CMBS transactions have been in the crosshairs of COVID-19 given the pandemic’s direct impact on commercial real estate. The retail and hospitality sectors have been significantly affected as a result of forced closures and reduced travel. Social distancing efforts have reduced the ability of organizations to conduct office operations, and many companies continue to implement work from home procedures. As a result, many property owners are facing shortfalls in rent collections and are having difficulty meeting their debt service payments. With virus cases still rising and a proven vaccine not yet imminent, commercial real estate will likely remain under near-term pressure until social distancing efforts are eased and individuals regain the confidence to return to normal life. Longer-term challenges may also persist, particularly for properties that were struggling prior to the onset of the pandemic. Through a combination of structural features, CMBS transactions offer protection for investors that can help to address both near- and long-term risks.

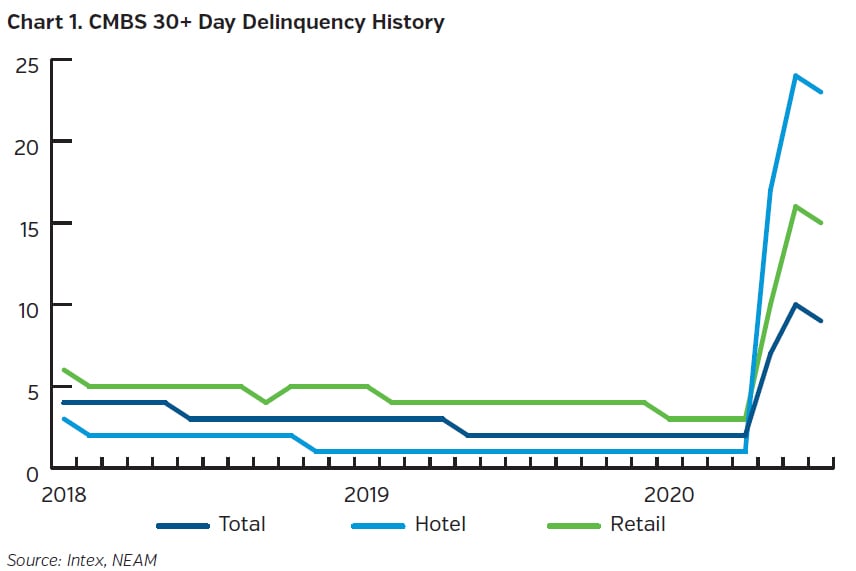

The immediate effect of COVID-19 on CMBS has been a sharp increase in delinquency rates as borrowers began to fall behind on monthly payments. The overall 30+ day delinquency rate jumped from 1.8% in February 2020 to 9.2% in July. The hospitality and retail sectors, however, have experienced outsized increases with delinquency rates of 23.3% and 15.1%, respectively. While concentrations of hotel and retail loans can vary significantly between deals, they comprise roughly 16% and 24% of the outstanding CMBS universe, respectively. To alleviate the reduction in available cashflows due to delinquencies, CMBS transactions feature an advancing mechanism whereby the master servicer (the primary point of contact for the borrower and party responsible for collecting debt service payments) is required to advance principal and interest payments on delinquent loans to the extent those amounts are deemed recoverable. The near-term result is that cashflows at the bond level should continue without disruption with the master servicer acting as a buffer to enable continuity of bond payments while delinquent borrowers gain some breathing room and time to work out a loan.

In addition to the master servicer, the special servicer plays a critical role in working with troubled borrowers and getting their loans performing again. The primary goal of the special servicer is to maximize recoveries to the trust, thereby minimizing investor losses. Indeed, the rate of specially serviced loans has increased simultaneously with delinquencies, and now stands at 9.4% in July, up from 2.4% in February. Though CMBS special servicers have traditionally been considered inflexible with respect to borrower requests, one method they have recently employed to provide relief is the granting of forbearance modifications. A forbearance is a short-term loan modification that gives the borrower time to bridge the gap until property cashflows recover. To date, many servicers have favored forbearances in the form of reserve relief whereby borrowers are permitted to use reserves (escrowed funds typically set aside for future capital expenditures, tenant improvements, leasing commissions, etc.) to pay debt service over a period of several months. This short-term relief may enable the borrower to remain current on the loan and reduces their burden by allowing them to replenish reserves in periodic installments at later dates.

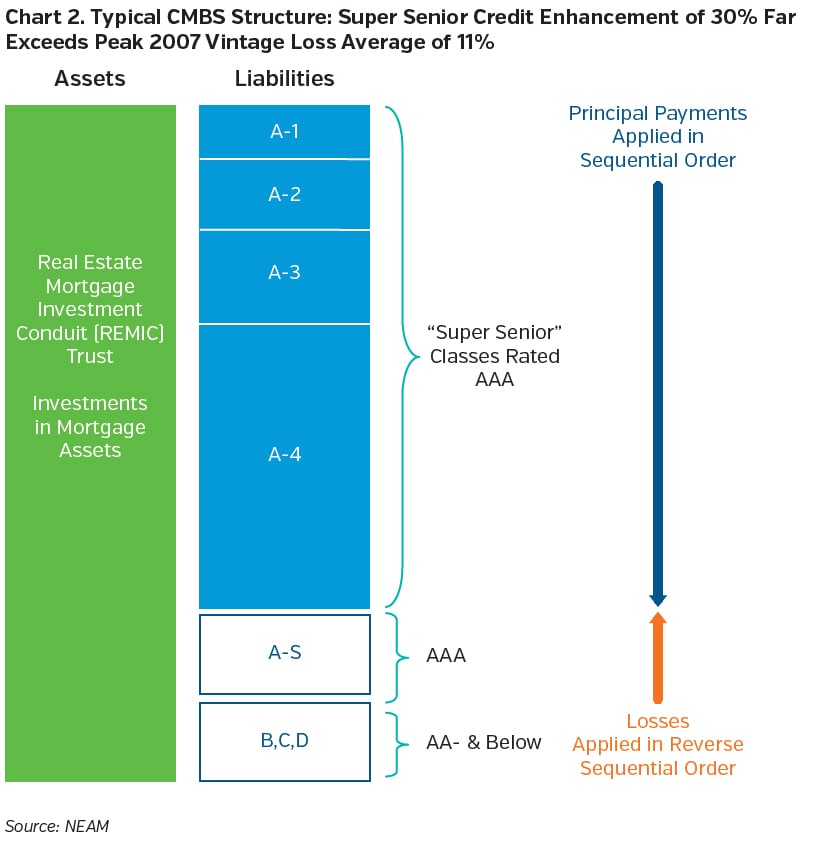

For more distressed properties, however, a short-term forbearance agreement may not be sufficient to resolve the loan. A long-term modification, such as principal forbearance (known as an “A/B Note Modification,” where the loan is bifurcated into a senior, interest-bearing note and a junior, non-interest-bearing note), may be required. In the most severe cases, the property may be subject to foreclosure and liquidation. In these instances, the trust could face a permanent disruption in cashflow through interest shortfalls and principal losses. Two structural provisions in CMBS transactions that protect bondholders are 1) cashflow payment priority and 2) available credit enhancement. Because CMBS transactions are tranched into different classes of certificates, the senior classes in the structure are given priority due to the application of payments in sequential order. The result is that any shortfalls or losses will be directed first to the most junior certificate outstanding and then applied in reverse sequential order up the capital stack. As losses flow through to the trust, the subordinate certificates act as credit enhancement for the senior notes. Credit enhancement can reach levels of 30+% for super senior, AAA rated tranches, which provides a significant amount of protection from losses. For example, despite some downside ratings volatility, no super senior class sustained a loss throughout the Great Financial Crisis. According to Fitch, the cumulative average loss severity on CMBS loans since 2003 has been 46.6%. Applying this severity, a newly originated deal can withstand defaults greater than 60% before the super senior class suffers a loss. Because of the strong protections that exist for senior note holders, maintaining an up in structure bias can help insulate investors from the downside risks facing CMBS as uncertainties surrounding commercial real estate unfold.

Key Takeaways

- CMBS delinquencies have ramped up significantly in recent months due to forced closures, social distancing requirements and reduced travel during COVID-19. The delinquency rate is likely to remain elevated in the near-term until restrictions are eased, and individuals begin to resume more normalized levels of social activity.

- Currently, CMBS investors have experienced little to no disruption in bond cashflows as a result of master servicers advancing payments on behalf of delinquent borrowers. Master servicers are predominantly backed by large banks and are expected to have adequate liquidity to meet advancing needs.

- In the short-term, many borrowers will be able to work with the special servicer to obtain a forbearance agreement which can help bridge the gap until property cashflows have stabilized.

- Over the longer-term, properties that have seen a more permanent disruption in cashflows may face modifications or even foreclosure, which can generate shortfalls and losses to the trust.

- The tranched nature of CMBS transactions provides senior bondholders with both payment priority and credit enhancement, which can help mitigate the risk of any shortfalls and losses that are allocated to the trust.

- We maintain an up in structure bias for our insurance company clients and look to opportunistically take advantage of future spread volatility should it arise.