Introduction

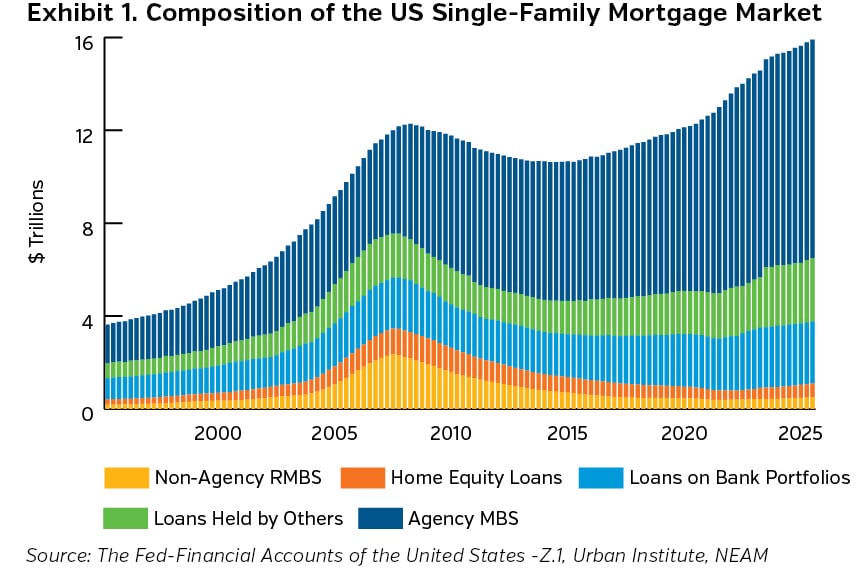

Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) are the cornerstones of the U.S. housing finance system. As Government-Sponsored Enterprises (GSEs), their primary function is to ensure liquidity, stability, and affordability in the secondary mortgage market by purchasing mortgages from lenders, pooling them, and issuing mortgage-backed securities (MBS) with a repayment guarantee. This process frees up lenders’ capital and enables them to extend more loans to homebuyers, contributing significantly to housing affordability and availability. Together, the GSEs guarantee $6.67 trillion of Single-Family mortgages, equivalent to ~52% of outstanding U.S. mortgage debt.1,2,3

Not-so-temporary Conservatorship

The conservatorship of Fannie Mae and Freddie Mac was a pivotal event in the aftermath of the 2008 financial crisis. Leading up to the crisis, both entities expanded aggressively into the Subprime and Alt-A mortgage markets, increasing their exposure to risky assets. When the housing bubble burst, mortgage defaults soared, severely undermining the financial stability of the GSEs. In September 2008, the Federal Housing Finance Agency (FHFA), a newly established regulator, placed both Fannie Mae and Freddie Mac into conservatorship to prevent their collapse and stabilize the broader financial system.4

Under conservatorship, the federal government assumed control of the GSEs, injecting over $190 billion in capital through senior preferred stock purchase agreements (PSPAs) and mandating strict oversight.5 The arrangement was intended as a temporary measure, but 17 years later, Fannie Mae and Freddie Mac remain under government control. Key actions during this period included changes to business practices, reductions in risk exposure, removal of certain shareholder rights, and the retention of profits by the Treasury to recoup taxpayer investments. The timeline has been further marked by ongoing debate regarding the future of the GSEs, with multiple legislative proposals but no definitive resolution.

What are the Objectives Behind Potential Privatization or IPO?

Privatization or an Initial Public Offering (IPO) of Fannie Mae and Freddie Mac has been a subject of considerable policy discussion.6 Technically, it would be a reprivatization and a reoffering of GSEs’ shares, as prior to the Great Financial Crisis, GSEs existed as publicly traded private entities. The rationale for privatization centers on several objectives:

- Reduce Government Involvement: Diminish the federal government's direct role in mortgage finance, shifting risk and decision-making to private shareholders.

- Limit Taxpayer Exposure: Shield taxpayers from future bailouts by ensuring that private capital bears the risk of losses rather than the taxpayers.

- Enhance Market Efficiency: Foster competition, innovation, and efficiency in the housing finance market, improving availability of mortgage financing, and lowering costs for borrowers.

Significance of the Implicit Government Guarantee

A defining feature of Fannie Mae and Freddie Mac's role in the mortgage market is the implicit government guarantee of repayment associated with their MBS. While not formally codified, investors widely believe that the U.S. government will support the GSEs in times of distress, as demonstrated by the 2008 intervention. This implicit guarantee has several important implications:

- Market Stability: The perception of government backing underpins investor confidence, allowing Fannie Mae and Freddie Mac to issue MBS at lower yields which results in lower mortgage rates for homeowners.

- Liquidity: The implicit guarantee facilitates deep and liquid markets for MBS, attracting domestic and international investors.

- Systemic Risk: While the implicit guarantee promotes stability, it also creates moral hazard risk, as investors may underestimate credit risk, assuming government support in adverse scenarios.

Any move toward privatization must address the future of the implicit guarantee, as its removal or modification could have significant consequences for the functioning of the mortgage market and costs to the borrower.

Financial and Political Challenges to Privatizing GSEs

Privatizing Fannie Mae and Freddie Mac presents a host of financial and political challenges that complicate efforts to reform the system.

Financial Impediments

- Capital Requirements: To withstand market shocks, privatized GSEs would need to maintain substantial capital buffers, potentially requiring massive capital raises through equity offerings and retained earnings. While the capital requirement may vary depending on the capital ratios and the prospective business focus of the GSEs, by one standard, i.e. FHFA’s Enterprise Regulatory Capital Framework, GSEs’ combined capital shortfall is $375 billion as of Q2 2025.1,2

- Outstanding Obligations to the Treasury: Fannie Mae and Freddie Mac have significant obligations to the U.S. Treasury, which holds senior preferred stock in both entities with a combined liquidation preference value of $354.9 billion.1,2 The U.S. Treasury also owns warrants to acquire 79.9% of their common equity.5 These arrangements mean that the U.S. Treasury has an ongoing dividend claim on the GSEs and could heavily dilute existing shareholders if they choose to exercise the warrants, complicating any prospective privatization or IPO.

- Transition Risks: Shifting from government conservatorship to private ownership could unsettle markets, raise borrowing costs, and disrupt the flow of credit to homebuyers.

- Valuation Uncertainty: Determining the value of the GSEs and their assets is complicated by an as-yet-unknown guarantee fee structure, uncertain future earnings, and the treatment of retained profits by the Treasury.

Political Impediments

- Regulatory Hurdles: Privatization would require significant regulatory changes, including new frameworks for oversight, capital standards, and affordable housing mandates.

- Stakeholder Opposition: Diverse stakeholders, including affordable housing advocates, lenders, investors, and politicians, hold conflicting views on the optimal structure of the housing finance system.

- Policy Uncertainty: The lack of consensus on the role of government in housing finance has stalled reform efforts, with concerns about access to credit, market stability, and taxpayer risk at the forefront of the debate.

These challenges have kept Fannie Mae and Freddie Mac in conservatorship far longer than originally anticipated, with no clear path to total privatization in the near term.

Key Takeaways

- The U.S. housing finance system remains most consequentially tied to the future of Fannie Mae and Freddie Mac.

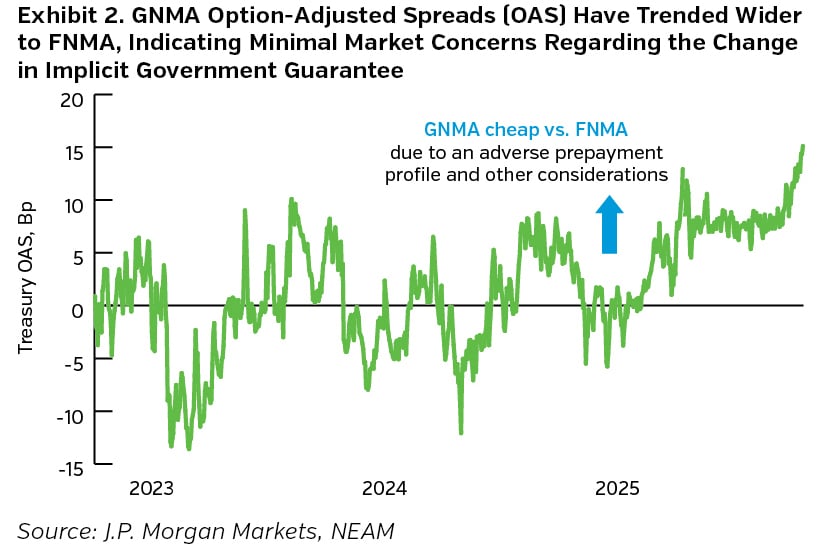

- Considering the key issues and challenges of privatizing the GSEs, we believe that maintaining the implicit government guarantee is essential. Relatively stable spread levels between Agency MBS and government-guaranteed Ginnie Mae MBS indicate that the market also does not expect any change to the implicit guarantee.

- Although privatization promises potential benefits in terms of market efficiency and reduced taxpayer risk, it is hampered by significant financial and political obstacles.

- While the administration may still proceed with a limited IPO, given the magnitude of the endeavor and GSEs’ sizeable capital need, it is unlikely to be adequate and may not materialize until well into the future.

- Agency MBS offer insurance company portfolios a high-quality, liquid investment alternative with compelling relative value—especially when compared to the richly valued corporate bond sector. Agency MBS are expected to remain a bedrock of the U.S. housing finance system despite the uncertainties surrounding the potential privatization of GSEs.

ENDNOTES

1 Form 10-Q, Q2 2025, Fannie Mae (https://www.fanniemae.com/media/56021/display)

2 Form 10-Q, Q2 2025, Freddie Mac (https://www.freddiemac.com/investors/financials/pdf/10q_2q25.pdf)

3 Federal Reserve Bank of New York (https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2025Q2)

4 https://www.fhfa.gov/conservatorship/history

5 https://www.fhfa.gov/conservatorship/senior-preferred-stock-purchase-agreements

6 https://www.wsj.com/finance/regulation/trump-aiming-to-ipo-fannie-mae-and-freddie-mac-later-this-year-13b138cf?