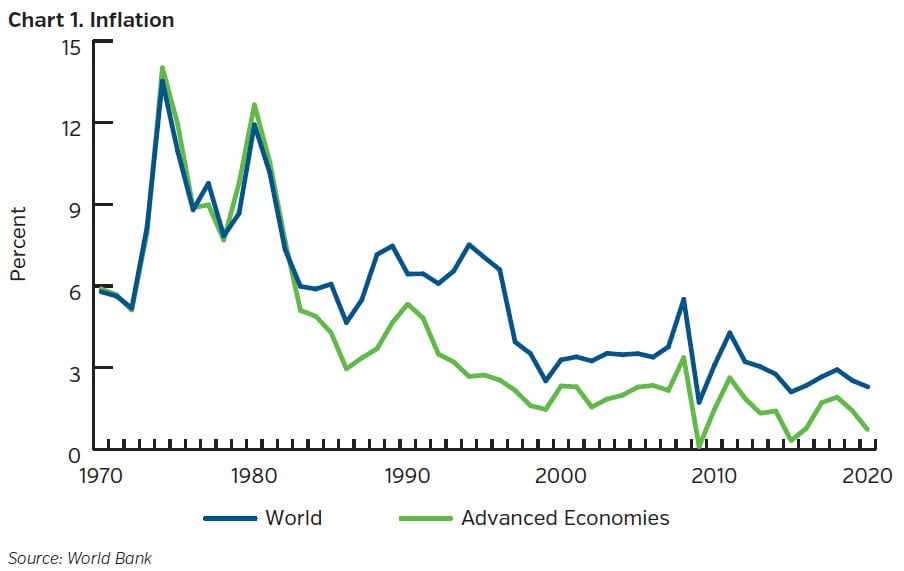

Secular Decline in Inflation Driven by Globalization and Related Factors

How many tentacles does an octopus have? (Hint: it’s a trick question.) Answer: none. Rather, an octopus has six “arms” and two “legs”, which might be an apt metaphor to begin to frame the discussion of the highly complex ecosystem of global trade (which surely has more than eight limbs).

Globalization has been evolving over a long period of time. Along with related secular shifts (technology, demographics, trade and monetary policy, Global Value Chains (GVCs), and the explosion of China, India, and others within the global trading system), these “limbs” have contributed to years of stable and sustained low inflation which, in turn, have supported strong performance of financial assets. The recent rise in protectionist sentiment and a focus on supply self-reliance following the pandemic have some suggesting a trend toward deglobalization in the future. If these trends were to take hold in a meaningful way, global inflation would be expected to rise.

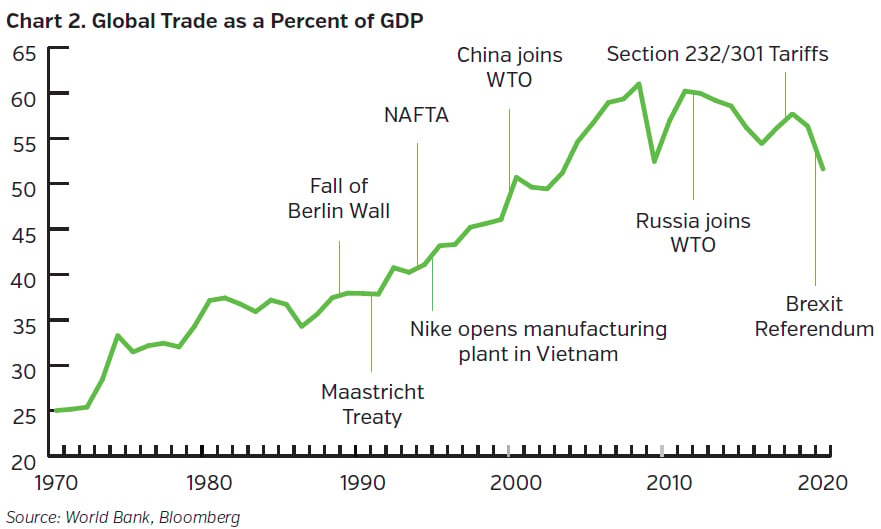

The “great moderation” in inflation began in the early 1990s, set in motion by a series of events that changed the competitive landscape underpinning international trade. The fall of the Berlin Wall and China’s transition to a market economy and acceptance into the World Trade Organization (along with Russia) expanded the global supply of low-skilled workers by 1.6 billion, opening the floodgates for cheaper products. The development and expansion of supply chains connected the world as multinational companies capitalized on excess labor and output gaps in emerging market economies. Intra- and extra-regional trade agreements (European Union, North American Free Trade Agreement) brought about greater regional interconnectedness and economic integration.

U.S.-China Trade War: Minor Impact on Inflation

Trade activity (as measured by global trade as a percent of global GDP) peaked in 2008, stumbled after the Great Recession, and was tested again 10 years later as the U.S.-China trade war unfolded. A side effect of the decades-long influx of cheap Asian-made goods was a massive downward shift in the U.S. manufacturing base which reduced the bargaining power of U.S. workers and suppressed wage growth. This backdrop created a fertile political backdrop for Donald Trump’s “Make America Great Again” campaign.

In the most aggressive U.S. protectionist move since the Smoot-Hawley Tariff Act of 1930, the Trump administration imposed a broad swath of Section 232 (aimed at national security threats) and Section 301 (relief from unfair trade practices) tariffs on China and, to a lesser extent, other countries. Yet, despite the harsh rhetoric and financial market reaction, the tariffs had only a very modest effect on inflation. Tariffs imposed from 2017 through 2021 amounted to $29.1 billion or 0.3% of total U.S. personal consumer expenditures.1 Considering that the trade war involved (and continues to involve) the two largest economies in the world, the inflationary impact was mild, especially in the context of today’s raging inflation prints.

Reshoring of Global Value Chains: Not Gaining Traction

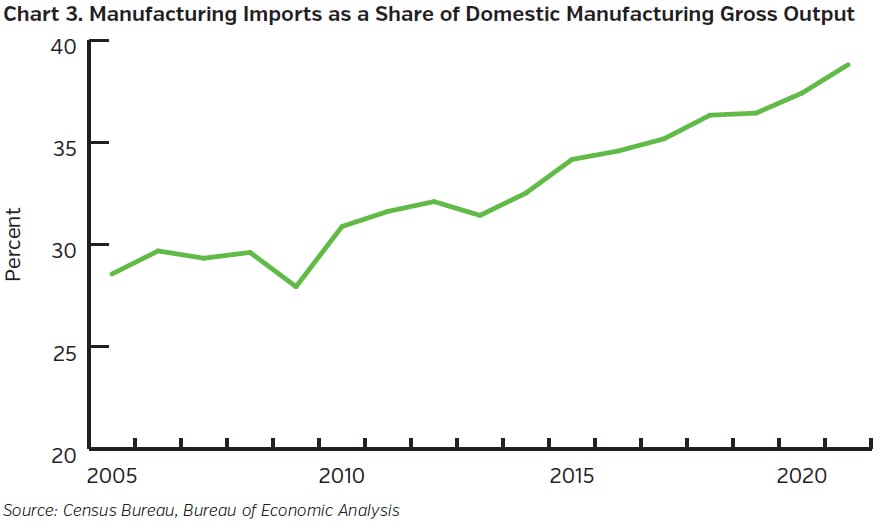

Supply chain disruptions and shortages during the Covid-19 pandemic highlighted perceived risks and instability associated with GVCs. For their part, U.S. companies are taking a proactive approach to fortifying supply chain resilience with an emphasis on overstocking inventories and broadening and diversifying supply chains (predominantly to Southeast Asian countries). Nearshoring (moving operations to a nearby country from one of greater distance) is another growing trend. Though the percentage of manufacturing imports as a share of domestic manufacturing gross output would appear to suggest that onshoring is moving in the opposite direction, it would be difficult to disentangle the effect of stimulus-fueled goods purchases (and hence imports) during the pandemic and its effect on that measure. Nonetheless, early indications are that U.S. corporations have done the math and are opting for alternatives other than onshoring to gain supply chain “insurance.”

More Pressing Concerns

The more immediate and pressing concern is the fallout from the war in Ukraine, where we are reminded of the global reach of commodities, the vital “limb” in our octopus analogy. High persistent inflation evident across virtually all economies via surging food and energy prices is unleashing “a new inflationary era” according to the Bank for International Settlements.2 Social unrest is beginning to emerge in low-income countries. Europe is embarking on plans to reduce its dependency on Russian energy which, along with the transition from fossil fuels to renewables, will pressure prices upward. The current challenges have less to do with a reversal of globalization than with commodity supply shocks in an already highly interconnected world.

Key Takeaways

- The inflationary impact from the U.S.-China trade war and onshoring efforts has been limited thus far.

- Global inflation has recently ratcheted higher; energy prices and food shortages could create unrest in some emerging market countries.

- Following a period of subdued inflation, the near-term outlook will present greater volatility as tighter financial conditions are needed to address rampant inflation. This backdrop argues for an up-in-quality bias while maintaining a neutral duration posture to take advantage of higher rates across the curve.

Endnotes

1 “Tariff increases did not cause inflation, and their removal would undermine domestic supply chains,” Economic Policy Institute, January 19, 2022

2 “The Return of Inflation,” BIS International Center for Monetary and Banking Studies, April 5, 2022