The start of 2016 has witnessed extreme volatility in capital markets. While the finger has been pointed at many culprits, from oil prices to China and European banks, one plausible driver has surely been the divergence of monetary policy between the Fed and ECB. In this Quick Takes we examine why the U.S. and Eurozone central banks are embarking on different paths, how sustainable this is in a world of growing headwinds to global and U.S. growth and what the implications for capital markets might be for the remainder of 2016.

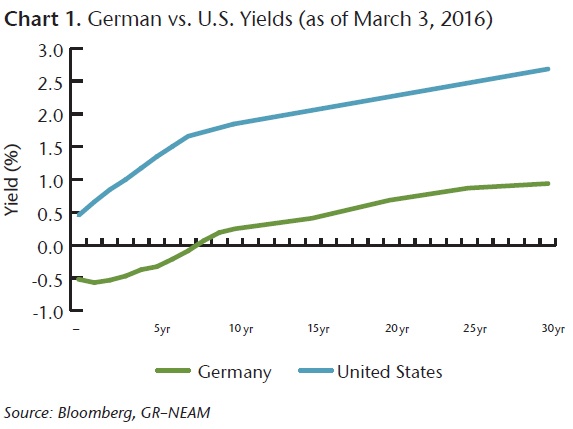

December saw the Fed tighten and the ECB loosen within the space of a fortnight, a contrast not seen since 1994. Both central banks are talking up further action with the Fed “Dot Plot” indicating 3 further rate rises by year-end and the ECB promising an expansion of its QE programme. These divergent policy paths largely reflect different stages in the business cycle; in particular the lower slack evident in U.S. labour markets but also heightened ECB anxiety over deflation. Fed Chair Yellen is watching headline unemployment fall to 4.9% whereas ECB President Draghi has to contend with a stubbornly high 10.3%. Fixed income markets have listened with the yield curve for U.S. Treasuries sitting well above that of German bunds (see Chart1).

What is notable is that this yield differential has narrowed (20 to 30 bps inside 10 years) since the December policy announcements, as markets increasingly question the Fed’s ability to follow through on policy tightening against a backdrop of rising economic headwinds. These include falling commodity prices and their impact on emerging market growth, tightening financial conditions for higher risk U.S. borrowers, global asset price volatility and continued dollar strength. Yellen has acknowledged these challenges in her recent House testimony, but stopped short of accepting the Fed may have to remain on hold indefinitely.

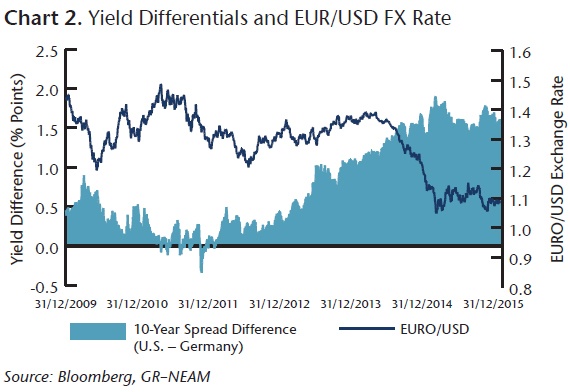

The divergence question will likely remain a key theme during 2016 and add to volatility in equity, fixed income and currency markets. Yellen has noted the “intensified uncertainty about China’s exchange rate policy and the prospects for its economy,” but the strength of the dollar itself and the volatility of the EUR/USD exchange rate is also cause for concern. As more robust growth and labour markets in the U.S. since 2012 have raised the yield differential with German bunds, the dollar has strengthened to almost parity (see Chart 2). Volatility, however, has been a companion on the journey – when the ECB disappointed the doves on December 3rd, the EUR/USD appreciated by 4% on the day whilst European equity markets fell by 4%.

At the same time, central bank policies targeting negative interest rates are at least partly designed to act as competitive and unofficial tools to talk down currencies. However, such policies have indirectly led to fear for European bank earnings and stability while adding more volatility to the economic mix. Don’t lay all the blame at the ECB’s door though as the Swiss, Scandanavians and BOJ are all playing along to the same tune of negative rates.

The Fed’s ability to continue normalizing rates has certainly diminished recently amid tighter credit conditions, which have developed early in 2016. Nonetheless, growth momentum and labour markets will likely remain stronger than in the Eurozone, where the ECB remains in full easing mode on fears of deflation. Government bond yield and curve differentials are expected to continue to be significantly in favour of U.S. Treasuries. Currently, USD credit markets remain deeper, in terms of liquidity, new issuance, maturity and diversity by name and sector. Global investor demand for these high quality assets are expected to provide a technical bid for USD credit product, supporting the back-end of the U.S. Treasury yield curve through flattening pressure. European investors frustrated with ultra-low reinvestment yields may wish to take advantage of these current USD opportunities. Worth remembering, however, will be that the Fed is the first key central bank to tighten policy – it will certainly not be a smooth path without volatility. Recognising the importance and cost of currency hedging would also be an important part of analysing the return prospects for any such EUR denominated investor.

Key Takeaways

- Fed and ECB monetary policy have begun to diverge for the first time since 1994. This reflects the U.S. and Eurozone being at different stages in the business cycle and is reflected currently in yield differentials between Treasuries and German bunds.

- The sustainability of this divergence is open to debate given growing economic headwinds to U.S. growth. Asset price and exchange rate volatility are likely consequences.

- Deeper U.S. credit markets are expected to continue to provide opportunities for global investors in a world of ultra-low yields. These opportunities include for example, taking USD denominated corporate credit exposure for EUR denominated investors.

- Volatility and currency hedging are key considerations for such investors.