A number of prominent members of the investment industry have recently highlighted the decline in market liquidity, observations with which we generally agree. Many have focused on the more limited ability of banks and brokers to provide liquidity under revamped regulatory regimes. Some have also noted the potential challenges that might arise should we see a reversal of the flows into fixed income funds that promise daily liquidity while holding portfolios of less liquid assets. When insurance companies are mentioned in these discussions at all, they are generally cited as a more stable source of demand for fixed income investments. We expect this to be the case and believe that, in aggregate, insurance companies should be uniquely positioned to take advantage of any dislocations that develop.

Current Liquidity Environment

As has been widely noted in discussions of market liquidity, banks and brokers are now much more focused on attempting to match buyers and sellers of bonds and much less willing to assume risk. Proprietary trading desks have been eliminated. Higher risk based capital requirements, as well as newly introduced simple leverage requirements, have limited the willingness of dealers to make and defend markets. As a result, we could see (and to some extent already have seen) sharp price swings simply because buyers and sellers of particular bonds have not emerged at the same moment. Historically, these timing differences would often have been smoothed by dealers.

We expect further growth in electronic trading and buy-side to buy-side trading in fixed income markets, leading to increased efficiency and lower transaction costs. At least in the near term, however, we do not envision either of these developments as a solution to the price volatility that can result from a gap between the time at which a seller (buyer) wants to transact and the time at which a buyer (seller) is willing to take the other side of the trade.

Fixed income mutual funds and ETFs have frequently been cited as potential sellers who may need to transact at a particular time in large size. These funds have garnered significant inflows in recent years. One might debate the extent to which the increased flows are a longer term trend driven by demographics and two periods of sharp equity losses at the outset of the 21st century or a shorter term phenomenon subject to reversal in a period of rising interest rates and more attractive money market yields. While the potential magnitude may be difficult to gauge, some reversal in these fund flows during a period of reduced liquidity nevertheless represents a risk to fixed income markets.

The transformation of higher risk loans into highly rated bonds via the securitization market was one of the defining features of the last cycle. We believe there is some possibility that the transformation of lower liquidity bonds into mutual funds and ETFs with promises of daily liquidity could be a parallel in this cycle.

Implications for Insurance Companies

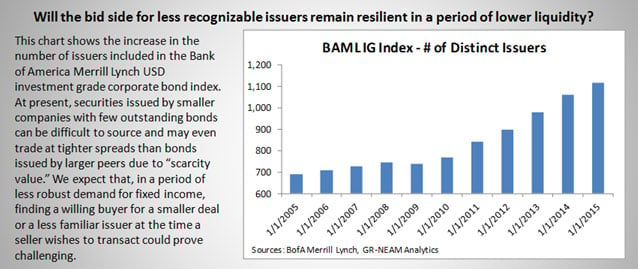

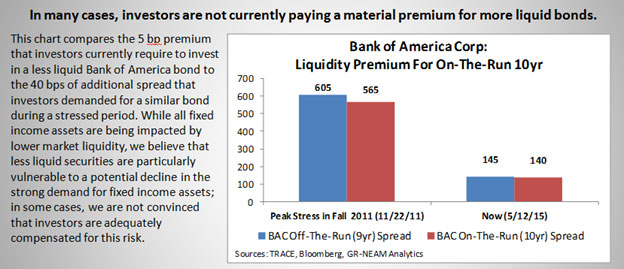

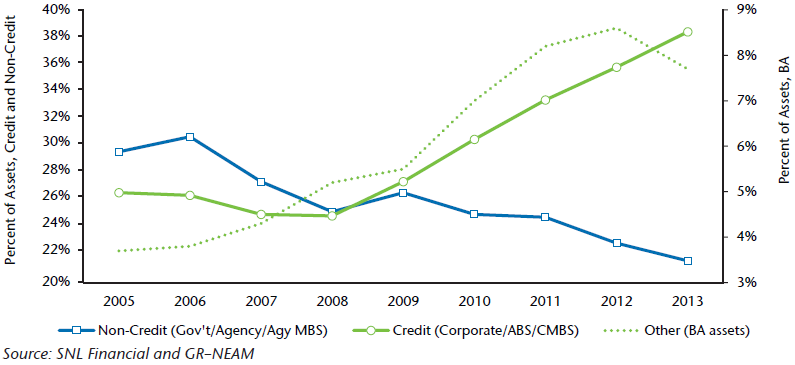

These liquidity concerns are coming at a time when insurance companies seem to be pulling any risk lever they can in an attempt to maintain reasonable levels of returns in a low interest rate environment. While it can be misleading to generalize from industry data, it does appear that insurance companies have been assuming more liquidity risk in their portfolios. As illustrated in the chart below, not only is the P&C industry increasing its allocation to BA assets (granted this increase is dominated by one firm), but also Corporates, CMBS, and ABS (credit) which, while normally considered liquid, would be the sectors whose liquidity could be more adversely affected by these new regulations (the trend in the Life Industry, while not illustrated, is similar to that of the P&C industry).

There is certainly nothing inherently wrong with this approach. In fact, on a selective basis, we have been comfortable adding less liquid securities to client portfolios over the last few years as well as increasing exposure to credit sectors when we are being aptly compensated. However, with this new regulatory paradigm untested in periods of stress, extra precautions should be taken when managing the liquidity profile of an insurance company.

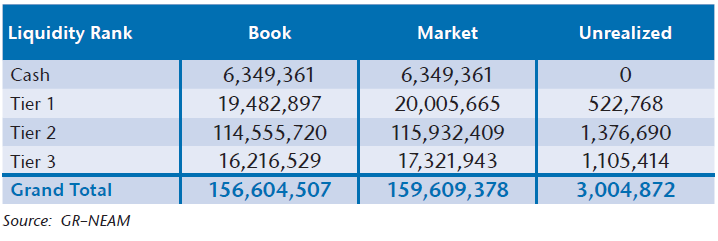

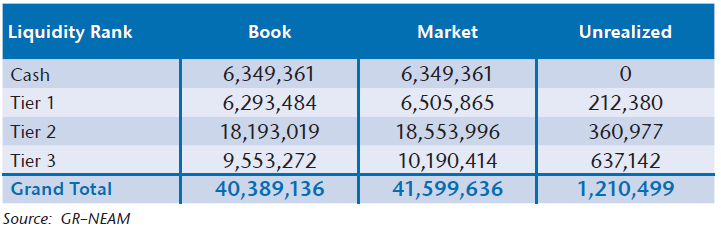

The best way for an insurance company to combat this uncertainty is to be able to regularly and effectively measure the company’s true liquidity position - not only what it looks like today, but also where it may be in the future. To aid with this endeavor, GR-NEAM has developed a proprietary framework for evaluating an insurance company’s liquidity profile by identifying the most liquid assets that can be sold without generating a realized statutory loss. The framework decomposes an insurance company’s fixed income assets into various liquidity tiers, with Tier 1 being the most liquid and Tier 3 being the least.

Table 1 contains an excerpt from this liquidity analysis for “XYZ Insurance Company.” In the first two rows of the table you can see the portfolio’s total market value of highly liquid securities which we identify as cash, as well as Tier 1 holdings (Treasuries, Agencies, or Agency MBS) that are currently in an unrealized gain position.

Tier 1 securities have historically traded well, even in environments when liquidity is very limited, and we anticipate these securities will remain among the most liquid options within a fixed income portfolio. Therefore, an insurance company’s cash and Tier 1 holdings should be an accurate gauge of how much cash could be generated quickly at a low cost and without having a negative impact on surplus (from realizing losses).

Table 1. XYZ Company Portfolio Liquidity Analysis (Holdings at Unrealized Gains Only)

In Table 2, we show how the liquidity position of XYZ Insurance Company shifts after an interest rate shock of 100 bps. In this scenario, XYZ’s highly liquid position (cash and Tier 1 assets at an unrealized gain) has been reduced from over $26 million to less than $13 million. By evaluating this highly liquid position in a stressed scenario, XYZ Insurance Company has isolated its true portfolio liquidity in a reasonably worst case situation, over the short term, for its portfolio.

Table 2. XYZ Company Portfolio Liquidity Analysis (Holdings at Unrealized Gains

Only, Stressed – Rates Up 100 bps)

When considering how much liquidity is enough, an insurance company must take into consideration not just its investment portfolio but also its expected operating cash flows as well as the availability of lines of credit, including those from the FHLB. A company may find that it is in a comfortable liquidity position when all these factors are considered which may open the door to add liquidity risk to the portfolio to enhance expected returns.

However, if a company is uncomfortable with its liquidity position, increasing the allocation to Tier 1 securities may be appropriate. If that is the case, we typically favor Agency MBS which trades in a very liquid market and also provides monthly principal and interest payments, which may lessen or eliminate the need for sales should unexpected operating cash outflows occur.

Conclusions

The current market environment may be presenting insurers with challenges in sourcing bonds at attractive yields while maintaining a disciplined approach in assuming investment risk. To date, however, insurers have generally benefited from strong demand for fixed income securities, low rates, and fair to rich spreads when sales have been required to fund claims, dividends, or other opportunities. We believe that insurance companies should take advantage of the current environment to ensure that their portfolios will remain positioned to provide appropriate liquidity to support their businesses in stress scenarios.

Takeaways

- Liquidity in fixed income markets has declined.

- A reversal of the recent strong demand for fixed income could cause price dislocations.

- With ample natural liquidity in their businesses and consistent demand for fixed income, insurance companies, in aggregate, should be beneficiaries of any opportunities that may develop to add fixed income securities at attractive levels.

- Individual insurers should be sure that they are appropriately positioned to participate in these opportunities by effectively managing their liquidity positions today.