Recent banking turmoil has thrust the Federal Home Loan Bank (FHLB) into the headlines again highlighting its role as “lender of next to last resort” and provider of liquidity to financial institutions including commercial banks, insurance companies, savings and loan institutions (thrifts), credit unions, and community development financial institutions. In March 2023, significant bank deposit outflows contributed to the failures of Silicon Valley Bank on March 10 and Signature Bank on March 12, marking the second and third largest bank failures in U.S. history, with combined assets in excess of $300 billion. First Republic Bank followed on May 1, 2023 with $229 billion in assets.1

Given the important role that the FHLB has historically played in providing liquidity to financial institutions during times of distress, we wanted to revisit how insurance companies could benefit from membership with the FHLB as we have highlighted in previous publications.2

FHLB Overview

The FHLB System consists of 11 regional member banks which are government-sponsored enterprises organized under the Federal Home Loan Bank Act of 1932 and regulated by the Federal Housing Finance Agency (FHFA). Additionally, each bank is registered with the SEC. While they function as cooperatives, each FHLBank is operated independently and receives no taxpayer assistance. The FHLB System looks to source and subsequently provide reliable, low-cost funds to member institutions. FHLBanks fund themselves through debt issued on a joint and several basis into the capital markets through the Office of Finance. As of year-end 2022, the combined entity had approximately $1.25 trillion in assets, the predominant portion of which consisted of about $819 billion “advances” made to its member institutions (66% of the combined FHLB entity’s asset base). Advances reached the highest amount in the past 10 years and more than doubled from year-end 2021 at $351 billion driven by depository member demand for liquidity due to declining deposit balances, loan growth, and the effects of higher interest rates.3

FHLB & Recent Banking Turmoil

Among the various risks facing banks and insurance companies, interest rate risk is one that garners heightened attention given the current rate environment since changes in interest rates can have a material impact on both industries’ balance sheets (i.e., resulting in changes to the unrealized gain/loss position of bank and insurance company investment portfolios). In the low-rate environment that prevailed in 2008 to 2021, banks and insurance companies faced the challenge of generating a sufficient return from their investments to support their operations within an appropriate level of risk. While 2022 may mark the end of the secular downshift in interest rates since the late 1980s, the swift rise in interest rates (10-year U.S. Treasury increased 237 bps in 2022) presents another challenge for banks and insurance companies related to sizable unrealized losses on their investment portfolios and potential impact on their capital position.

The banking system is fundamentally based on investor and depositor confidence. If that confidence is called into question, banks can be susceptible to “a run on the bank” because of the inherent mismatch between their assets and liabilities as banks accept short-term deposits while making long-term loans. The speed at which bank runs can happen today has only increased given technological advances. Depositors do not need to line up outside their local branch. Instead, they can quickly move their money from anywhere in the world with just a few taps on their smartphone.

In March 2023, significant deposit outflows and financial challenges caused three FHLB member banks to become distressed and shut down. These banks were among the top borrowers for certain FHLBanks as of year-end 2022 with Silvergate Bank and Silicon Valley Bank members of the FHLBank of San Francisco and Signature Bank a member of the FHLBank of New York. According to the FHLB, despite the issues at these banks, they expected no losses from their exposure. Indeed, the FHLB’s 2022 annual report states, “As of the publication of this Combined Financial Report, no advances to Silvergate Bank and Silicon Valley Bank remain outstanding. Advances to Signature Bank are fully collateralized and are expected to be repaid with no credit loss to the FHLBank of New York.”3

Alongside the Federal Reserve’s discount window and newly established Bank Term Funding Program (BTFP), the FHLB played a pivotal role in supplying liquidity to the financial sector in March 2023. To that point, the FHLB system saw advances increase significantly from $819 billion at year-end 2022 to $1.04 trillion at Q1 2023 driven by increased member demand primarily led by commercial banks.4 Outstanding FHLB advances at the end of the first quarter of 2023 set a record high and exceeded the prior peak of $1.0 trillion in Q3 2008 at the height of the Great Financial Crisis.

Insurance Companies & The FHLB

Membership

Membership is specific to one of the 11 regional FHLBanks (see graphic at the end), with the location of the company’s principal place of business largely determining which regional FHLBank one can join. Members must purchase and maintain a stock investment in their district’s FHLBank based on a percentage of the insurer’s invested asset base. The FHLB stock is not publicly traded but can be redeemed at par at the issuing bank. Both membership stock and activity-based stock (which is purchased at the time an advance is taken) pay a dividend.

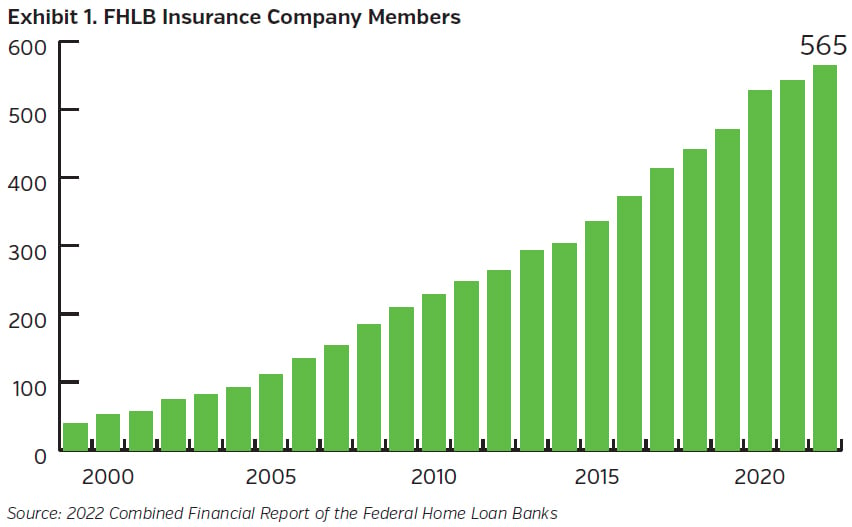

Insurance company membership has increased steadily over the past two decades, averaging ~13% annual growth between 1999-2022. In 2022, the FHLB system added 23 new insurance company members, bringing the total insurance company membership to 565, or about a 4% increase year-over-year. This compares to a 1% decline in overall FHLB membership during 2022 which declined from 6,557 at year-end 2021 to 6,502 at year-end 2022.3 The number of insurance company members at the individual FHLBanks varied with a range of 26 (FHLBank San Francisco and FHLBank Topeka) to 74 (FHLBank Boston).5

Funding

The FHLB provides funding to members through secured loans known as advances. Members access funding through direct contact with their respective FHLBank and must post collateral to obtain funds. Eligible collateral can vary and typically consists of marketable securities such as U.S. Treasury securities, U.S. Agency securities, Agency, and Non-Agency Mortgage-Backed Securities (MBS), Collateralized Mortgage Obligations (CMO) and Commercial Mortgage-Backed Securities (CMBS), and housing-related Municipals, along with other assets such as real estate loans. Each FHLBank sets funding limits as a percent of a member’s assets. Additionally, advance limits are determined by applying a haircut to the collateral posted, with the level of haircut depending on the risk level and perceived liquidity of the collateral. In addition, the financial condition and credit profile of the borrowing company are considered when joining as a member and on an ongoing basis. All FHLBanks regularly review their haircuts and eligibility rules on an ongoing basis. The collateralization requirement for advances has helped to ensure that since 1932 no FHLBank has incurred a credit-related loss from a member.6

Advances

FHLB advance terms are flexible and are offered in fixed and floating rate structures with maturities ranging from overnight to 30 years. This gives insurers the flexibility to select the terms that best meet their specific needs.

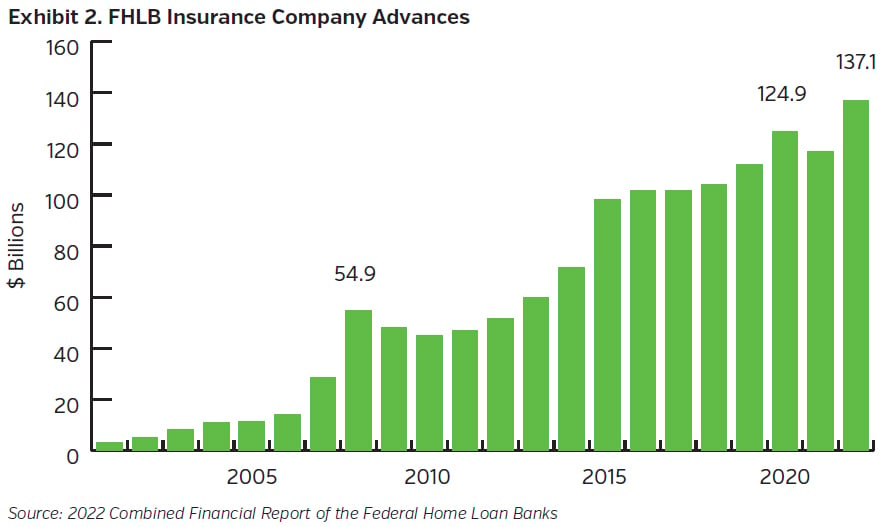

While insurance companies comprise nearly 9% of the FHLB System’s membership, they represent 17% of total advances at year-end 2022, with 41% of insurance company members having advances outstanding. This compares to commercial banks which had just under 60% of advances which represents about the same percentage of the FHLB System’s membership base.3

The chart below illustrates the trend in insurance company advances over the past two decades. Periods of acute market stress and heightened volatility experienced in the Great Financial Crisis, COVID-19 pandemic, and significant backup in interest rates in 2022 have corresponded with notable increases in insurance company borrowing year-over-year (+91%, +12%, and +17%, respectively).3

Uses

Historically, insurance companies have utilized advances from the FHLB for a wide variety of uses including:

- A ready source of liquidity

- Manage catastrophic events or unexpected claims payments

- Liquidity management, such as awaiting receipt of reinsurance recoverables

- Lower overall cost of funds

- Limited cost (i.e., membership stock, which pays a dividend) until funding is accessed (costs may vary by FHLBank)

- Benefit from FHLB’s status as a government sponsored entity

- May be used to pay down other debt including higher cost surplus notes

- Offer greater financial flexibility

- Access to capital markets via FHLB membership at attractive rates

- Ability to fund a particular project (i.e., new facilities)

- Aid investment portfolio management

- Avoid selling securities in unfavorable market conditions to meet cash needs

- Access funds to invest in capital markets when cash is low, but markets are attractive

- Asset liability management (ALM)

- Reduce duration gaps or “mismatches” between assets and liabilities

While there are many ways that insurance companies can use the proceeds from an FHLB advance, emergency liquidity tends to be the primary reason for borrowing as evidenced by the spike in insurance company advances during the Great Financial Crisis in 2008 and COVID-19 pandemic in 2020. However, the potential for insurers to use an FHLB advance to pursue a spread lending or arbitrage strategy to enhance investment income when market opportunities arise is another benefit and potential opportunity.

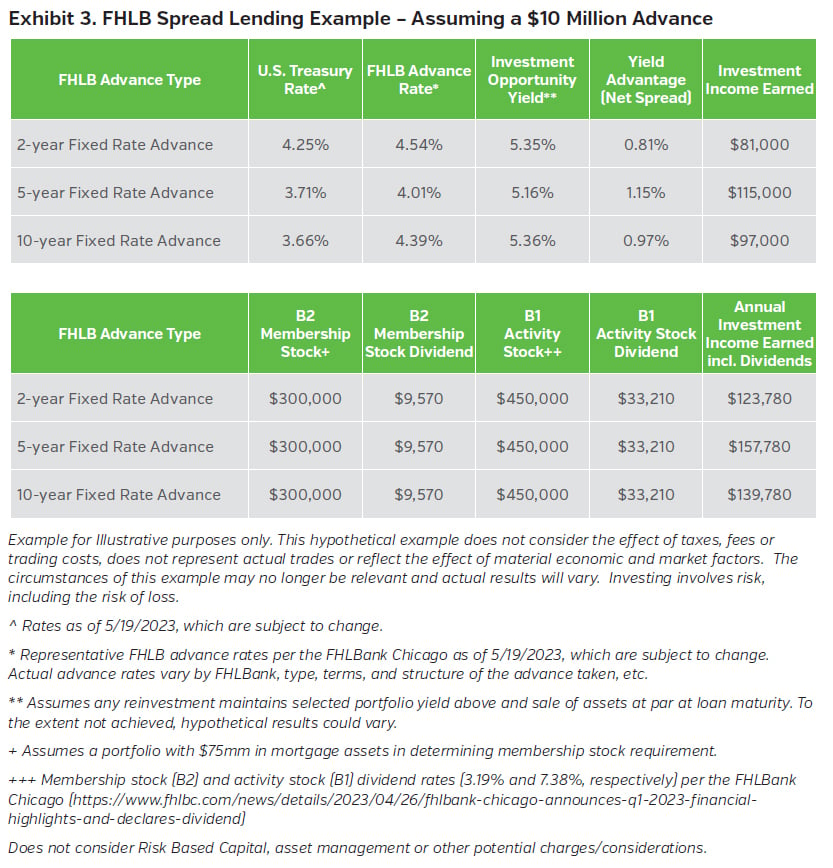

Spread Lending Strategy

A spread lending or arbitrage strategy involves borrowing money from the FHLB at an advance rate and then reinvesting the proceeds in securities offering higher yields (with the yield advantage or “spread” being the difference between the FHLB advance rate and the reinvestment rate on securities purchased). Arbitrage opportunities arise throughout market cycles as investment conditions change and sector dislocations present the potential for incremental yield enhancement. Recent periods of acute market stress and heightened volatility (such as the COVID-19 pandemic and banking turmoil in the spring of 2023) enabled investors to take advantage of low-cost funding from the FHLB to invest in high-quality fixed-income securities with yields in excess of the FHLB advance rate to generate potential incremental investment income.

Summary Observations

Insurance company use of the FHLB program has grown over the last two decades. Membership has increased steadily with companies joining various member banks throughout the country. Companies that have joined the FHLB have benefited from access to liquidity, albeit secured, at attractive rates compared to commercial lenders. About one third of NEAM’s clients were members of a FHLBank at year-end 2022 and we have seen client membership steadily increase over the years consistent with broader insurance company FHLB membership trends.

To learn more about the FHLB program, please contact your Client Strategist or New Business Development at 860-676-8722.

Key Takeaways

- The FHLB program offers insurance companies a reliable source of low-cost liquidity

- Insurance companies can use this liquidity to increase their financial flexibility

- Market dislocations (i.e., Great Financial Crisis, COVID-19 pandemic, spring 2023 banking turmoil) highlight the increased need for liquidity as well as potential investment opportunities to enhance income via a spread lending strategy

Endnotes

1 FDIC. “Bank Failures in Brief- 2023.” FDIC website. https://www.fdic.gov/bank/historical/bank/bfb2023.html. Last updated 03/21/2023.

2 See Quick Takes, “Federal Home Loan Bank Program” (https://www.neamgroup.com/insights/federal-home-loan-bank-program); Quick Takes, “Federal Home Loan Bank: Proposed Changes to Insurance Company Membership.” (https://www.neamgroup.com/insights/federal-home-loan-bank-proposed-changes-to-insurance-company-membership); and NEAM published brochures, FHLB and Insurers (2018 and 2019).

3 FHLBanks Office of Finance. “FHLBank Financial Data.” FHLBanks Office of Finance website. https://www.fhlb-of.com/ofweb_userWeb/pageBuilder/fhlbank-financial-data-36. Last updated March 24, 2023.

4 FHLBanks Office of Finance. “Office of Finance Announces First Quarter 2023 Combined Operating Highlights for the Federal Home Loan Banks.” FHLBanks Office of Finance website. https://www.fhlb-of.com/ofweb_userWeb/resources/2023Q1FHLBCombinedOperatingHighlights.pdf. April 28, 2023.

5 Federal Housing Finance Agency. “Federal Home Loan Bank Membership Data.” Federal Housing Finance Agency website. https://www.fhfa.gov/DataTools/Downloads/Pages/Federal-Home-Loan-Bank-Member-Data.aspx. Last updated March 31, 2023.

6 FHLBanks Office of Finance. “Lending and Collateral Q&A.” FHLBanks Office of Finance website. https://www.fhlb-of.com/ofweb_userWeb/resources/lendingqanda.pdf. March 24, 2023.

Federal Home Loan Bank Locations

Stars Signify the FHLBank for Each Region

For more information, contact the FHLBank nearest you.

There are many conditions to borrowing from the FHLB, and not all insurance companies will qualify. A qualified insurance company must, among other things, become a member by purchasing stock from the FHLB, which is not freely transferable and pledge securities in excess of 100% of the amount borrowed. Activity-based capital requirements at time of investment also apply. These financial commitments may impair an insurance company’s ability to meet other obligations or make other investments. Also, the addition of assets without additional capital can impact a company’s overall financial profile.