Bond yields remain challenged in the major currencies and investors continue to face low yields across sectors in the investment grade universe. Few markets are impacted as severely as the European bond market where short-term underlying rates remain negative, slowly eroding earnings and almost guaranteeing a negative return.

With this in mind the search for higher yielding (and positive) paper remains strong with many euro-denominated insurers considering non-traditional sectors such as high yield debt and others content to take exposure in a foreign currency.

Embarking on investment in a new sector brings its own challenges and moving away from a domestic currency market brings further complexity. Are the new markets well understood and is there a comfort level for investment groups making this move? What are the regulatory capital considerations? What are the additional risks being taken and how are these being measured?

In this issue of Perspectives, we address these questions and explore other issues that impact bond holdings, Solvency II and infrastructure investments.

U.S. Dollar Denominated Bonds for Investors

Over the past few years, many European investors have increased their holdings in U.S. dollar (USD) denominated bonds in an attempt to enhance the yield on their portfolios. In many cases, this is easily achieved by switching exposure within the same credit, i.e., taking exposure to the name in USD rather than Euro dollars (EUR). As a result, the underlying risk-types remain and little or no changes are required to the sector or rating aspects of the investment guidelines.

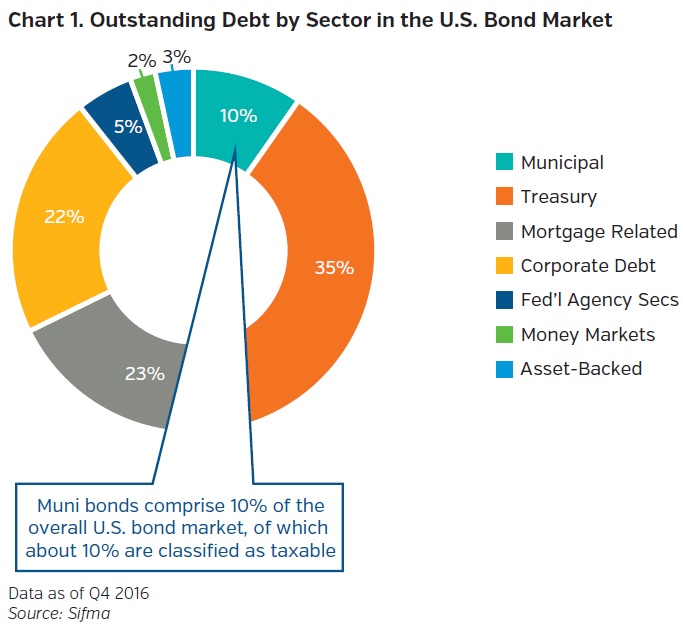

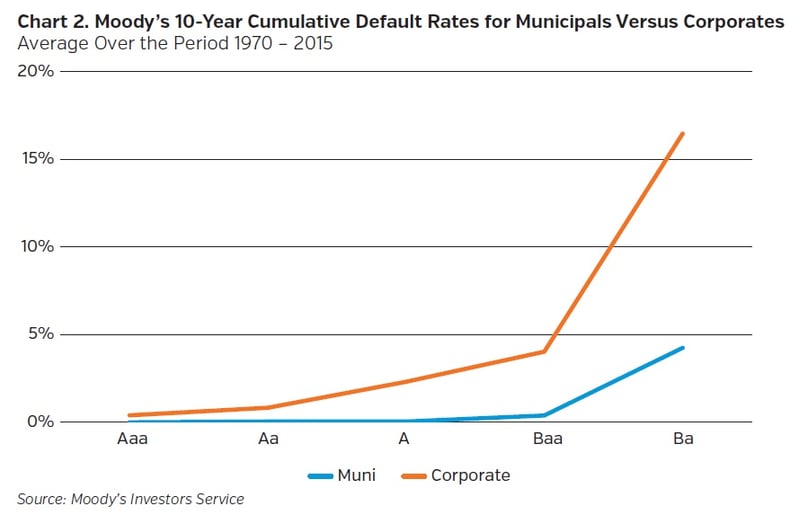

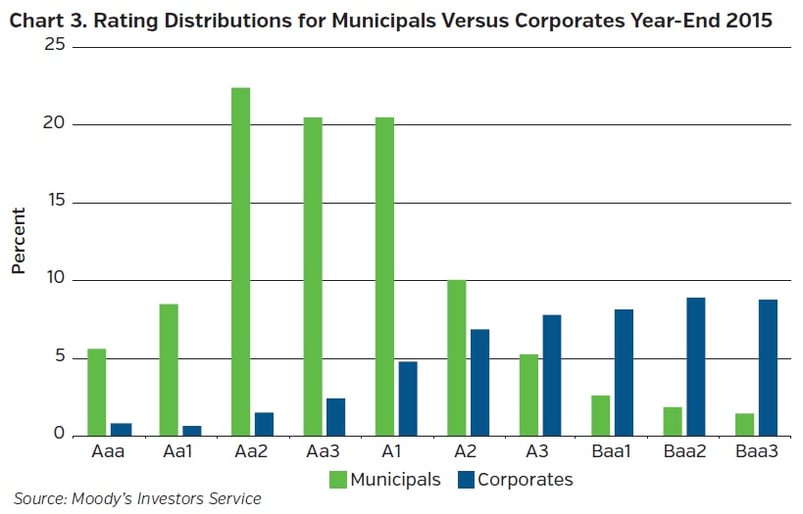

As illustrated, the U.S. municipal bond market is the fourth largest sector, and the next largest to corporate debt. Thus, for non-traditional USD investors wishing to take exposure beyond corporate credit, the U.S. municipal bond market is an option. Though less well known in Europe, the U.S. municipal bond market is typically attractive to insurance investors due to its yield levels, long duration, and high-rating profile. Chart 2 compares the corporate and municipal bond market default rates per rating cohort and Chart 3 shows the two sectors again by rating distribution. In both, the municipal bond market compares favorably with lower default rates and a higher average rating quality.

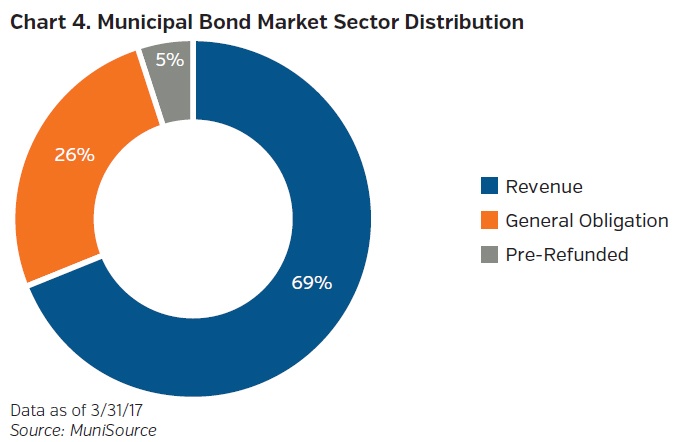

Municipalities can either issue debt classified as taxable or tax-exempt. Municipal bonds are categorized depending on how the bond is funded – whether the liabilities are General Obligations (GO), pre-refunded, revenue-backed, or subject-to-appropriation. Chart 4 illustrates the market composition.

The largest sector, revenue bonds, includes a variety of sub-sectors, such as utilities (power, water, sewer, etc.), transportation related (highway tolls, airports, etc.), colleges and universities, hospitals, dedicated tax (income tax, sales tax, etc.), and several others. Taxable municipal bonds are less available than tax-exempt municipals, but are generally higher yielding given that the income generated is taxed and therefore requires a higher incentive than municipals that are tax-exempt for U.S. investors.

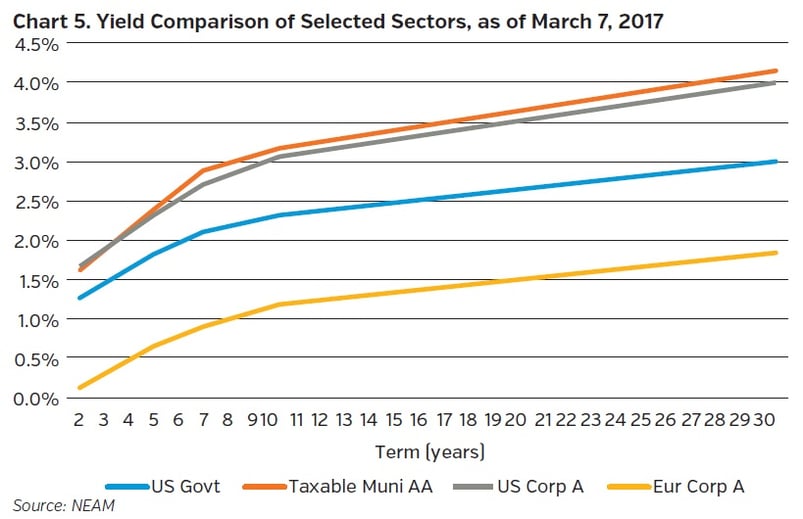

In Chart 5, we compare a EUR-denominated A-rated corporate curve to a USD-denominated A-rated corporate curve and a AA-rated taxable municipal bond curve to illustrate one of the issues facing European investors. The level of compensation investors currently receive for taking credit risk remains low, driven largely by underlying government yields. Moving to the U.S. market where underlying Treasury yields (also shown) are positive means that yields are higher when compared to European counterparts. It is also interesting to note that the yields shown for the U.S. corporate and municipal sectors are similar; however, the credit quality of the corporates is lower.

We believe that as an asset class the yield levels, high credit quality and low default rates of taxable municipals could be attractive to non-US investors. Furthermore, some revenue-backed municipal bonds may qualify as infrastructure debt in accordance with European Insurance and Occupational Pensions Authority (EIOPA) Delegated Regulation 2016/467 and benefit from special consideration under Solvency II.

Solvency II and Infrastructure Investments

Since January 2016 European-based insurers have been subject to Solvency II and its capital requirements. Taking into consideration the market risk module of the standard formula, the capital requirement of a bond is calculated by interest rate, spread, concentration and currency modules.

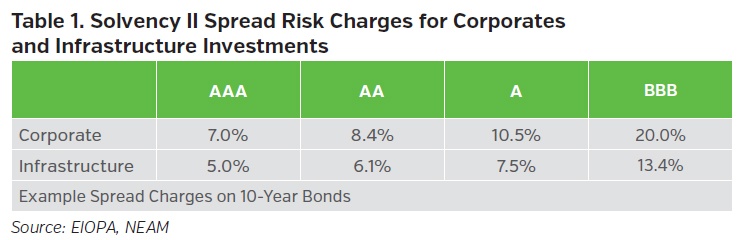

In simple terms, the spread risk module assigns a capital charge based on the duration, rating and risk factor of a bond where the risk factor charges depend on the sector. For example, European Sovereign bonds have a risk factor of zero – regardless of rating – and therefore do not incur a spread charge. Furthermore, AAA/AA covered bonds have a lower risk factor than standard corporate bonds and benefit from a lower capital requirement. In contrast, securitizations have been assigned a high risk factor which has resulted in punitive capital treatment, leading some investors to shun the market.

In 2016, EIOPA updated the spread risk module to include a new set of capital requirements specifically for “infrastructure debt.” When compared to similarly rated corporate bonds, the newly identified infrastructure debt sector requires approximately 30% less capital to be held by the insurer. While the existing spread risk charges for corporate holdings are modest and are comparable to other regimes, the lower charge on infrastructure holdings can free up capital to be deployed elsewhere.

EIOPA defines a qualifying infrastructure entity as one “which is not permitted to perform any other function than owning, financing, developing or operating infrastructure assets.” These assets must be “physical structures or facilities, systems and networks that provide or support essential public services,” such as toll roads and water treatment plants. Furthermore, the asset needs to have “predictable” cash flows. Bonds should be investment grade and the insurer should be able to demonstrate the ability to hold these assets to maturity. Given these criteria, certain U.S. taxable revenue-backed bonds may meet the requirements and, as part of our Solvency II standard formula reporting process, we identify these bonds and classify them accordingly.

The motivation for this move by the European authorities was to help support European infrastructure development with private sector funds (insurance and pension funds) through both equity and debt instruments. However, as the market is in the early stages of development, the opportunities are scarce. Yet, there is a belief that the supply of projects, and therefore the funding required, will increase over the coming periods. In the meantime, in the absence of an active European Infrastructure sector, the attractive spread levels and comparatively high yields of the U.S. taxable revenue-backed municipal bond market could be a good option for European-based insurers.

Taxable Municipal Market (Outlook)

While the U.S. economy has improved since the financial crisis, state and local governments have not levered up commensurately, due in part to the easier politics of fiscal austerity. While pensions remain a concern for some, when viewed in the aggregate the liabilities should be manageable over time. The lack of new issue supply has resulted in a flat-to-shrinking market over the past few years, which has provided positive technical results and an increase in excess returns. New issue supply of taxable municipals is fairly limited, while additional allocations may be sourced in the secondary market allowing investors to build an exposure to the sector over time.

- The search for yield among European investors is expected to continue. The demand for a non-Euro investment option remains high and flows into the U.S. are strong.

- Taxable U.S. municipal bonds should be considered as an incremental yielding, higher quality, longer duration (albeit supply constrained) investment option.

- Certain taxable U.S. municipal revenue-backed bonds may qualify as infrastructure investments under Solvency II rules where all criteria are met. Infrastructure investments are an opportunity for many insurers to take exposure to a new sector and with it the diversification benefits of a low correlation to traditional fixed income securities.

- Under Solvency II, qualifying infrastructure investments benefit from lower capital requirements of approximately 30% when compared to corporate bonds of similar credit quality. We believe a lower capital requirement along with an attractive investment yield should appeal to European-based insurers who are considering USD exposure in their portfolios.

- Investing in a non-domestic currency can incur additional capital charges under Solvency II when the currency exposure is unhedged. In many cases, this only makes sense when capital is not an issue and when attractive relative returns are the driving factor.