The fragility of the European banking sector was exposed during the euro area sovereign crisis of 2010–2012. Policymakers now hope the opposite is true of banks–improved liquidity, capital strength and supervision leading to greater confidence, higher lending volumes and a recovery in euro area economic growth. In this Quick Takes we review how the banking sector has rehabilitated itself and whether policymakers’ hopes are justified. Our conclusion is a qualified “yes.”

The Problem

When the Greek government finally backed down in February by requesting a bailout extension from official international lenders, the trigger for the capitulation was a liquidity crunch in the domestic banking system. With domestic corporates, households and even the sovereign itself almost wholly dependent on local banks for funding, the system had to be saved. Whilst this was a story of politics as much as economics, it underlined the central role played by the banking system in European capital markets. Approximately 80% of euro area corporate funding is channelled through bank lending, with only the largest corporates having direct access to capital markets funding. This is in contrast to the U.S. where “disintermediation” is far more established and is one key reason for the comparably deeper recession and slower economic recovery in Europe.

Another key reason was the fragmented nature of the euro area banking system with supervision at the national level, allowing differing rule books and local political interference. The result in many cases was over-extended banks during the boom, severe liquidity withdrawal during the downturn and obstacles to confidence building during the attempted recovery. The ability of the ECB to engineer this recovery through liquidity provision via the banking system was therefore materially impaired. This was most notable at the euro area periphery where the banks were weakest and confidence was lowest.

The Solution

Policymakers have responded to these systemic challenges with a number of confidence building measures. Firstly, unlimited liquidity at a historically low cost has been made available by the ECB to the euro area banking system.

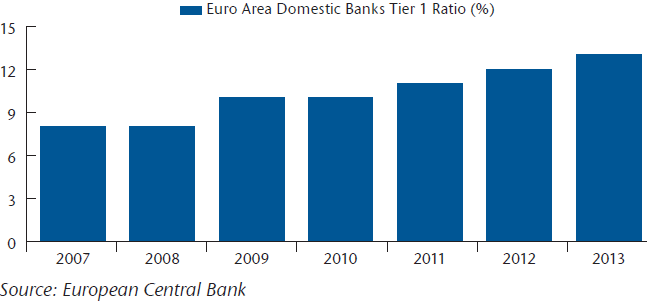

Secondly, Basel III adoption in Europe has mandated banks to substantially increase both the quality and quantity of capital (Chart 1). Driven by pressure from regulators, politicians, investors and rating agencies, euro area banks have increased Tier 1 capital ratios from 8% in 2007 to 12% at end 2013. Some observers raise valid questions about the gaming of Risk Weighted Asset (RWA) calculations, but leverage ratios (which are unweighted) have also improved substantially.

Chart 1: European Banks – Positive Capital Evolution

Thirdly, in November 2014 the ECB took over responsibility as lead supervisor for 123 of the euro area’s largest banks, representing over 80% of banking assets in the region. This was accompanied by credible stress tests on the banks with largely clean results. Ceding national regulatory sovereignty was a huge political concession by euro area countries, illustrating that they recognised that a monetary union was unworkable without the transparency of a banking union.

The Prognosis

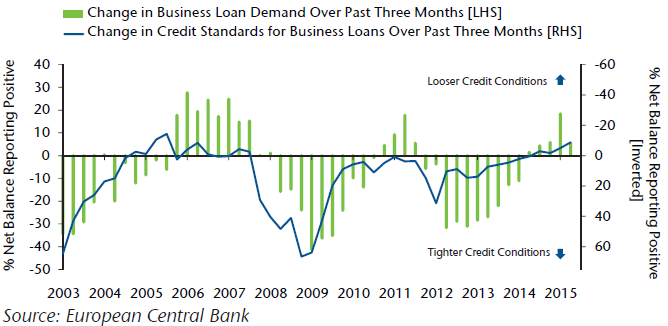

Bank lending standards have begun to loosen as management teams become more confident and competition increases (Chart 2). Loan volumes are also increasing with a net 6% of banks reporting an increase in Q1 2015. In peripheral countries where these metrics matter most, volumes are still contracting but at a much reduced rate whilst loan finance costs for corporates have fallen sharply – from over 5% for Spanish SMEs in 2012 to 4% now.

Chart 2. Euro Area: Bank Lending Standards and Loan Demand

The wider euro area economy itself is showing signs of a turnaround with consensus expectations for 2015 GDP growth recently raised to 1.5%. What we cannot know is the extent to which this improvement is being driven by lower oil prices aiding consumer spending, a weaker euro helping exporters or the undoubted confidence boost from the ECB’s monster QE programme. It is clear, however, that the banking system is now acting as a tailwind rather than a headwind.

Takeaways

- European banks are most of the way through the post-crisis curing process and can now help rather than hinder the recovery. Absent any unexpected events, such as a policy error over Greece, we expect this to continue.

- Other drivers will nonetheless dominate the recovery narrative, most notably ECB QE.

- A stronger turnaround would increase euro area inflation expectations, thereby reducing the QE induced downward pressure on the EUR/USD exchange rate. This in turn would boost U.S. corporate earnings and dilute one reason for the Fed to delay raising interest rates.