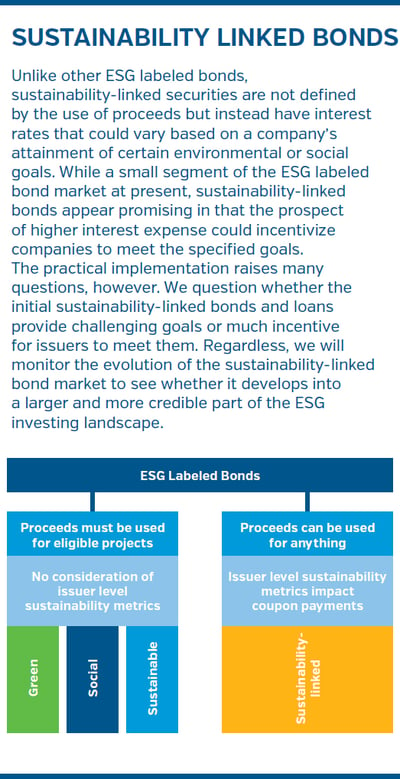

Green, social, and sustainable bonds – collectively known as ESG labeled bonds – specify that an amount equal to the bond proceeds will be invested in environmentally responsible initiatives, socially conscious projects, or, for sustainable bonds, a combination of both. For the investor inclined towards sustainability, the growth in ESG labeled debt outstanding, as discussed in a previous Quick Takes ("ESG Labeled Bonds: A Very Fashionable 'Label,'" 2021), may seem like a great opportunity. However, investors must look beyond the ESG label since that label is not a guarantee that a bond will meet one’s ESG expectations.

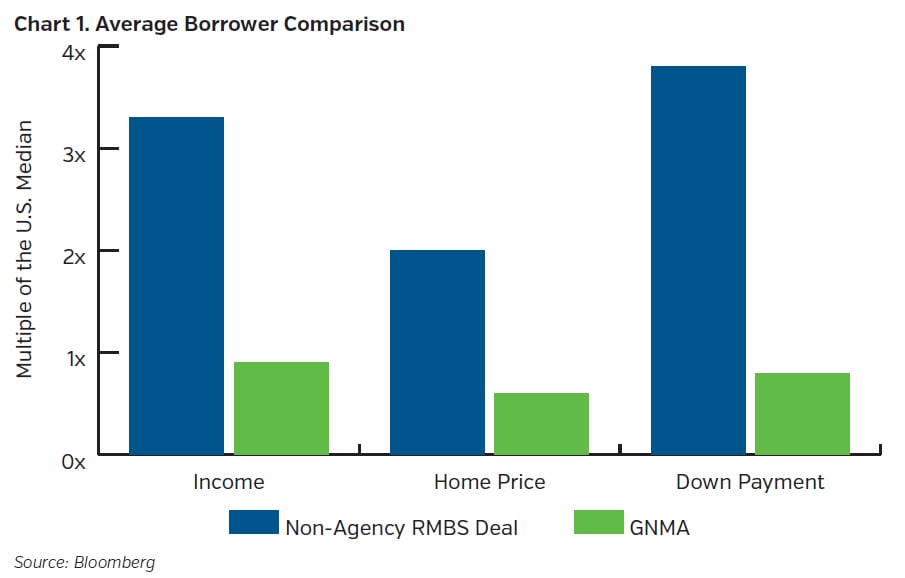

For instance, in the spring of 2021 an issuer of non-agency residential mortgage-backed securities labeled at least one of their securitizations as a “Social” bond because the underlying loans were made to individuals whose borrowing needs did not conform to U.S. agency standards and who therefore were, in the view of the issuer, underserved borrowers. The loans did not conform to U.S. agency standards due to factors such as income documentation as the borrowers were largely self-employed entrepreneurs and loan size since some loans exceeded agency limits. The average borrower in the pool of loans underlying this deal had an annual income of approximately $225,000, had the ability to make a down payment of approximately $150,000, and purchased a home worth approximately $650,000. For comparison, the Government National Mortgage Association (GNMA), a U.S. agency that supports first time home buyers, low-income borrowers, and other underserved groups, also issued a bond in the spring of 2021 in which the average borrower had an annual income of approximately $60,000, made a down payment of approximately $10,000, and purchased a home worth approximately $195,000. The GNMA bonds did not have a Social label. Despite not having a label, investment in the GNMA bond may have been more consistent with the goals of an investor seeking to advance social causes than investment in the labeled non-agency RMBS securitization.

While we’ve wondered in some cases whether ESG labeled bond proceeds are supporting the most worthy environmental or social initiatives, we believe that issuers have generally identified legitimate investments in sizes that correspond to the bond proceeds. Some utilities, for instance, have invested in wind or solar power projects. We question, however, whether the issuance of green bonds has any bearing on a utility’s decision to pursue such a project. Green bonds are generally issued with a yield similar to the level at which the company could issue an equivalent bond without the ESG label. With financing costs that approximate those of other bonds, the green bonds do not provide a cost advantage that would induce a company to undertake an otherwise uneconomic project. In fact, many ESG labeled bonds include a “look back” window that allows projects completed in the preceding years to qualify as investments funded by the ESG labeled bond. Continuing with the utility example, we believe that renewable energy investments are driven by cost relative to alternatives as well as legislative and regulatory prompts to produce cleaner energy. A company might issue an ESG labeled bond to modestly broaden the pool of investors to include some with specific ESG mandates and to demonstrate a focus on ESG considerations, but we would be surprised if ESG labeled bond issuance factored meaningfully into any capital allocation decisions. Moreover, the issuance of an ESG labeled bond and the allocation of an amount equal to the proceeds toward environmentally or socially responsible investments has no impact on the potential ESG risks associated with the remainder of an issuer’s business.

From an investor perspective, ESG labeled bonds are typically pari passu with other bonds issued by a given company. In other words, a senior unsecured green bond is in the same position in the capital structure as any other senior unsecured bond issued by a given company. While an issuer pledges to allocate an amount equal to the bond proceeds to certain environmental or social projects, the ESG labeled bonds are not secured by those projects or otherwise distinguishable from the other indebtedness of the company. Investors might choose to invest in ESG labeled bonds to illustrate their awareness of ESG considerations and highlight investments in companies that are pursuing environmentally or socially responsible projects, but investment in ESG labeled bonds does not help to manage ESG risks in a portfolio relative to investment in other bonds of the same issuers.

Our holdings of ESG labeled bonds have increased as issuance has grown. We expect that insurers will highlight ESG labeled bonds to stakeholders to illustrate their awareness of ESG considerations and their ownership of bonds issued by companies that are pursuing environmentally or socially responsible initiatives. We wonder, however, if the current focus on ESG-labeled bonds will fade as ESG analysis evolves. When investors are seeking to manage ESG risks in their portfolios and invest in responsible and sustainable companies, we believe this analysis is best done at the issuer level, as opposed to focusing on the use of proceeds from individual bonds that may represent a very modest portion of an issuer’s capital structure. At NEAM, we will continue to incorporate ESG considerations, among other factors, into our evaluations of issuer credit quality.

KEY TAKEAWAYS

- Issuers of ESG labeled bonds can highlight environmentally or socially conscious projects while broadening the investor base to include those with specific ESG mandates.

- Investors can illustrate their awareness of ESG considerations via participation in ESG labeled bonds.

- We have added ESG labeled bonds when we otherwise believed that credit quality and valuations were attractive; we expect our holdings of ESG labeled bonds to continue to expand as the market grows.

- At present, ESG labeled bonds generally trade at similar levels to equivalent bonds without proceeds earmarked for environmental or social projects.

- We can envision a scenario in which ESG labeled bonds trade at a premium, leading to outperformance for these securities; however, this is not, in our view, the most likely scenario.

- We wonder if, in the long-term, the current popularity of ESG labeled bonds might fade, with investors focusing on a more holistic view of an issuer, instead of the use of proceeds for a specific bond, as they integrate ESG analysis into investment processes.