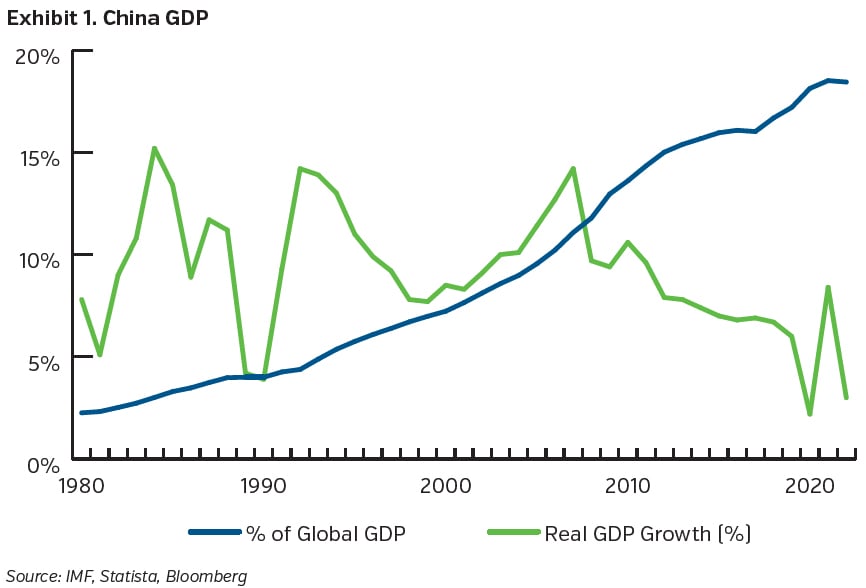

China has been the largest contributor to global growth over the last 20 years (contributing ~40% to global growth) and is now the second largest national economy in the world behind the US. China is the largest manufacturing centre, largest consumer market for autos and electronics and largest housing market in the world.

However Chinese GDP growth rates have fallen over the last 10 years averaging ~ 6% per-year from 2013 to 2022 from ~ 10% per-year in the period from 1992 to 2012. Consensus forecasts for 2023 and 2024 are 5.2% and 4.5% growth respectively.

What are the factors contributing to the reduction in growth rates?

Demographics - Shrinking Working Age Population

Favourable demographics primarily driven by a material shift of rural workers to urban settings enabled the Chinese economy to grow rapidly, particularly up to 2010.

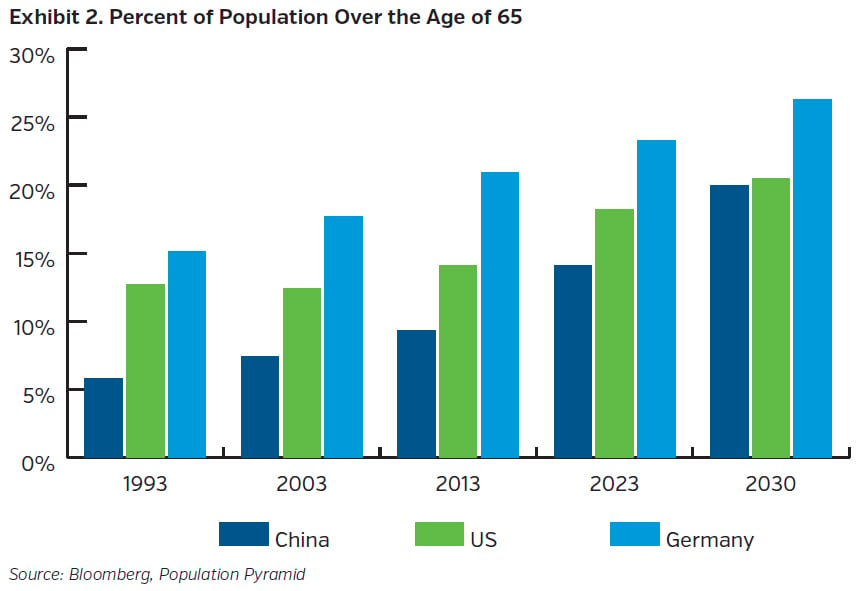

Since then, the working age population has fallen due to an ongoing decline in the birth rate which is a hangover from the one child policy introduced in 1978, later relaxed in 2015. The working age population is forecast to be ~ 750 million by 2036, down from a peak of ~950 million in 2011.

In parallel, the Chinese population is getting older with ~ 20% expected to be > 65 by 2030 which will further reduce the working age population and lead to increased spending on healthcare and pensions.

Internal Policy Limiting Foreign Investment

For most of the last 30 years, the Chinese Communist Party (“CCP”) resisted the impulse to interfere in the private sector with a “no politics, no problem” approach. However, as levels of income inequality became more transparent and, in an attempt to maintain social cohesion, the CCP took a more active role in the private sector. This manifested itself in an aggressive “anti-corruption” campaign by the CCP which began in 2013 and has impacted several private sectors including IT, healthcare and education.

Increased state interference and less predictable policy making has led to investors reassessing their levels of engagement with inward investment rates turning negative.

External Policy Disrupting Trade

Xi Jinping has been leader of the CCP since 2013 with his tenure characterised by a more robust foreign policy stance which has contributed to increased trade friction. The integration of China into Western supply chains has stalled somewhat and reversed in some respects. Examples include the European Union's labelling of China as a systemic rival in 2019 and, more recently, an anti-subsidy probe into Chinese electric vehicles sold in Europe. The US has also reacted with export curbs to block China’s access to advanced semiconductor technology in October 2022 which have recently been expanded to include advanced artificial intelligence chips.

Over-expansion and leverage in Real Estate

In the period up to the Global Financial Crisis (GFC), growth in China was broadly export related as supply chains expanded. Since the GFC, growth pivoted towards the domestic real estate sector which was debt driven and has caused some concern in terms of potential defaults of developers and the impact on local banks. That being said, a large portion of debt is held by local government, thus lessening the risk of external contagion. Property development as a percent of GDP grew from ~ 5% in 2000 to a peak of 15% in 2014 before falling back to ~11% in 2022.

So, what might the overall impact be on the global economy if the world’s growth engine endures a sustained downturn?

Growth

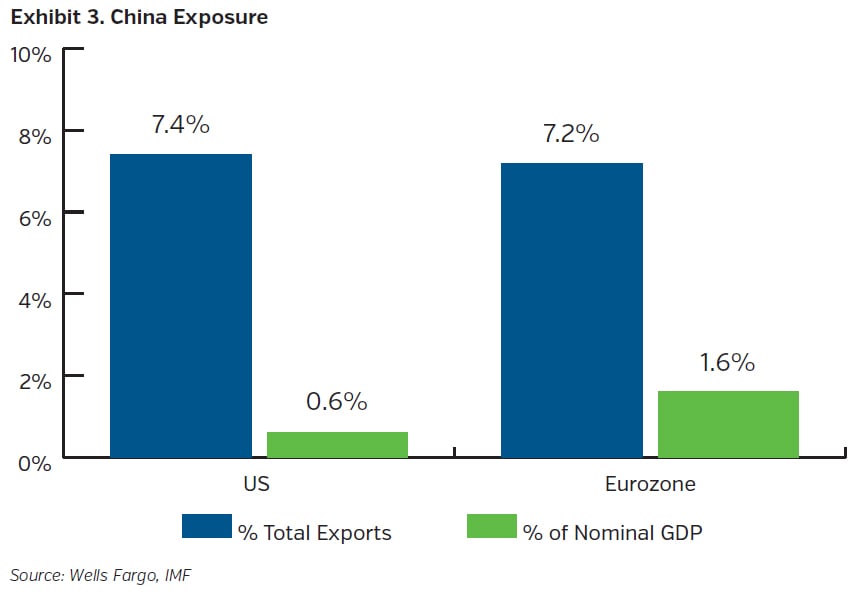

The US and EU imported approximately the same amount from China over the last 5 years. However, in terms of exports to China, the EU is more exposed in GDP terms with 28% growth over the last 5 years vs. 15% growth in the US. Within Europe, Germany is the most exposed county with ~ 3% of GDP related to Chinese exports and German companies relying on critical imports from China for ~ 25% of all manufacturing sales. While Germany seems relatively exposed, most other non-Asian countries have relatively modest amounts of direct Chinese exposure.

Inflation

Chinese economic growth has had a broadly deflationary impact over the last number of decades with a large amount of labour and manufacturing capacity added to the global pool along with demand enhanced by an ever-expanding Chinese middle class. The future path of inflation may now be less pronounced and could see higher costs move through the system as the Chinese working age population decreases and multinationals relocate to more “expensive” but supply chain friendly locations.

Financial Markets

Historically China has been a material buyer of US government debt over recent years in order to keep their currency relatively weak to aid exports and this has supported US government bond yields (China holds roughly 2.5% of total US debt outstanding). There is some speculation that recent sales of US Treasuries to build reserves in an attempt to defend the yuan could produce selling pressure and increase yields.

Key Takeaways

- The Chinese economy is entering a new phase of more moderate growth with demographics now providing a headwind and supply chains becoming decoupled as trade friction increases.

- These forces could potentially lead to higher global inflation and higher yields which may also be impacted by reduced Chinese demand for US Treasuries.

- From an issuer perspective, we closely monitor consumer cyclical companies with material sales in China (autos, luxury goods, for example) and companies who are heavily reliant on China in terms of the global supply chain (apparel, chemicals, for example).