Introduction

On 25 October 2021, Lloyd’s published the Revised Membership & Underwriting Conditions and Requirements (“the new M&URs”; Lloyd’s Market Bulletin Y5353), culminating an 11-month process since the initial consultation document was introduced. In response, capital providers (“members”) have started to make adjustments and we are seeing some early signs of where the market is moving under the new regulation.

Background

The new M&URs, effective starting 1 January 2022, represent a comprehensive refresh of the rules on being a member at Lloyd’s and introduce new guidance on how to provide the capital to fund underwriting and investment activities.

Notable changes include:

Quarterly Corridor Test

In addition to the annual process of funding 100% of capital requirements each April (known as “Coming into Line”), a quarterly test has been introduced, which requires that members fund at least 90% of the capital requirements. Members can apply to release funds if the funding ratio exceeds 110%, which should not exceed 165% at the maximum.

Standard Strategic Asset Allocation (“SSAA”)

The SSAA sets maximum limits on certain asset classes within investment portfolios. Lloyd’s clarified in the final version of the regulation that the limits should be assessed on the aggregated member’s capital and member’s share of syndicate assets, even though during the consultation and in the first published version of the new guidance (Market Bulletin Y5348), these limits seem to solely apply to how a member invests its capital, i.e. Funds at Lloyd’s (“FAL”) and/or Funds in Syndicate (“FIS”).

Operational Efficiencies

A host of measures have been introduced to simplify the interactions between members and Lloyd’s. Some examples:

- It’s compulsory for members to appoint investment managers for FAL1, subject to the approval of the Lloyd’s Council

- Limiting acceptable currencies to six (i.e. USD, GBP, EUR, AUD, CAD and JPY)

- The new FAL Online Portal serves as a single repository for members’ data and documents

We understand that Lloyd’s has been working to simplify the investment operational arrangements further. For example, as of 19 December 2022, there is no longer a requirement to seek approval from Lloyd’s prior to introducing new assets to FAL accounts.

THE REDUCTION OF LETTERS OF CREDIT SEEMS TO STABiLISE

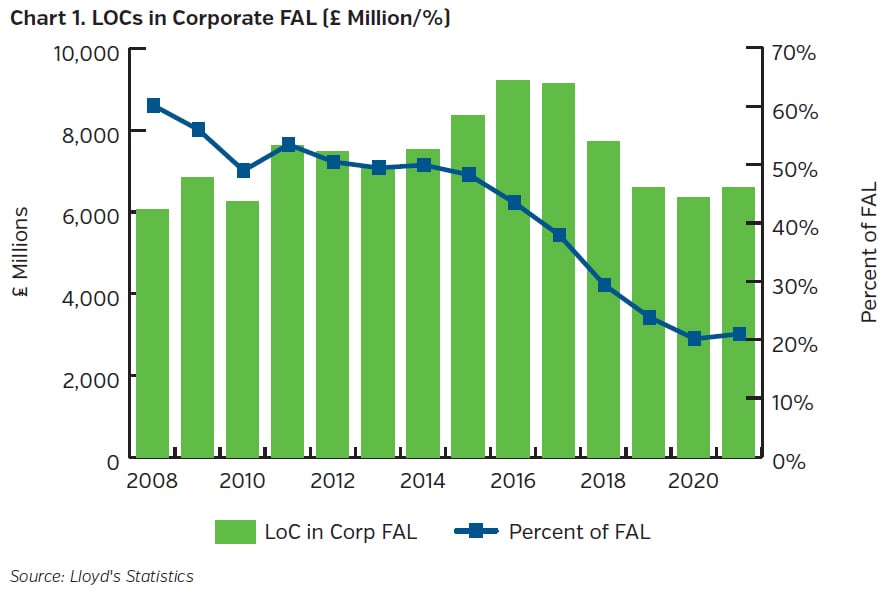

Corporate members have been heavily reliant on Letters of Credit (“LOCs”) in their FAL, with the aggregate amount reaching £9.2 billion in 2016. LOCs are traditionally seen as a cost effective and flexible source of capital. In April 2018, Lloyd’s introduced restrictions on the proportion of LOCs (Market Bulletin Y5177), which were phased in to reduce the limit to 50% from December 2020.

While still materially lower than the amount at year-end 2018, LOCs remain more than one fifth of the Lloyd’s capital base and increased slightly during 2021. Chart 1 shows how the aggregate utlisation of LOCs among corporate members has evolved.

Lloyd’s initially looked to reduce LOCs further during the consultation process of the new M&URs, but this was dropped in the final version. Instead, the new M&URs give Lloyd’s discretion to reduce the limit from 50%, “depending on overall market utilisation” of LOCs.

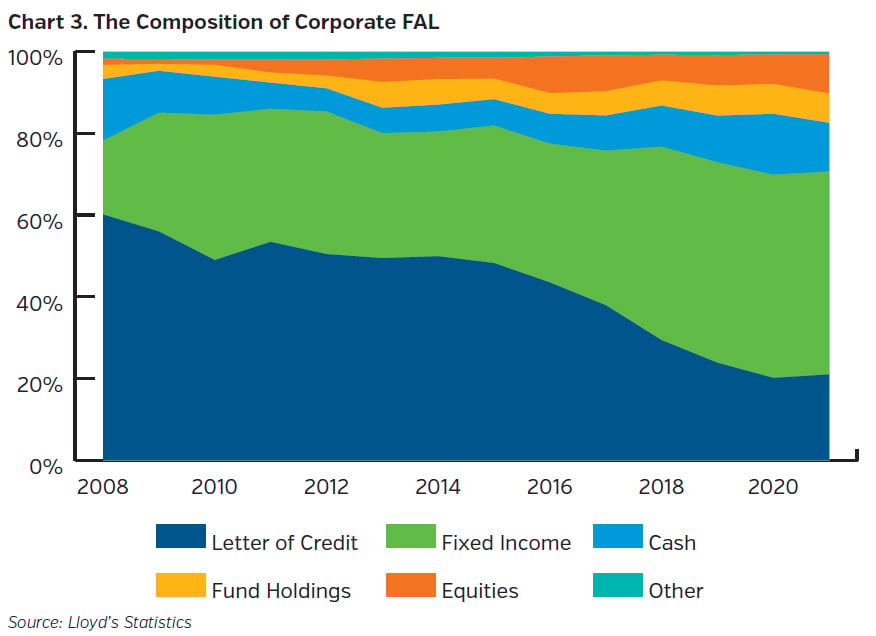

We expect corporate members to continue to evaluate the usage of LOCs within FAL. Given the elevated investment yields available for liquid fixed income assets, it’s likely that members will, at the expense of LOCs, increase the allocation to government bonds/investment grade corporate bonds, continuing the long-term trend.2

THE RISE (AND FALL) OF FUNDS IN SYNDICATE

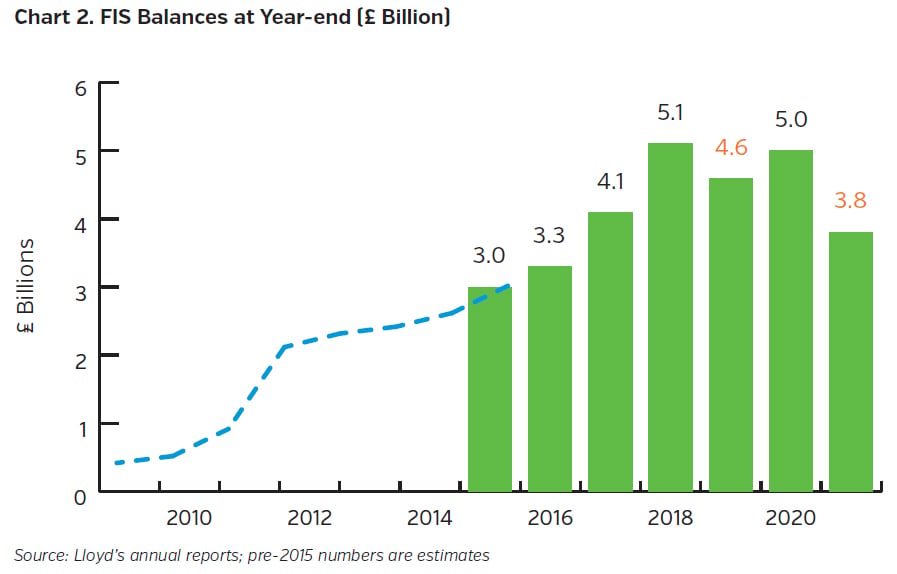

Since 2007, Lloyd’s has allowed for aligned members to hold (some of the) capital within the relevant syndicates. The cumulative amount of FIS reached £3.0 billion at year-end 2015 and further increased to £5.0 billion at year-end 2020 (see Chart 2 for the movement of FIS balances).

2021 saw members withdraw c.£1.3 billion from FIS. It’s conceivable that the amount of FIS reduces further in the coming years, now that the FAL investment processes are simplified.

For members operating both FAL and FIS accounts (usually through different group entities), it’s preferable to hold fund investments within FAL, as holding these within FIS requires look-through reporting, which can create additional operational burden.

THE (LACK OF) IMPACT OF THE SSAA SO FAR

The allocation of FAL has yet to show any meaningful movements as of year-end 2021 (ahead of the new M&URs becoming effective), though we have anecdotally learned that certain members started to make material changes at the Coming into Line in April 2022.

Given that the SSAA limits are assessed on the aggregate assets (i.e. a member’s capital and its share of syndicate assets), and consequently Lloyd’s dropped the requirement for pre-approval when these limits are breached (for FAL or FIS), we don’t believe the introduction of the SSAA would in itself make a material impact on the asset allocation of FAL/FIS.

Nevertheless, the 40% upper limit for Non-Core Assets3 and 10% upper limit for illiquid Assets4 set new anchoring points and will likely encourage members to consider these higher risk asset classes. These measures come at a time when higher risk assets have become less attractive relative to high quality fixed income, with the latter’s yield elevated from central banks’ actions and market reactions. Therefore, we do not expect material allocations by members to risk assets in the near-term.

For members with highly volatile investment strategies (e.g. >60% allocation to equities within FAL), the new Quarterly Corridor Test may well nudge them to adopt more balanced portfolios, as this will reduce the likelihood of portfolio drawdowns triggering a capital shortfall.

More generally, the simplified and more transparent investment processes will enable members to react quicker to investment opportunities.

KEY TAKEAWAYS

- The regulation introduced by Lloyd’s in October 2021 outlines new rules on how members should provide the capital to fund underwriting and investment activities.

- The new rules would prompt members to adjust how they structure Funds at Lloyd’s and Funds in Syndicate, including the utilisation of Letters of Credit and allocation to higher risk asset classes.

- Members are likely to consider further replacing Letters of Credit with government bonds/investment grade corporate bonds.

Endnotes

1 “Except where the FAL comprises cash and LOCs or Guarantees only…”

2 See NEAM's Quick Takes titled "Funds at Lloyd's: How Asset Allocation is Changing": www.neamgroup.com/insights/funds-at-lloyds-how-asset-allocation-is-changing

3 Include Sub-Investment Grade Corporate / Government Bonds, Sub-Investment Grade Bond Funds, Equities, Equity Funds, Alternatives (Funds) and A/BBB-rated Collateralised Securities.

4 Defined as assets that “cannot be realised for cash within 20 Working Days,” or those that are “not capable of being accurately and fairly valued on an ongoing basis (in practice at least once a week)."

REFERENCES

A) Lloyd’s Market Bulletin Y5353 - Revised Membership & Underwriting Conditions and Requirements, October 2021

B) Lloyd’s Market Bulletin Y5348 - Membership & Underwriting Conditions and Requirements, September 2021

C) Lloyd’s Market Bulletin Y5177 - Provision of capital to support members’ Economic Capital Assessments; timing and Solvency II tiering limits, April 2018

D) Lloyd’s Market Bulletin Y3946 - Syndicate PTF Investments, January 2007