In this Perspectives, we explore the realignment of insurance product portfolios and the asymmetric behavior of asset returns and property/casualty underwriting margins on both asset allocation and enterprise outcomes. We find realigning insurance product portfolios can favorably impact enterprise results. Further, product realignment can enhance the earnings contribution of asset reallocation.

We also find that product realignment and asset reallocation outcomes will differ depending on whether or not returns and margins are deemed to be asymmetric which may lead to possible behavioral changes. Further, the role of reinsurance, noted in a previous Perspectives, increases in a comprehensive enterprise review where product realignment is addressed.1 The only caveat to our conclusions pertains to individual company variation based upon underwriting practices and enterprise risk tolerances. As always, the devil is in the details and readers are urged to review the endnotes.

Asymmetric Returns

We have published articles on the topic of asymmetry twice before, exclusively focusing on asset returns.2 In this Perspectives, we broaden our scope to include underwriting margins. Chart 1 below presents two hypothetical asymmetric distributions that are compared to a normal distribution of outcomes.

/NEAMgroup_asymmetric_and_normal_outcomes_hypothetical_distributions.jpg?width=797&name=NEAMgroup_asymmetric_and_normal_outcomes_hypothetical_distributions.jpg)

The underwriting margin’s distribution is skewed heavily to the left, reflecting exposure to loss which can be many multiples of the premium with upside gain limited to premium less operating expenses. The asset return distribution has a lesser probability of significant downside loss, offsetting an “unlimited” upside.3

The hierarchy of asset allocation decisions is top-down: fully taxable versus tax-preferenced securities; fixed income versus equities; and, within fixed income, duration, optionality, liquidity considerations etc., all subject to enterprise and investment risk tolerances, capital charges, etc.; and a long list of metrics.4

Product mix has analogous drivers, not the least of which is the categorization of losses into attritional and non-attritional events, deductibles and self-insured retentions, occurrence versus aggregate loss policy limits and near immediate versus latent manifestation. Mispricing these attributes of losses can compound both normal and asymmetric outcomes within the insurer’s product portfolio.

Enterprise Approach

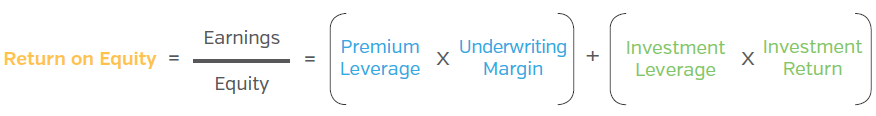

We follow a straightforward enterprise approach to capture the dynamics of insurers’ sources of return and risk.5 The drivers of return and risk are underwriting outcomes, investment results, capital levels and their composition. Embedded in the return on equity (ROE) is whatever might be the correlation effects between underwriting margins and asset returns. The “arithmetic” of the DuPont formulation is as follows:

Premium and investment leverage are defined by the premium to capital ratio and invested assets to capital ratio, respectively; underwriting margin equals 100 minus the combined ratio; and investment returns equal the return on invested assets. Viewing underwriting margin through the lens of classical risk theory leads to formulaic probabilistic means of estimating historic volatility, prospective downside risk and dependencies for solvency assessment.6 Chart 2 places the “enterprise” at the intersection of all capital, underwriting and investment decisions.

/NEAMgroup_enterprise_intersection_2.jpg?width=847&name=NEAMgroup_enterprise_intersection_2.jpg)

In the sections that follow, we present three scenarios. In the first, asymmetry is completely ignored and the asset return (and underwriting margin) and risk metrics are based on the first two moments of their respective outcomes. In the second scenario, the risk metric is the T-VaR of each asset and product derived from the first two moments of their respective distributions. In the third scenario, the risk metric is the T-VaR reflecting the estimates of asset and product outcomes’ asymmetric characteristics. The underlying underwriting margins and asset returns are the same in the three scenarios.7

Scenario I: Symmetric Asset and Product Risk Metrics

Chart 3 contrasts three after-tax efficient frontiers (EFF) for a hypothetical multi-line property/casualty insurance company. EFF-A allows for modifications to the insurance portfolio when holding the asset allocation constant. EFF-B results from a reallocation of asset classes and, within fixed income sectors, a mean-variant efficient re-configuration of duration, credit, liquidity, etc., and risk metrics. Product line mix is static. And, EFF-C allows for assets and products to be jointly reconfigured simultaneously.

/NEAMgroup_alternative_enterprise_return_risk_trade_offs.jpg?width=847&name=NEAMgroup_alternative_enterprise_return_risk_trade_offs.jpg)

Table 1 displays similar enterprise T-VaR outcomes for the three EFFs in Chart 3. EFF-A results are driven by an improvement in the underwriting margin and risk of 0.4 and 0.3 combined ratio points respectively; and product and investment leverage increases as the product portfolio is realigned. Asset allocation is unchanged. EFF-B total return on assets improves over 120 bps after-tax through asset reconfiguration, driving a nearly full-year duration increase and a one-notch credit quality reduction. Defaults and liquidity are only modestly impacted.

/NEAMgroup_similar_t-var_outcomes_support.jpg?width=859&name=NEAMgroup_similar_t-var_outcomes_support.jpg)

EFF-C shows the greatest improvement in the enterprise return/risk profile, as asset reconfiguration and product realignment occur simultaneously. However, product margin actually declines, offset by product and investment leverage increases. Both product and asset risk decline and whereas duration increases and credit quality lessens, defaults and liquidity actually improve (as equities are added).

The role of leverage is critical to the outcomes. In the joint optimization, product leverage increases (less required capital). However, the product realignment favors those products having both a higher ratio of reserves to premiums leading to a still greater level of investment leverage, and a higher total return on assets (leveraged) offsets lower underwriting margins. The obvious caveat is whether the increased ratio of reserve to premium signifies an increase in underwriting risk.

Clearly, the results shown above are dependent on margin, return and volatility assumptions, assumed product capital allocation and reserve to premium levels, and prospective underwriting price elasticity. As such, outcomes will vary by company; and they are shown only to highlight the importance of enterprise interdependencies and, at a minimum, demonstrate the sensitivity of asset allocation to underwriting outcomes and leverage. The reshaping of product mix is not a short cut to improved underwriting results; rather, those improvements can occur only when superior underwriting execution is present.8

Scenario II: 1st Comparison of Symmetric and Asymmetric Results

Chart 4 contrasts three EFFs originally constructed with three different risk measures: normal market standard deviation; normal market 99.5 T-VaR; and, an asymmetric 99.5 T-VaR. For each EFF, we compute the historic normal standard deviation values of all portfolios. Chart 4 shows each frontier’s total return associated with the calculated historic standard deviation. It is then possible to show the metrics for any portfolio for each EFF with a common risk metric basis of comparison.9

/NEAMgroup_alternative_enterprise_return_risk_trade_offs_4.jpg?width=920&name=NEAMgroup_alternative_enterprise_return_risk_trade_offs_4.jpg)

Table 2 displays the various metrics of several portfolios for the Normal Markets and Normal Markets – Tail Risk EFFs. The minimal Normal Markets earnings risk and corresponding total ROE are 3.88 and 9.59 percent, respectively (as highlighted in the table). The similar total return portfolio return is 12.30 and is associated with a 5.01 normal markets earnings risk. The Tail Risk portfolio, with a normal market earning risk of 5.01, has a corresponding total return of 11.31 percent. Note the corresponding differences in product margins, leverage, duration and liquidity. Also, note the convergences of all metrics as return and risk increase.10

/NEAMgroup_normals_markets_risk_and_tail_risk_allocation.jpg?width=1169&name=NEAMgroup_normals_markets_risk_and_tail_risk_allocation.jpg)

Scenario III: 2nd Comparison of Symmetric and Asymmetric Results

Table 3 displays the various metrics of several portfolios for the Normal Markets and Asymmetric EFFs. There are several differences in outcomes between the two. First, the minimum asymmetric total return is 9.11 percent, 110 bps greater than the 8.01 percent of the normal markets. However, the former’s normal market’s earnings risk is not achievable in an asymmetric world (3.56 versus 4.79). Also, note the differences for the similar total return portfolio (with identical normal markets risk of 5.01), 12.28 percent versus 10.30 percent, respectively.

/NEAMgroup_normals_markets_risk_and_asymmetric_tail_risk_allocation.jpg?width=1173&name=NEAMgroup_normals_markets_risk_and_asymmetric_tail_risk_allocation.jpg)

Meaningful differences also exist in several other key asset risk metrics: defaults, liquidity, duration and credit quality and statistical metrics, such as asymmetry (negative values denotes skewed adverse outcomes), asset correlation and product correlation. Outcomes converge but only meaningfully as the maximum normal markets risk and total return are approached. This is similarly true for sector allocations and product alignments.11

Key Takeaways and Next Steps

NEAM’s enterprise framework offers a simple yet comprehensive approach to examine many of the inter-related financial decisions made by insurers as they seek to enhance sustainable risk-adjusted returns on capital. In this Perspectives, we examine the impact of product portfolio realignment and asymmetric asset returns and underwriting margins on both asset reallocation and enterprise level return and risk metrics.

These are our key takeaways:

- Product realignment might offer the opportunity to improve enterprise results independently of asset reallocation. However, we caveat that point by noting underwriting is not a fool’s game.

- Product realignment can result in long-term premium and investment leverage changes, thereby enhancing the contribution of asset reallocation to the enterprise return/risk profile. However, leverage also amplifies the impact of downside risk: its measurement and risk tolerance specification are essential.

- Product realignment and subsequent asset reallocation are further impacted by reinsurance considerations of costs and opportunities further suggest a need for an integrated Enterprise evaluation.

- Regardless of the risk metric deployed, asset allocations will converge as the required rate of return is increased, unless constrained by statistical limits derived from the underlying return and margin distributions.

- Relying on assumptions of “normal” returns and margins masks the adverse impact of extreme events upon asset allocation. On the other hand, utilizing asymmetric return and risk measures capturing such events might discourage pursuit of opportunities due to fear of events that will never reoccur (others will replace them!). In either case, the consequences of assumptions need to be well understood.

- Stress testing, and otherwise assessing, “the consequences of being wrong,” should be the path to follow.12

The “Enterprise: The Intersection” articles are about choices and informed decision making. NEAM has experience and tools to assist companies with their assessments. Future editions of Perspectives will demonstrate the impact of the utilization of debt and asset derivatives’ hedging upon asset allocation. In the interim, if you would like to learn more about NEAM’s Enterprise Capital Return and Risk Management® framework, please feel free to contact us.

Endnotes

1 Perspectives, “Enterprise: The Intersection of Capital, Underwriting and Investment Management Opportunities," December 2019.

2 See, General ReView, Issue 37, “Enterprise Based Asset Allocation: When the World is Not Normal,” August 2007, and General ReView, Issue 50, “Managing Asymmetric Returns: Inside Downside Risk,” May 2011.

3 The insurer’s underwriting loss is limited only by occurrence limits and aggregates. For a portfolio of insurance risk, the “safety net” can be the “law of large numbers” or, failing that, reinsurers with larger and balanced exposure to “model” losses resulting in a differing return/risk utility function. The investor’s loss is limited to the principal investment amount, unless leverage is present.

4 Within this hierarchy there might be explicit consideration given to assets which offer an inflation hedge. Examples might include equites or often touted TIPS. In these instances there might be reason given to defease liabilities whose cost behavior exceeds initial product pricing assumptions.

5 The application of Enterprise analytics presented in this Perspectives is branded as the Enterprise Capital Return and Risk Management® (ECRRM™) methodology. The methodology allows for most quantifiable drivers of enterprise return and risk to “be in play” separately or simultaneously. A more narrow but more common application is Enterprise Based Asset Allocation™ (EBAA™). However, EBAA™ assessments are conditional upon current levels of underwriting and enterprise risk tolerance estimates. The most comprehensive view is through the ECRRM™ lens. “Enterprise Risk Management” and “Enterprise Capital Management” might be similarly inclusive; however, their applications might be greatly different and possibly limited in scope.

6 In simple terms, underwriting margin = premium (expected loss + expense + profit load + contingency margins) – actual losses or expenses. Volatility revolves around the magnitude of the error in the estimated losses. Following classical risk theory, expected losses can be broken into frequency and severity and each component has a distributional form associated with it depending on the underlying circumstances. The distributional form of the loss function is the compound distribution of the frequency and severity components. The “error” term is subject to model risk and the smaller the insurer’s risk portfolio, the greater the volatility of the outcome. Thus, the role of reinsurance can be vital to manage point in time and, over time, the manifestation of adverse outcomes.

Dependencies, often used synonymously with correlation, might be difficult to assess because of their lack of statistical stationarity. Accordingly, stress testing becomes critical to assess the consequence of being wrong around this critical factor to enterprise risk calculations. See Buhlmann, Hans. Mathematical Methods in Risk Theory. Berlin: Springer-Verlag, 1970.

/NEAMgroup_sample_underwriting_assumptions.jpg?width=815&name=NEAMgroup_sample_underwriting_assumptions.jpg)

8 Successful underwriting market leaders surpass other companies’ enterprise outcomes, and even then product entry and positioning is time consuming and difficult, impacting distribution channels, targeted customer groups etc. See, Perspectives, “Don’t Uncork the Champagne: 2018 P&C (Investment Results)," November 2019.

9 The three EFFs, all normalized to the same enterprise risk metric, appear different from one another: they are different. This leads us to question the suitably or preference for each risk metric and whether the differences in risk levels are sufficient to change an insurer’s behavior.

10 At the end of the day, maximum return requirements or maximum allowable risk levels will converge to the same asset allocation, yielding similar micro risk metrics; a point often overlooked. However, “across the curve” differences might (most often will) exist and the practitioner needs to decide whether the differences merit a change in behavior.

/NEAMgroup_endnotes_table_2.jpg?width=1153&name=NEAMgroup_endnotes_table_2.jpg)

/NEAMgroup_endnotes_table_3.jpg?width=1153&name=NEAMgroup_endnotes_table_3.jpg)

12 See, General ReView, Issue 68, “Stress Testing: Avoiding a Collision With the Past in the Future”, March, 2015.

NEAM’s portfolio management tools were utilized to provide illustrative examples of asset allocation and enterprise return and risk metric estimates based on certain assumptions. NEAM makes no representations and warranties as to the reasonableness of these assumptions. Results are based on data available at the time of the analysis and may not reflect the effect of material economic and market factors. Actual results will differ from any information shown.