Federal Reserve. Our base case forecast for 2022 is for supply chain disruptions to ease in the second half of the year as major ports work through backlogs and shippers enter a seasonally slow shipping period. Labor markets, especially at the low wage end in many service sectors should continue to be faced with a supply demand imbalance as the economy continues its recovery. Wage pressures will likely persist and in conjunction with still higher levels of overall inflation, should force the Fed to move short rates higher in 2022. Chart 2 reflects our views for a flatter U.S. Treasury curve by the end of 2022 with modestly higher absolute rates.

Liquidity

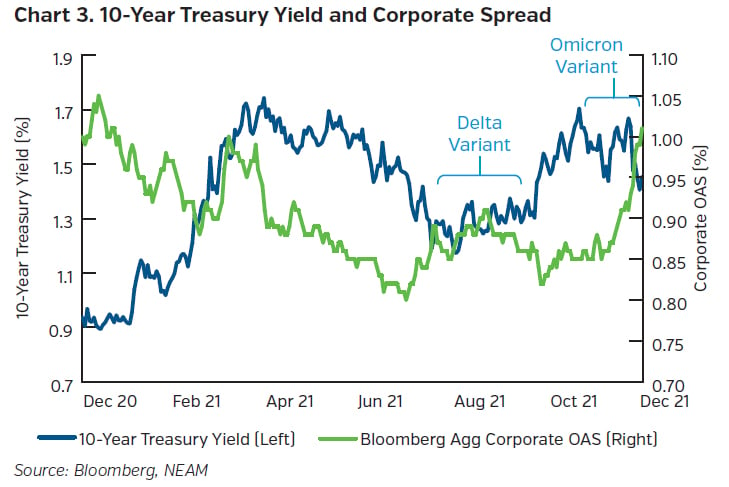

One lesson we have learned over the last 20 months is that news of a new Covid variant outbreak is met with increased volatility and temporarily diminished liquidity in the capital markets. Chart 3 reflects spread volatility in investment grade corporate bonds after the announcement of the Delta and Omicron variants. What might happen if the next variant is a “super variant” that reaches outside of the current vaccines available and results in a resurgence in hospitalizations and deaths? Having access to cash or available liquidity facilities will be paramount should the need arise to raise cash. One of the most cost-effective ways for an insurance company to do this is by becoming a member of the Federal Home Loan Bank System. We have called attention to this program for years and this could be an opportune time to begin the membership process. Advances can be used for a variety of needs and provide a ready source of liquidity. A Covid driven spike in illiquidity and volatility can be an optimal time to draw on an FHLB liquidity facility, avoiding selling securities at a loss and realizing capital losses. Remember, interest is only paid on advances when drawn. No fee is charged on the “unused” balance of the facility.1

Allocation to Structured Securities

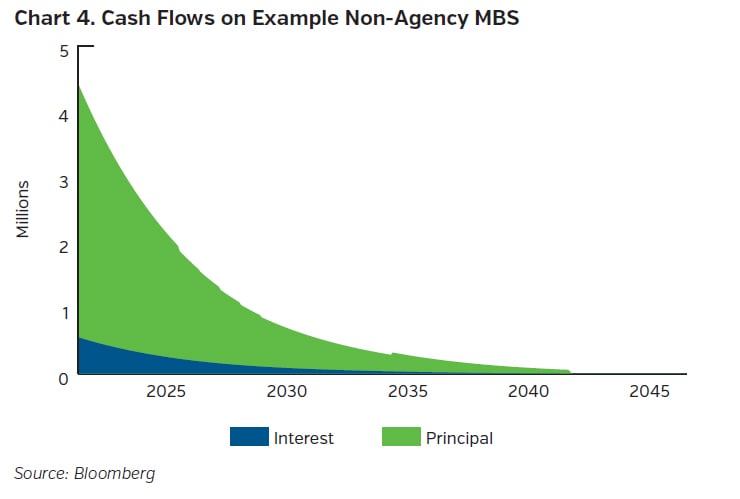

Given our interest rate outlook for 2022 is for a modest increase in interest rates with a flattening bias in the short/intermediate part of the Treasury curve, the opportunity cost in holding cash will remain high. Increasing the use of high-quality monthly amortizing structured securities can be a highly efficient strategy to build cash flows in a portfolio should another Covid outbreak emerge. The structured securities market is highly diversified across asset types from plain vanilla agency MBS to asset classes such as timeshares, whole business securitizations (i.e. franchise loans) and aircraft lease securitizations. In addition, this market allows for the investment in floating rate securities which can be very attractive in a rising interest rate environment. Chart 4 reflects an example of the immediate monthly cash flows on a recent non-agency residential mortgage bond.

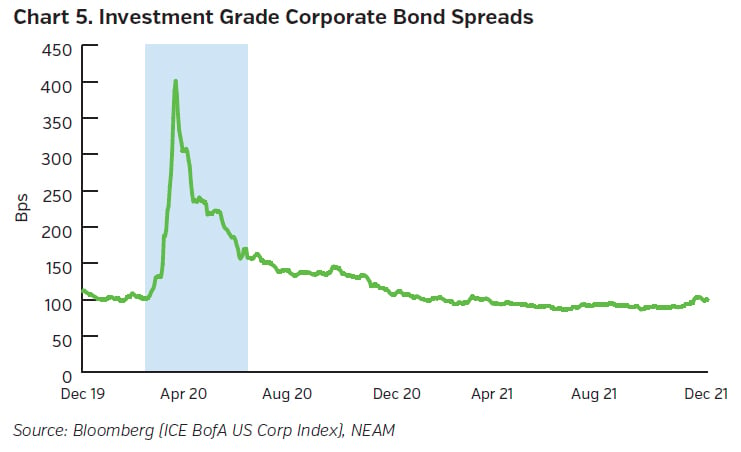

Keep Some Powder Dry

When Covid hit in February 2020, fixed income spreads gapped out quickly but the buying opportunity was very short lived. Chart 5 shows that by the end of May 2020, spreads had retraced a significant amount of the spread widening since the highs on March 23. The last 21 months have been marked by very strong technicals and rare spread widening opportunities outside of the Delta and Omicron outbreaks. Opportunities in these markets go to those who can react quickly and are able to deploy cash on a moment’s notice.

Key Takeaways

- Given the low vaccination rates in many parts of the emerging world, there remains a high probability we will experience additional Covid variant outbreaks in 2022. Insurance companies need to be prepared for the spikes in volatility and illiquidity that accompany these outbreaks.

- The Federal Home Loan Bank Advance program is a very cost-efficient source of liquidity for an insurance company. Over one third of NEAM clients are FHLB members and we stand ready to assist with the membership process for those insurance companies considering membership.

- Increasing the allocation to structured securities can be an efficient strategy for building liquidity in an insurance company portfolio. High quality, monthly amortizing securities can be a very attractive alternative to holding large amounts of cash. In addition, in an increasing interest rate environment, floating rate structured securities would be an attractive alternative to similar fixed rate investments.

- Buying opportunities in spread product can be short lived. Keep some powder dry to take advantage of any dislocations in valuations for fixed income spread product.

Endnote

1 There are many conditions to borrowing from the FHLB, and not all insurance companies will qualify. A qualified insurance company must, among other things, become a member by purchasing stock from the FHLB, which is not freely transferable and pledge securities in excess of 100% of the amount borrowed. Activity-based capital requirements at time of investment also apply. These financial commitments may impair an insurance company’s ability to meet other obligations or make other investments. Also, the addition of assets without additional capital can impact a company’s overall financial profile.