Datacenter Asset Backed Securities (“ABS”) emerged in 2018 as a niche asset class with limited activity and investor participation. Fast forward to today and the market has grown to over $15 billion in debt outstanding1 and a liquid secondary market. We think the sector offers fixed income investors diversification, strong underlying fundamentals, and attractive risk-adjusted relative value.

What is a Datacenter?

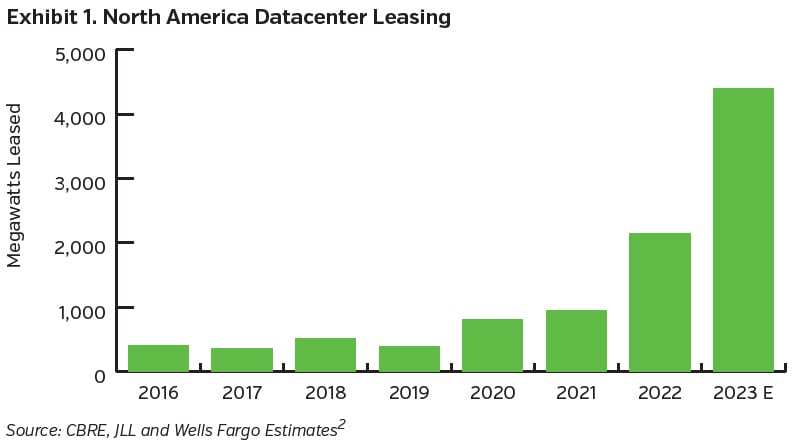

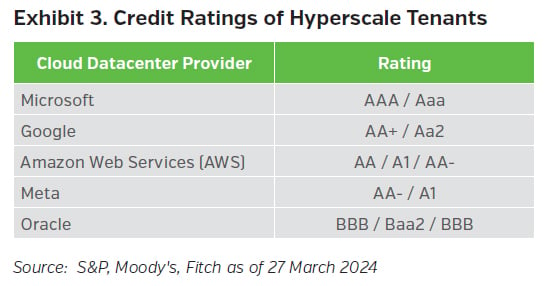

A datacenter is a centralized location that houses the physical IT infrastructure equipment used to host applications and store data. Datacenters can vary greatly in size, ranging from an internal “data closet” located on-premises and managed by internal IT resources, to large scale external modern datacenter campuses. As an organization’s needs expand, they may move from an on-premises setup to a third-party Colocation facility. Here customers lease out physical space or server racks to host their equipment within a larger facility. At the other end of the spectrum is the Hyperscale market where the large cloud providers reside. In this setup, a company may decide to outsource their needs to a solution where their data and applications are stored on third party servers (“the cloud”) hosted by the likes of Microsoft and Amazon. Cloud providers (i.e. Microsoft or Amazon) then lease large amounts of space in datacenters where they house their equipment, enabling them to provide cloud hosting services to the customer. Regardless of model, the need for outsourced IT resources has led to record datacenter leasing activity.

The growth in demand for datacenter leasing arrangements has coincided with the use of securitization as a funding option. This is a function of the favorable attributes of the datacenter business model that fit with the requirements of ABS investors, while offering a scalable financing vehicle for datacenter operators. In a leasing arrangement, the facility operator provides the physical space, connectivity, power and cooling, while the tenant (customers) uses their own equipment and is responsible for paying the power costs. This is extremely important considering the significant amount of power these facilities consume. Other features that make the asset class attractive to bond investors are long lease terms ranging from several years to 15+, and tenants that tend to be sticky and have high switching costs (leading to minimal turnover). For these reasons, the predictable cashflow (along with the pledge of the physical structure) lend themselves well to an asset backed security structure.

What is Driving Demand?

Demand for datacenter space has steadily grown over time driven by a few durable trends, some of which have been accelerated by the impacts of the Covid-19 pandemic and overall increased digital demands.

- Social Media – Platforms, uploading and sharing of media, and advanced algorithms requiring significant datacenter resources.

- Internet of Things (IoT) – Proliferation of “smart” enabled devices that track, store, and share data from device to device in our increasingly interconnected world.

- Cloud Adoption – Companies moving to cloud based applications and storage, offering a flexible and scalable solution for a business’s IT needs and workloads, with broad accessibility. This has been a major driver of datacenter space to date.

- Artificial Intelligence – Breakthroughs in Large Language Models and other advanced AI models requiring large amounts of datacenter resources to train and retrain.

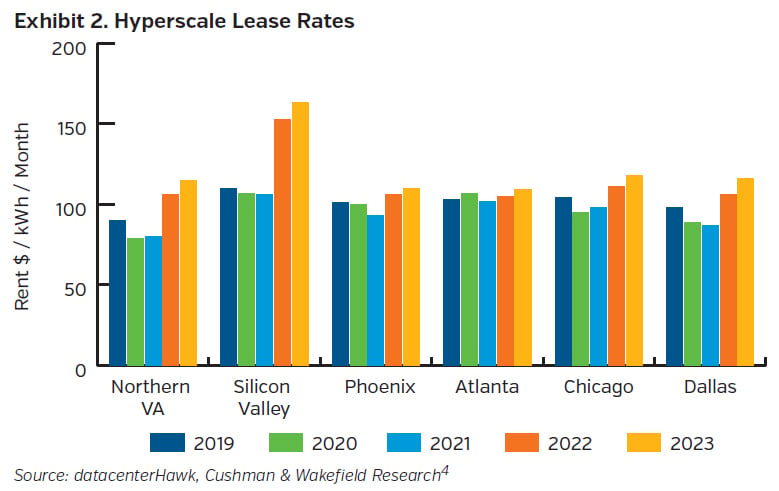

The exploding demand has run into constrained supply due to the massive power requirements for these facilities, which for recent AI projects have reached several hundred Megawatts (MW). (One MW is equal to 1,000 kilowatts (kW), which is enough energy to power over 800 residential homes at a point in time.)3 Before a new datacenter site can break ground, a commitment from the local utility is required in addition to local zoning and permitting, and utilities are having a hard time keeping up. This has pushed out lead times for new developments creating limited supply in key markets, increased rents, and tenants preleasing space several years in the future.

Datacenter ABS Structures & Opportunities

In a typical ABS datacenter transaction, securities are backed by a pool of multiple datacenters. The structure is flexible in that, over time, as new datacenters are constructed, they are contributed to the trust as new collateral and additional debt can be issued. Transactions will typically have a 5-year Anticipated Repayment Date (ARD), with prepayment protection for 3 years and a bullet maturity in year 5. There is a moderate amount of leverage on a Loan to Value (LTV) basis, with advance rates on senior classes in the mid 60% range. Leverage is capped at 70% however, and if the value of the properties fall and cause the LTV to increase above 70%, a provision in the waterfall redirects cashflow away from equity to instead amortize the ABS notes until the 70% level is achieved. In terms of collateral, NEAM views the hyperscale segment as particularly attractive due to a tenant roster of highly-rated, large capitalization technology companies; long term leases with contractual rent escalators; and the nature of these datacenter locations as mission critical to the operations of these entities. The sector is not without risks – one of those being potential rating volatility as S&P currently has a Request For Comment on a new rating criteria for datacenter ABS. Despite the potential for rating downgrades associated with the new criteria, we think that with current spread to treasuries in the mid to high 100s for senior A- rated bonds, this asset class delivers portfolios diversification and incremental yield in a secular growth sector.

Key Takeaways

- Demand for datacenter space remains robust, with AI adding incremental demand to traditional growth areas in cloud hosting and social media.

- Power constraints in key markets are significant, limiting the availability of new datacenter supply to market and providing a positive technical backdrop to the sector.

- We think datacenter ABS offers investors compelling relative value and exposure to a secular growth area in the economy. Currently, relative to a comparably rated corporate security, a senior datacenter ABS can pick up ~65 to 100 bp of incremental yield.5

- Datacenter ABS is still relatively novel and could face potential rating volatility as rating agencies’ approaches are subject to change over time.

Endnotes

1 Data provided by Intex, as of 12/31/2023.

2 Luebchow, Eric, and Caleb Stein. "Data Centers Q3 Preview – Does the Bull Story Still Have Legs?" Wells Fargo Securities, LLC. 19 October 2023.

3 NEAM provided estimates based on the below noted EIA article:

"Use of Energy Explained: Energy Use in Homes." U.S. Energy Information Administration (EIA). 18 December 2023.

4 Albers, Jacob. "Data Center Spotlight: Power and Lease Pricing Outlook." Cushman & Wakefield website. 26 July 2023. https://www.cushmanwakefield.com/en/united-states/insights/data-center-power-and-lease-pricing-outlook. Accessed 23 January 2024.

5 ICE BofA 5-7 year A rated corp index (C3A3), Spread to Worst vs. Govt, was +81 on 31 March 2024. NEAM estimates the range for 5-year (A-) datacenter ABS is ~+145 to 180 to treasuries (as of 31 March 2024).