The fall in Euro Area (EA) inflation during the last twelve months has been a surprise to policy makers and market participants alike. In addition to current headline inflation reading of slightly above zero—longer term inflation expectations have also declined. A lackluster growth/deflationary outcome would represent a significant medium term challenge to some EA sovereigns that still require de-leveraging and structural reform.

European Central Bank (ECB) policy is increasingly following the Fed’s QE template and with policy rates at zero, the ECB has outlined various instruments it will deploy to rebuild the size of its balance sheet and thus provide further monetary stimulus to the EA economy. However some observers, skeptical on the efficacy of the current ECB proposed policies, believe that the ECB will be required, perhaps grudgingly, to purchase EA sovereign bonds in order to ease monetary policy in a timely and sufficient manner. Sovereign QE was never envisaged when the EUR was created in 1999.

In this issue of General ReView, we explore the ECB QE strategy and associated implications for Euro based and USD based investors.

Eurozone Inflation

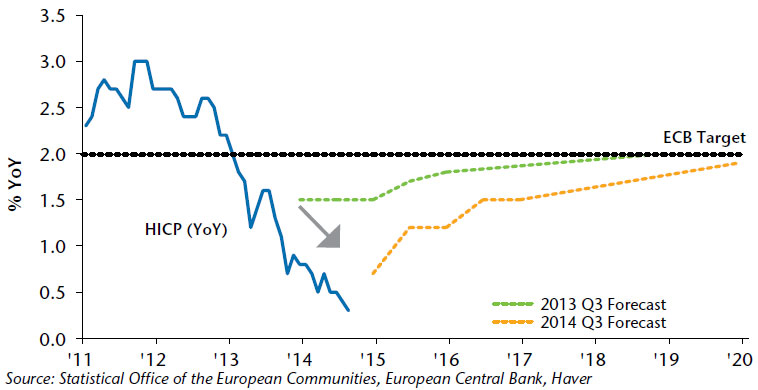

Eurozone inflation is currently 0.3% which is only just above the zero level. Harmonised Index of Consumer Prices (HICP), the Euro Area’s common measure of inflation, has fallen to 0.3% in 2014 from 2.6% in September 2012. This is well below the ECB’s definition of price stability of “below but close to 2% over the medium term.” Core inflation, which excludes more volatile elements such as food and energy prices, has also fallen recently and stood at 0.7% in September. The drop in inflation has caught markets and policymakers by surprise, as illustrated in Chart 1.

Chart 1. Fall in Euro Area Inflation a Surprise

According to the ECB’s quarterly Survey of Professional Forecasters (SPF), in Q3 2013 the expectation was that HICP would print at 1.5% at year end 2014. The most recent forecast, in Q3 2014, now anticipates year end 2014 HICP at 0.7%. The size and persistence of the undershooting of the inflation target has led the ECB to consider more radical policy alternatives in order to prevent the dis-anchoring of long term inflation expectations.

The 2014 Q4 SPF forecast path illustrates that based on the past year, the pace at which inflation is likely to return to the ECB target level is significantly slower than was the expected case twelve months ago. This outcome is evidenced by looking at forecasts for annual inflation in each of the next five years. At the outset of 2013, annual expectations for each of the next five years were tightly grouped around 2%. As the year progressed and economic activity in the EA faltered, the 2014 expected level fell dramatically. Recently, inflation expectations for future years have fallen.

ECB President Draghi has cited the expected 5yr/5yr forward inflation as a key metric to determine the credibility of ECB monetary policy. This measure, which effectively tells us where market participants can hedge exposure to inflation beginning in five years, for the following five years, has recently fallen to 1.88%. This is a historically low level and illustrates the scale of the medium term challenge faced by the ECB in attempting to re-anchor inflation expectations.

Deflation and the Euro Area

The risk of deflation is one that policymakers generally wish to avoid. In the EA, persistently very low inflation or deflation would be particularly unwelcome as the member states attempt to recover from the recent EA sovereign crisis. Deflation is usually associated with weak growth outcomes and EA growth is likely to be, on average, approximately 1.50% lower than U.S. growth this year and next. In addition, EA unemployment is likely to remain around 11.5%—potentially double that of the U.S. by next year. These outcomes signal persistent excess capacity in Europe and continued downward pressure on prices. The financial crisis, combined with the EA sovereign crisis, have left many EA member countries with high sovereign debt levels. In return for previous ECB liquidity support programs, EA countries committed to the Fiscal Compact, a key legal agreement which sought to return sovereign debt levels to those originally envisaged when the EA was set up under the Maastricht Treaty.

Low inflation (or worse, deflation) would make running the annual budget surpluses required to amortise the debt load extremely difficult, as evidenced by Japan in recent years. Any attempt to impose further fiscal austerity in the EA risks destabilising national politics in different member states.

On the other hand, undermining the Fiscal Compact risks response from markets, rating agencies and German/core country politicians.

Boosting the ECB’s Balance Sheet

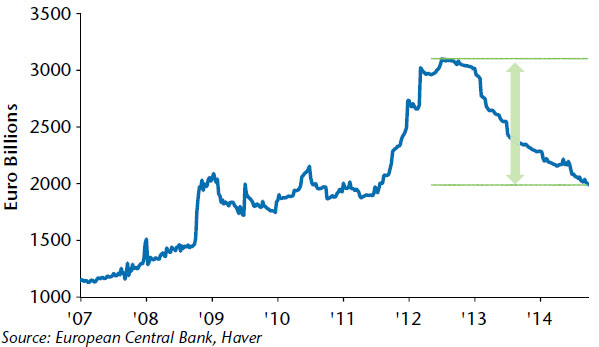

As illustrated in Chart 2, the ECB is perceived as being increasingly behind the curve by market participants since the balance sheet has been shrinking as inflation has been falling. ECB President Draghi has recently stated that a goal of central bank policy should be to increase aggregate demand. This focus on growth is a change for the ECB which has spent many years advocating fiscal austerity and structural reform at the national level as the key components of the EA recovery strategy.

To date, the ECB has been seemingly concerned with moral hazard—the notion that more support from monetary policy would reduce the likelihood that governments would implement required fiscal and structural reforms. President Draghi indicated that the ECB will boost the size of its balance sheet in an attempt to ease monetary policy now that policy rates have reached the zero bound.

Chart 2. ECB Balance Sheet: Behind the Curve

Chart 2 shows the evolving size of the ECB’s balance sheet. Market participants have focused on President Draghi’s stated desire to see the ECB’s balance sheet return to its early 2012 level. In other words, the ECB is targeting a balance sheet increase from its current level of €2 trillion to its level of two years ago—€3 trillion.

The ECB has outlined two main policies for accomplishing this objective. These policies represent a form of private sector Quantitative Easing (QE).

The first policy, implemented in September, is the provision of very long term, fixed rate loans to banks in a program termed Targeted Long Term Refinancing Operation (TLTRO). Initially, €400 billion was made available, of which only €87 billion was requested at the initial auction. The second auction takes place in December and ECB President Draghi stated that the success of the program should be judged by measuring the cumulative total drawn down between both auctions. There will be further auctions over the next 18 months with the amount of available funds being a function of the net lending undertaken by banks in the meantime. Despite his view point, scepticism about the ability of the ECB to attract sufficient demand for its loan programs has increased.

The second part of the ECB strategy to boost its balance sheet is an Asset Backed Securities Purchase Program (ABSPP) and a Covered Bond Purchase Program (CBPP3). Some details were provided by ECB after its meeting on October 2nd. Based on the eligibility criteria outlined by the ECB in early October rating, jurisdiction, seniority and currency denomination market observers have sized the available universe for the ECB program at €620–€650 billion. Of that total universe, approximately 75% has been retained by the originating bank and 25% of the universe has been placed with end investors.

Throughout the sovereign crisis, EA banks structured ABS transactions which were then used to attract funding in ECB liquidity operations. The ECB has announced that it will purchase primary and secondary ABS whether retained or distributed. In addition, the ECB will purchase up to 70% of an individual ABS or Covered Bond issue—previous programs in the Covered Bond arena did not allow the ECB to become the majority holder of any individual security. If the ECB is successful in purchasing 30% of the outstanding eligible float, in line with the Fed’s purchases of MBS in the U.S., then it could boost its ABS holdings by approximately €200 billion.

The ultimate total purchased over the two years that President Draghi has outlined as the operating period for the ABSPP will be a function of the existing secondary ABS market and the amount of new issuance that will take place as originators respond to the purchase levels set by the ECB—a key variable that is not yet apparent. The key segments in which the ECB will gain access to sufficient size in the ABSPP are the bonds that are already used as collateral at the ECB and new issues that are structured specifically with the ECB in mind. Market participants currently believe that €300—€500 billion over two years is the range of total purchases that could take place. The extent to which this amount could boost the ECB’s balance size is uncertain, however, as ABSPP purchases that displace other existing financing alternatives will mute the impact of the program in boosting the ECB’s balance sheet size.

The ECB currently wishes to adopt a wait and see approach. It believes that its measures, as outlined above, represent a regime shift in the operation of monetary policy. As such, they should be given time to work before measuring efficacy and impact. If these policy measures fail to provide a timely shift in balance sheet size or if the EA growth/inflation outlook continues to weaken then the ECB may be forced to consider purchasing sovereign bonds, so called public QE.

The EA Government Bond Index has in excess of €6 trillion of available bonds by market value. Political, legal and structural hurdles in the EA make public QE a difficult option for the ECB. However, failure to grow the balance sheet sufficiently quickly under the ABSPP and CBPP3 initiatives, could result in a further decline in long term inflation expectations. Thus, it is possible, if not likely that the ECB will move in this direction during the first half of 2015.

Implications for EUR Investors

The weakness of EA growth and inflation has led to a significant rally in EUR bond yields during 2014. For example, German government bond yields have fallen more than 100 basis points in the seven year and longer-dated part of the curve. The two year to five year part of the German government bond curve has seen yields drop by between 25 basis points and 75 basis points as the front end of the curve already reflected a more dovish ECB stance. Nevertheless, the yield reduction at the front end of the German government bond curve means that German yields are now negative out to the four year area. We have calculated that approximately €700 billion of EA government bonds now trade with a negative yield to maturity.

EUR fixed income investors, such as insurers, wishing to preserve as much of the their existing book yield as possible on reinvestment will be required to maximise their allocation to credit sectors that provide incremental spread return as well as extending their maturity profile. Given the ultra-low yields mentioned, the spread component now forms a historically high proportion of the total yield available on investing in EUR corporate bonds.

At present, the credit spread component of the EUR Investment Grade (IG) corporate index represents approximately 80% of the total available yield. The proportion of yield derived from spread has increased significantly since prior to the financial crisis, when a more typical proportion of the yield derived from credit spread was 10% to 20%. This underscores the difference in underlying government bond yields.

Currently faced with the same meagre underlying government yields, the spread component as a proportion of yield in EUR High Yield (HY) is even greater. However HY performance has been weaker to concerns surrounding Fed tapering and now EA economic weakness.

Thus, we advocate blue chip EUR IG corporate exposure as the optimal way to preserve as much yield as possible while keeping exposure to EA economic weakness as low as possible. Many leading global blue chip entities have issued recently in EUR and exposure to these entities has typically involved lengthening the maturity profile of an existing EUR portfolio at the margin.

Implications for USD Investors

The Implications of recent ECB actions are significant for Eurozone markets and capital markets in general. These implications are being discounted in the currency, rates and equity markets as valuations adjust to take into account economic and monetary policy differentials across the world.

The U.S. dollar has appreciated smartly over the past several months versus a trade weighted basket of currencies including the Euro, Japanese Yen and the British Pound. The Federal Reserve is contemplating tightening monetary policy as early as mid 2015, given the U.S. economy’s relative strength. As such, the dollar has appreciated to multi-year highs. As a result of the U.S.’ position vis-à-vis many other advanced economies, interest rates (both real and nominal) remain significantly higher in the U.S. than in Europe or Japan.

From an equity perspective, valuations of U.S. markets are also materially higher than those ascribed to many other equity markets since investors are willing to pay a premium for better growth prospects going forward.

Fortuitously for Europe (not so for Russia), the price of oil has adjusted downward materially in recent weeks as the European and Chinese economies both encounter headwinds (by design, in the case of China). Global oil transactions are denominated in USD so fortunately for Europe, lower oil and distillate prices will offset the negative impact of stronger USD on energy costs. Ceteris paribus, this should improve the ECB’s chances of spurring economic activity.

As a result of the economic “drag” referenced above, we are maintaining neutral durations (versus benchmark) in U.S. client portfolios for the time being. Additionally, we are retaining our emphasis on spread products as global central bank accommodation should continue to buoy the credit markets. While IG spreads remain relatively tight, default rates are likely to remain quite low given solid corporate profits and a very favorable financing environment.