Cable television operators’ main source of revenue is under attack from several disruptive factors, including new providers of program content, more convenient and faster means to deliver that content as well as mobile devices that can deliver high quality video. These disruptors have had a double-edged effect on both the profitability and credit quality of bonds issued by the larger cable players. Below we examine the implications of these new technologies.

Cable Industry Changes Over Time

Cable services initially originated in the mid-20th century to allow remote communities access to broadcast television by sharing one large antenna via one wire. They have since evolved to offer a wide variety of programming to a broad area of the United States. HBO’s pay movie service began in 1972, followed by other cable-only channels such as ESPN and MTV in the late 1970s to early 1980s. Superstations like TBS now spread local television broadcasts across the country. There are now more than 900 national networks carried over cable wires.

Over the years, cable operators have had very little direct competition which has often led to unsatisfactory customer experiences and high prices. As the variety of programming grew, so did the cost to subscribers. During the 1990s, satellite dishes began to challenge cable companies by providing access to programming without requiring wires and this disruptive alternative attracted cable subscribers in search of more choice, flexibility and lower costs. More recently, cellular telephones have increased their capabilities to receive higher levels of data wirelessly, including television programming.

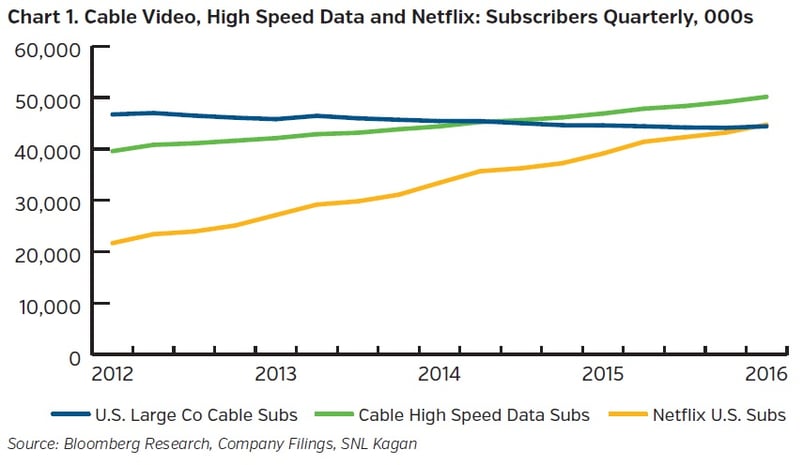

Within the home, devices such as tablets, personal computers and even video game systems can now access programming via a cable connection or through a Wi-Fi network, so customers are “cutting the cord,” with cable TV even if the connection is supplied by a cable provider. Taking advantage of these platforms, independent suppliers of programming such as Netflix, Hulu and Roku provide lower cost alternatives to cable and deliver high-definition programs on demand wherever there is an internet or cellular connection. Initially aggregators of content, these suppliers have also started to produce and distribute original content. Chart 1 shows recent growth in Netflix subscribers compared to a slight decline in cable subscribers.

These competitive challenges forced responses from traditional operators, including less expensive programming packages; improved capabilities, performance and customer experience; and an increase in broadband offerings to commercial customers. Customers are now offered a wider variety of service levels, from basic local programming to packages with hundreds of channels, including premiums such as HBO, digital channels and on-demand video. The major U.S. cable operators have also improved the quality of customer experience to slow subscriber attrition, as reflected by the 13% increase in 2015 capital spending focused on better call-center infrastructure, improved set-top boxes, higher capacity delivery hardware and vehicle repair to speed up service response times.1

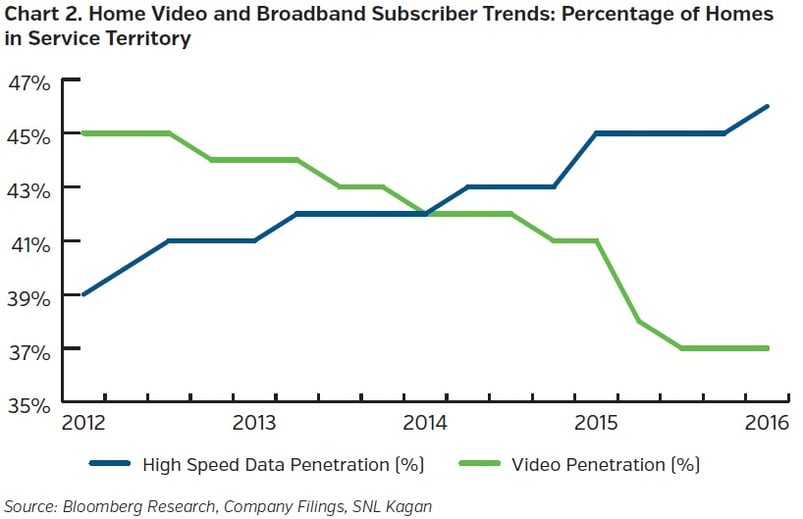

Ironically, forces driving subscribers away from the older pay-tv model spurred growth in internet connections and more specifically to broadband supplied by cable operators, which is generally faster than that provided by telephone companies. Chart 2 illustrates the dramatic percentage rise in homes with high speed data capabilities and at year-end 2015, cable providers had a 59% share of broadband compared to telephone companies at 39%.2 Broadband is more profitable than video for cable providers as there are no programming fees, which for the past 10 years have risen, on average, 30% per year.3 Moody’s estimates that broadband generates approximately half of pay-tv revenues, but two-thirds to three-quarters of profit, so revenues are protected as long as the ratio of new broadband subscribers to pay-tv subscriber losses stays above 2.0x. Over the past five years, this ratio has averaged 3.1x.4 Therefore, while the original business remains under threat from disruptive technology headwinds, “owning the pipes” plays an ever larger role in cable industry economics.

We are cognizant of the changes taking place within cable television service providers’ markets and operations and believe that given these changes, as well as the relatively high level of consolidation within the industry over the past few years, the sector is fairly valued from a fixed income perspective. Preferred firms within the sector are those with high quality assets like Comcast Corp. and Cox Enterprises, who have strong balance sheets, solid operating profiles and the desire to maintain conservative financial policies. In addition, we look for companies with size and reach to generate economies of scale; determination to invest in technology; equipment to provide competitive and flexible infrastructure; and high quality television programming with a solid conduit for connections to some of the disruptive content providers.

- Alternative video programming sources and delivery methods disrupt traditional cable service operating models by making content more accessible and individualized.In response, cable companies made improvements in terms of program scheduling flexibility, providing lower cost options and upgrading infrastructure to support video content.

- Despite challenges on the video front, cable service operators benefit from competitively advantaged broadband, providing cash flow to offset fading video subscriber growth.

- NEAM prefers to invest in higher quality bonds issued by companies like Cox and Comcast, due to large operating scale, solid cable and broadband offerings, conservative financial management policies and resulting strong balance sheets.

The corporate security examples shown are intended to help clients understand our investment management style, and should not be regarded as a recommendation of any security for any person. These examples were selected to show examples of companies we select for our clients based on the criteria we identified. These positions represent a small portion of our current holdings in managed client accounts. Past performance is no indication of future performance. Although we focus on long-term investments, portfolio holdings are subject to change.

1 Bloomberg May 9, 2016 Cable Exhibit

2 Bloomberg Intelligence April 26, 2016

3 SNL Kagan and Wells Fargo, LLC, April 7, 2016 “Unbundling Cable.”

4 Moody’s Investor Service Outlook May 3, 2016 – “Growth Nears 4% as Broadband More than Offsets Cord-Cutting Threat.”