Tariff Regime Change

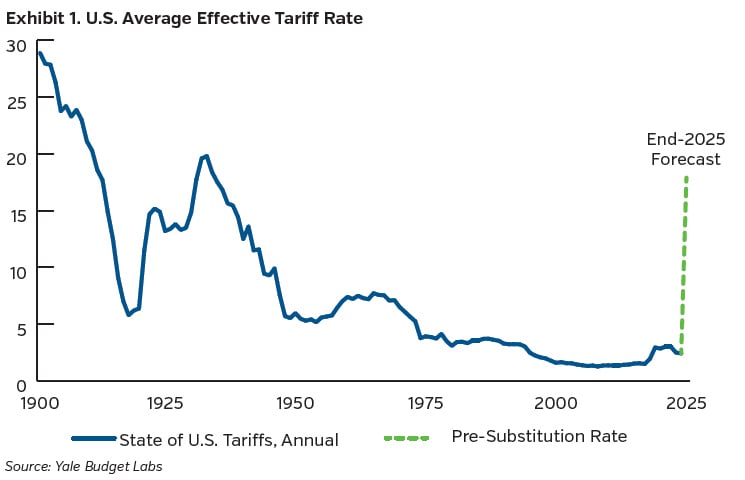

In 2025, the U.S. unleashed the most sweeping tariff regime since Smoot-Hawley: minimum 10% reciprocal duties on nearly all imports, layered on metals tariffs, and revived Section 301 penalties on targeted goods under national security authority. China faced combined rates as high as 145% before a fragile truce reduced many categories down toward 30%, but new moves (such as threats of 100% tariffs to Chinese port fees and stricter rare-earth export controls) show that volatility is returning. Removal of the $800 de minimis threshold for low-value imports has dragged e-commerce and everyday goods into the tariff net, extending the policy’s reach to every U.S. household. With average U.S. rates near 18% (see Exhibit 1), tariffs have become a structural feature of U.S. economic policy.

Mitigation Strategies

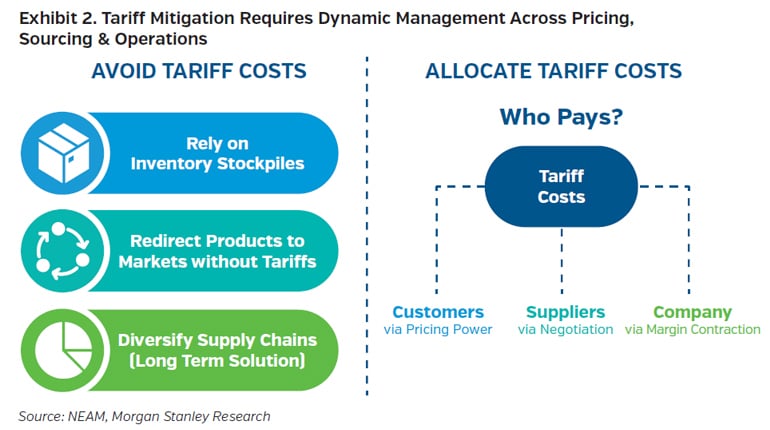

In response, corporate America is deploying a range of mitigation strategies (see Exhibit 2). Firms with brand strength and pricing flexibility are selectively passing through costs and adjusting product mix. Large buyers are renegotiating supplier contracts and leveraging scale for better terms. Others are reshoring or near-shoring production to the U.S., trading higher upfront costs for supply security. Tariff exposure varies by sector but is concentrated in firms with extended global supply chains.

Nowhere is the strain more visible than in the auto industry. A 25% tariff on imported vehicles and parts, alongside sharply higher duties on steel, aluminum and copper, have strained profit margins across Original Equipment Manufacturers (OEMs) and suppliers. GM and Ford face multi-billion-dollar annual tariff burdens, while Toyota and Honda are more insulated thanks to extensive U.S. and Mexico production and partial relief under a new Japan trade deal which lowered import tariffs to 15%. European OEMs gain similar relief under the new EU agreement, while talks with South Korea remain unresolved, leaving U.S. producers and Korean importers exposed. Automakers are working their way through greater U.S. and Mexico production and supplier renegotiations, but relief remains uneven as policy transitions unfold.

At the register, retailers feel the pinch. Nike estimated $1.5 billion in annual tariff headwinds, equivalent to roughly 3% of FY25 sales, despite shifting production to alternative markets.1 Walmart and Costco are using their scale and vendor leverage to share costs and selectively limit price increases to contain earnings impact. Retail companies consider supplier cost-sharing, product mix management, and regional sourcing diversification as strategies to manage the extent of tariff costs passed on to consumers without sacrificing sales volume.

It has been a mixed picture across industrial names. Large, diversified manufacturers are still grappling with higher materials and logistic costs, though many remain partly protected by long-cycle contracts and cost-plus arrangements. Smaller suppliers, lacking that scale, feel more of the squeeze through margin volatility and order deferrals. Caterpillar, Deere, and Honeywell have each cited higher input costs and softer global demand. Caterpillar is managing about $1.8 billion in annual tariff and supply-chain costs, offset through pricing discipline and productivity gains.2 Deere faces roughly $600 million in tariff-related headwinds this year and is tightening cost controls, trimming dealer inventories, and adjusting production to protect margins.3 Honeywell, meanwhile, remains better positioned thanks to its large service portfolio, long-cycle contracts, and global mix, which provide a buffer against rising costs and uneven demand.

For the tech industry, the world’s most global supply chain just got smaller. Apple expects up to $1.1 billion in quarterly tariff costs tied to component duties and China assembly disruptions.4 Intel faces higher sourcing costs and demand volatility as customers adjust to new pricing. Cisco continues to diversify production away from China to cushion hardware and networking exposure. Other chipmakers and equipment manufacturers face indirect friction through rare-earth and tooling tariffs. Many are accelerating U.S. fabrication investment under the CHIPS Act, trading near-term margin pressure for long-term strategic insulation. Tech’s heavy China exposure makes it the clearest barometer of global tariff friction and supply-chain stress.

Corporate Bond Market Response

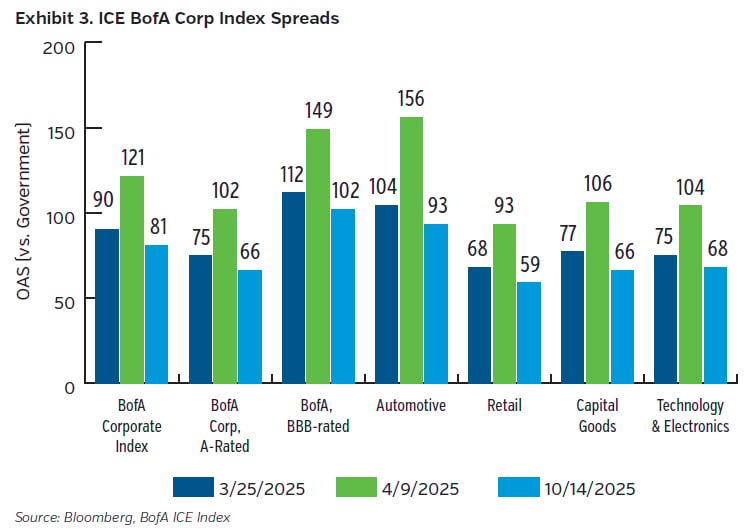

The corporate bond market flinched, then shrugged as credit spreads briefly widened on “Liberation Day,” reflecting uncertainty around trade flows, but quickly retraced as investors judged the earnings impact to be manageable. The BAML ICE index (see Exhibit 3) widened 31 bps to 121 bps but currently sits inside of pre-“Liberation Day” levels. Tariffs do not appear to be a decisive driver of spreads at this stage; movements remain more influenced by fundamentals, issuance trends, fund flows, and rate volatility. The market now views tariffs as a recurring cost of doing business rather than a systemic credit event.

For insurance investors, the key variable is tariff tolerance, the ability to absorb or pass through costs across cycles. Tariff exposure remains most acute in autos, retail, capital goods, and tech hardware, where global supply chains are hardest to unwind. Protectionism is now structural, and credit differentiation will hinge less on policy outcomes and more on issuers’ operational adaptability and sourcing flexibility. For now, companies are managing through this with minimal impact on their credit profiles, but the real test will be sustaining operational performance as these tariffs persist.

Key Takeaways

- Tariff exposure is concentrated in autos, retail, capital goods, and technology; industries with the deepest global supply chains and least flexibility to substitute inputs.

- Mitigation is active but uneven: firms are reshoring, renegotiating, and adjusting pricing, yet margin drag persists in import-intensive industries.

- Markets have adjusted quickly: credit spreads widened briefly on “Liberation Day” but retraced as investors judged tariff costs manageable.

- Credit differentiation will depend on execution, as issuers with sourcing agility, pricing power, and balance-sheet flexibility are best positioned to sustain performance as protectionism hardens into policy.

Endnotes

1 Nike, Q1 FY26 earnings call transcript (September 2025)

2 Caterpillar, 8K August 28, 2025

3 Deere & Company, Q3 FY25 earnings call transcript, (August 2025)

4 Apple Inc., Q3 FY25 earnings call transcript, (July 2025)