For the third quarter of 2018, the S&P 500 returned 7.2%, the best quarterly return since 2013. Fueled by the strongest U.S. macro backdrop since the Financial Crisis, the S&P 500 generated equally potent returns for July and August before momentum faded in September around renewed trade angst. Despite more subdued gains as the quarter progressed, the market achieved yet another all-time high by late September as well as earning the distinction of the longest bull market on record. In the wake of the tenth anniversary of the collapse of Lehman, volatility remained in the lowest historic quartile.1 Trade tension continued to impact the currency markets and the U.S. dollar strengthened, pressuring both the material and energy sectors. Outside of trade, healthcare impacted market performance positively as the sector contributed double digit gains within the S&P 500 for the quarter.

While the U.S. equity market reached new highs, the rest of the world - both developed and emerging markets - performed poorly in the 3Q. Developed market turbulence remained centered on Brexit and the sustainability of the Eurozone as Italy contended with its need to abide by EU budget criteria. Turkey first ignited volatility in the emerging markets when its currency plummeted after Trump doubled the tariffs on Turkey’s steel and aluminum. Argentina added to contagion fears across the emerging market complex when it requested an acceleration in its aid package from the IMF. Both geographies are highly indebted as a result of credit centric economic policies and suffer from high inflation, around 25% and 35% respectively.2 Further, their current account deficits are worsening, and these countries maintain insufficient currency reserves in the event of significant economic turbulence. Suffice it to say, there are country-specific risks that unify these countries in their vulnerability to localized crises, but other emerging geographies like South Africa and Indonesia also exhibited volatility.

The Federal Reserve is indirectly exerting additional pressure on emerging markets as it normalizes rates and continues its tightening regime. The resulting strength of the U.S. dollar makes repayment of associated U.S. dollar-denominated liabilities more expensive and possibly destabilizing. For now, the strength of the U.S. is overshadowing vulnerabilities elsewhere, somewhat reminiscent of the late 1990s when the emerging market complex, specifically in Asia, suffered from serial shocks that eventually undermined global markets. The sustainability of the U.S. market to decouple from the rest of the world may wear thin if this game advances.

Global Liquidity

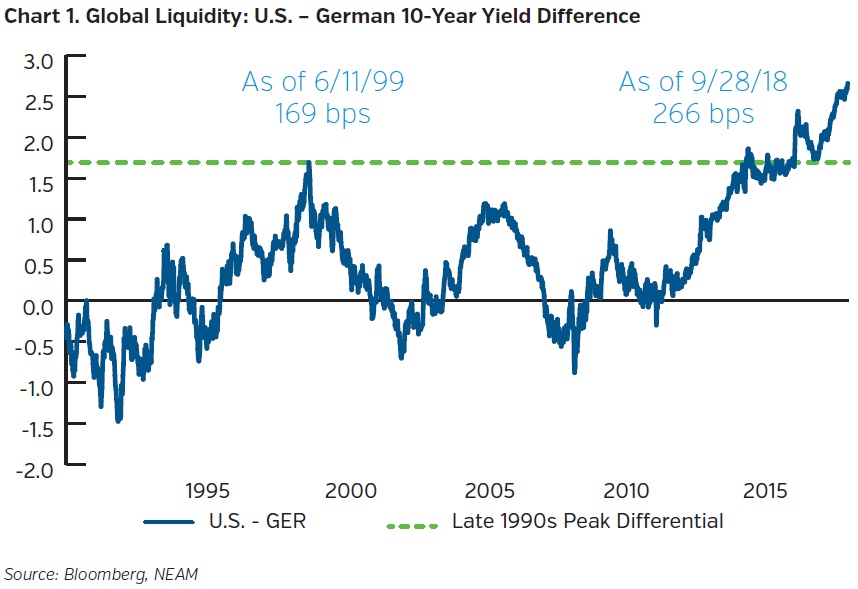

Similar to the late 1990s, the current period is characterized by a Federal Reserve tightening cycle that reduces global liquidity as the world dollar money supply falls. While the Bank of Japan and the European Central Bank continue to be accommodative, the current reduction in global liquidity can be conveyed by the differential between the U.S. 10-year Treasury yield and the 10-year German Bund yield (Chart 1). The current differential signifies increasing strain driven by the divergence between economic growth rates and policy around the world. Without sufficient dollar liquidity, world growth can be impacted, and the observed variance will prove unsustainable and potentially exert a downward pull on the strong fundamentals evident in the United States. Of particular note, this cycle notably exceeds the degree of difference reached in the late 1990s as the liquidity drain intensifies.

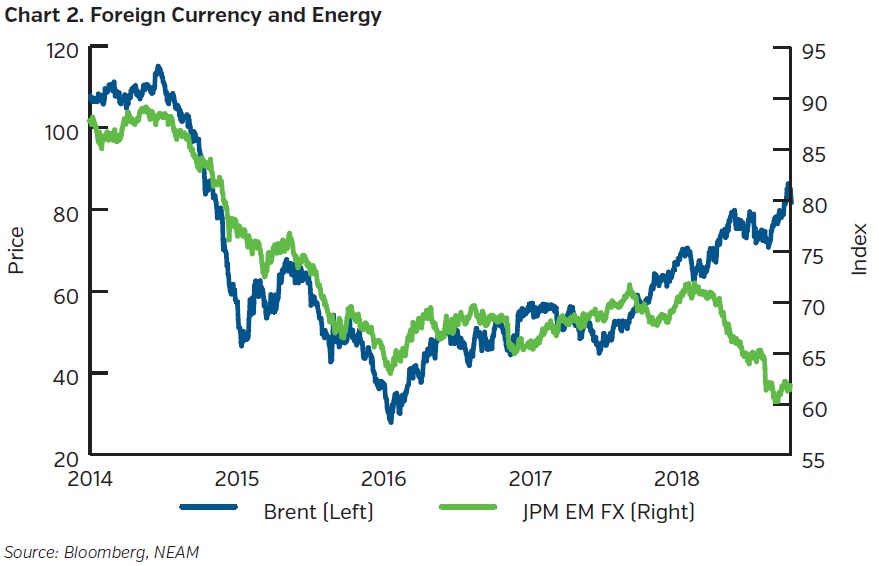

Conventional policy tightening is happening alongside the removal of excess liquidity, or quantitative tightening (“QT”), as the Federal Reserve tapers its balance sheet. This collective reduction in liquidity injects potential deflationary pressure on the rest of the world. Naturally, as their currencies depreciate, emerging markets endure a higher cost of servicing dollar-denominated debt as well as buying dollar-based goods such as oil (Chart 2). Since the beginning of the year, the harder hit currencies - the Argentinian peso and the Turkish lira - have contracted by as much as 40 to 50%. As a result, these regions face extreme headwinds, and recessions are unavoidable. While high profile, the relative size of these vulnerable economies do not appear large enough to derail developed market momentum at this stage.

Role of China

Conversely, China is the cornerstone of the emerging market complex; it has the economic scale and trade integration to be the conduit for contagion. China implemented restrictive lending policies to curb its credit expansion while the tariffs injected further economic variability. Consequently, these prevailing conditions slowed growth. Beyond the impact on emerging economies, this also creates a headwind for Europe given its large trading relationship with China. Risk assets reflect uncertainty with the Shanghai Composite Index, contracting over 20% from its 2018 high. Further, the Chinese yuan weakened amidst the ongoing trade war and bears watching (Chart 3).

The relative volatility of emerging markets could intensify if China is not able to successfully counteract the impact of tariffs and reflate, likely through stimulus and potential expansion of its balance sheet. The stakes are significant as the International Monetary Fund estimates that the trade war could cut China’s growth by nearly 2% over the first two years. China may be increasingly incented to compromise in trade relations with the United States as it endeavors to rebalance its economy in favor of consumption, while reconciling bad loans associated with infrastructure spend, housing investment, and the shadow banking system. In sum, it will be difficult for emerging markets to stabilize in the face of a slower China, particularly if the Chinese become more aggressive in devaluing the renminbi.

Low Implied Odds of Contagion

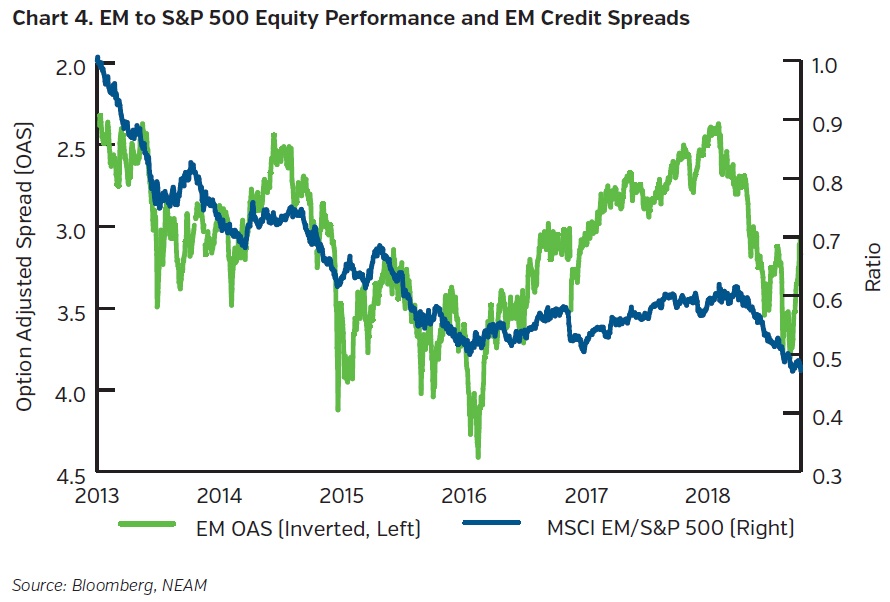

To date, the risk of contagion appears remote judging by the behavior of emerging market credit spreads. While option-adjusted spreads have widened on a year-to-date basis, upon rebounding, they now appear more sanguine than levels seen in other bouts of short lived volatility like the Chinese devaluation and the weakness in oil prices in 2015 to 2016 (Chart 4). When examined over the period since the Global Financial Crisis, current emerging market spreads reflect average levels, another indication that a more systemic issue is not telegraphed by the credit markets. Emerging market equities trade below beginning of year prices and have not stabilized, making relative returns weak compared to the United States.

The resilience of the U.S. market is grounded in solid fundamentals. Economic growth paced over 4% in the 2Q, consumer confidence sits near a 20-year high, and unemployment is the lowest in nearly 50 years. This backdrop generates exceptional earnings growth supporting stock prices. Repatriated funds and tax cuts have added fuel to the buyback war chest, another key underpinning to the equity market. Year-to-date statistics reveal stock repurchases of approximately $700 billion with completed buybacks pacing for an estimated $1 trillion for the year.3 Cumulatively, companies have spent $4.4 trillion on buybacks since the end of the financial crisis which outpaces the magnitude of the Federal Reserve’s entire quantitative easing program.3 Dry powder remains and could lend support should emerging market volatility, or otherwise, surface in the final quarter of the year.

CONCLUSION

The strong domestic narrative of the Goldilocks environment has reigned supreme assuaging concerns over the cautionary signs from the emerging market complex. However, the magnitude and the duration of the U.S. economic expansion and current bull market cause us to ask whether this is as good as it gets. Economic momentum could face headwinds from lower housing affordability, higher interest rates and rising oil prices which accompany this improving macro backdrop. Divergence may not be sustainable as interest rates and inflation trend up, and the resilience of the U.S. market is tested.

While contagion risk currently appears limited, emerging market currency volatility and oil prices merit surveillance as these markets will likely face continued fundamental pressure. Although the deceleration of growth is more profound outside the United States, earnings will also slow domestically. Volatility should rise as growth momentum peaks and the era of excess liquidity ends. Emerging markets have gained relevance, ascending over the last 20 years to comprise roughly 50% of world GDP.4 The health of this complex is important, no more so than China, the key domino piece on the global game board which must not topple for contagion risk to remain limited.

Within our active portfolios, our positioning imbeds some defensive elements that we believe will accrue benefits over a full market cycle. Reversion to the mean, likewise, remains a guiding principle in our investment approach as does a long-term return horizon; both require patience. Since it is virtually impossible to time the market, we continue our focus on risk adjusted returns, remaining cognizant of balancing downside risk with potential reward within the U.S. market.

With the S&P 500 enjoying its ninth year of outperformance versus the rest of the world and trading at a record premium on a price-to-book basis,5 relative value exists overseas. Although it remains our view that it is premature to commit funds to the emerging markets, we believe opportunities may exist over the longer-term in these geographies. We will continue to consider them for inclusion in portfolios.

Endnotes

1 Crestmont Research Update, October 9, 2018.

2 TradingEconomics.com, Data as of September 2018 for Turkey and August 2018 for Argentina.

3 Gandel, Stephen. “The Buyback Boogeyman May Have Struck Again.” Bloomberg. 10 Oct. 2018.

4 Barclays. “Global Outlook: The US, and then the Rest.” 27 Sept. 2018.

5 Bank of America Merrill Lynch. “S&P 500 Relative Value Cheat Sheet, The US versus Them Goes Parabolic.” 20 Sept. 2018.