Municipal Bonds

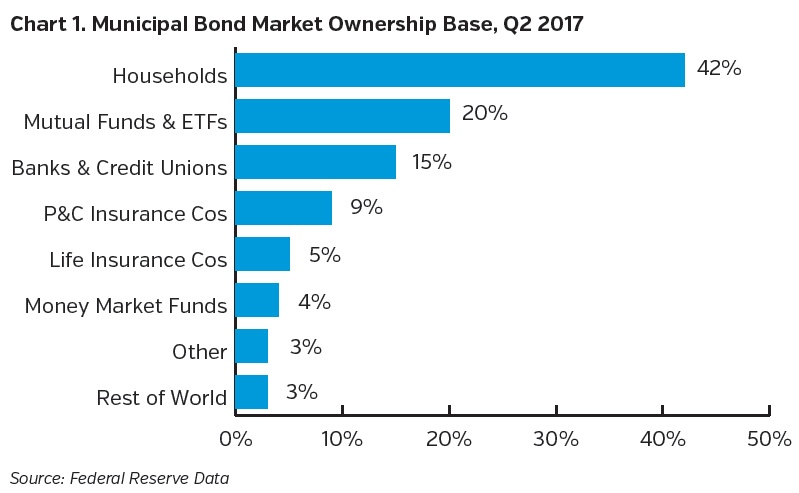

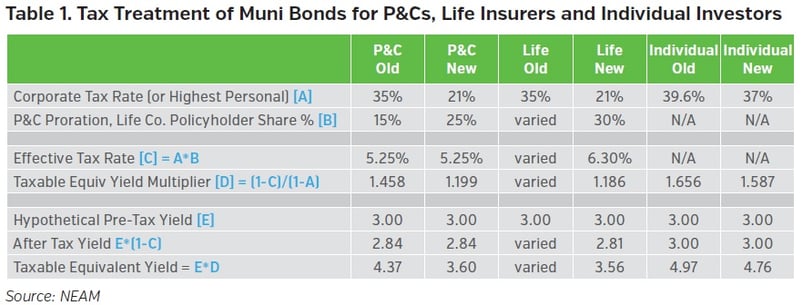

First and foremost, muni bond income remains tax-free at the Federal level for individual investors, as it has been since the Federal personal income tax was established in 1913. Personal income tax rates though were adjusted modestly by the tax act, including a reduction in the highest marginal rate from 39.6% to 37%. From a technical perspective, this should have minimal effect on demand from individual investors who own almost two-thirds of the market. The corporate tax rate reduction (from 35% to 21%), however, increases the attractiveness of taxable bonds relative to tax-advantaged securities for most corporations. This includes banks, credit unions and P&C companies which combined, comprise one-quarter of the market. Conversely, proration rules for life insurance companies were modified, thus increasing the attractiveness of tax-exempts relative to taxables for this historically small segment of the muni market.

The reform package eliminates the ability of issuers to advance refund higher cost debt

(tax-exempt pre-refunded bonds will no longer be created)1, though maintains allowances

for private activity bonds (hospitals, private universities, etc.). Finally, cuts to the mortgage

interest deduction and the cap on state and local income tax (SALT) deductibility will have

implications for the elasticity of taxes and demand for tax-exempt bonds in certain high

tax locales.

Implications for Insurance companies

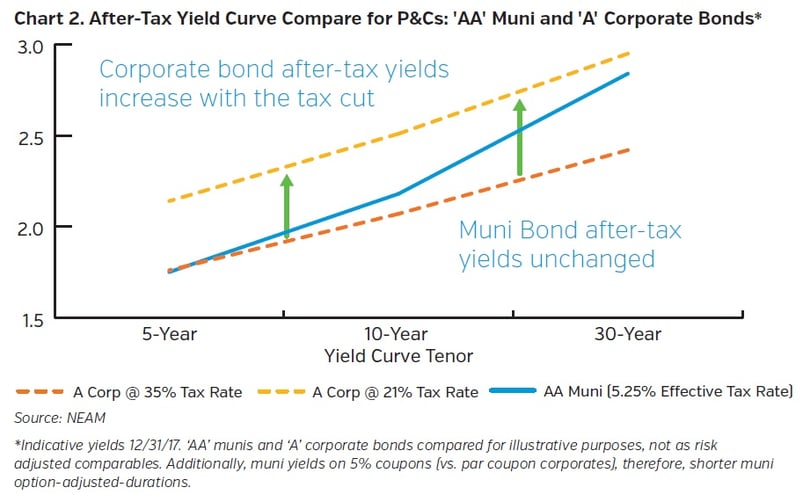

From an after-tax income perspective, taxable bonds will now offer more yield relative to tax-exempts than they did in 2017 for property and casualty insurance companies. In other words, while the effective tax rate for muni income is not changing for P&C’s (5.25%), after-tax yields on taxable bonds of all varieties will increase with the tax cut (Chart 2). As a result, we expect a lower level of municipal market participation from banks and P&Cs, assuming no change in current market valuations. A variety of factors, however, will continue to support P&C muni allocations. These include the benefits of higher credit quality, lower historical return correlations, late credit cycle resiliency and legacy book yield considerations. In addition, increased demand from life insurers could offset some of the potential reduction in demand from banks and P&C insurers. Life insurance companies, as we understand it, will now have an effective tax rate of 6.3% on tax-exempt muni income (as shown in Table 1)2 and therefore derive a more meaningful benefit from tax-advantaged income.

Muni Market Outlook

Market conditions may remain somewhat unsettled into 2018 until a post-tax reform supply/demand equilibrium is reached. Issuance is expected to drop (potentially materially) with the repeal of advance refunding bonds (~15% of issuance over the past decade3) and the massive “pull forward” of issuance that occurred in December.4 The level of ongoing bank and P&C support, however, is less certain, as is the potential degree of increased life company involvement. Bond valuations, though, will continue to find support from individual investors whose value proposition isn’t materially changing (Table 1).

In terms of asset allocations, tax-exempt municipals will remain a key sector in insurance company portfolios. While we will continue to invest in a tax conscious manner, focusing on best relative value (as we always have), we expect allocations will eventually move lower for P&Cs, all else equal. This will likely occur through the “next dollar” invested, rather than wholesale adjustments to existing portfolios. We do, however, anticipate more “crossover” trading opportunities given the now wider value proposition between individual and institutional investors.

Preferred Stocks

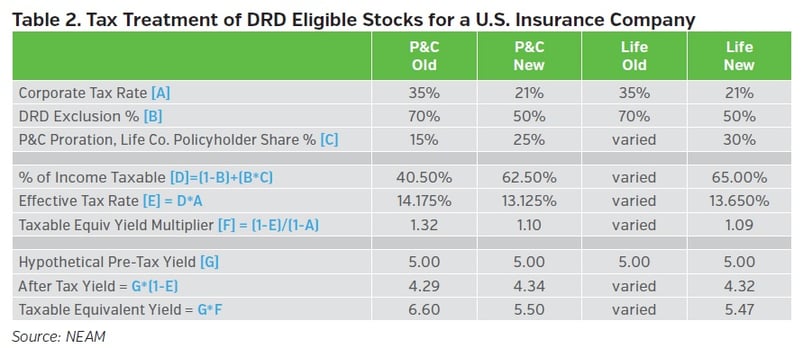

For a U.S. property and casualty insurance company, the effective tax rate for preferred stock holdings that are eligible for the dividends received deduction (DRD) will decline slightly (from 14.175% to 13.125%) as shown in Table 2. Accordingly, the after-tax yields for these DRD eligible preferred stocks will increase slightly on an absolute basis and relative to municipal bonds. However, when compared to fully taxable bonds (for which the tax rate will decline from 35% to 21%), the after-tax yields for DRD eligible preferred stocks will become relatively less attractive.

For a U.S. life insurance company, we understand that the policyholder share of income for a DRD eligible preferred stock had been, in prior years, complicated to calculate and fairly high for many companies. As a result, we believe that the effective tax rate for a DRD eligible preferred stock was not easily determined and, in some cases, not materially different from the effective tax rate for a fully taxable security. However, the new tax legislation specifies a 30% policyholder share of income, resulting in the 13.65% effective tax rate shown in Table 2.2 With this new tax legislation in place, we expect that many U.S. life insurance companies will enjoy a benefit from DRD eligible dividend income that is, if not more significant, at least more readily quantifiable.

Property and casualty insurance companies will likely revisit their allocations to preferred stocks and tax-advantaged securities generally, while some life insurance companies may now be more inclined to consider an allocation to preferred stocks. However, consistent with our thoughts on tax-exempt munis, we would not expect the modest changes to individual tax rates to impact demand from individual investors for tax-advantaged preferred stocks. We do not expect the impact on demand from recent tax changes to be the key factor influencing valuations in the overall preferred stock market. Marginal changes in demand due to the new tax rates could certainly have some impact but we expect the path of interest rates, movements in credit spreads and the degree to which investors continue to search for yield to be more significant drivers of preferred stock valuations.

Muni Market Takeaways

- Individual tax rates are not changing much with minimal technical impact on retail demand

- The corporate tax cut increases the attractiveness of taxable bonds relative to tax-exempts for banks and P&Cs

- Bank and P&C involvement is less certain going forward

- Life company demand may increase with proration changes

- Supply expected to drop in 2018, potentially meaningfully

- SALT and mortgage interest cuts not constructive for long term “blue” state credit outlook

Preferred Stocks Takeaways

- We do not expect U.S. tax changes to be the key driver of preferred stock valuations

- Some P&C insurance companies may reassess allocations to preferred stocks given improved after-tax yields on some alternative investment options

- Conversely, some life insurance companies may now be more inclined to consider an allocation to preferred stocks

Endnotes

1 With the exception of current refunding bonds which have <90 days to call/maturity date.

2 We would note that the new 30% policyholder share of tax-exempt income specified for life insurers appears to us to be somewhat counterintuitive and is, of course (like all tax legislation), subject to change by future congressional action.

3 J.P. Morgan, US Fixed Income Strategy – Municipals, Peter DeGroot, December 15, 2017.

4 The Bond Buyer, “December muni volume hits record $62.5B ahead of tax overhaul”, Aaron Weitzman, December 29, 2017. Notably, the prior record was December 1985, ahead of 1986 Tax Reform Act.