UK Prime Minister David Cameron announced that the UK will hold a referendum on continued EU membership on June 23, 2016. Voters will be asked a straightforward question – Should the UK remain a member of the European Union or leave the European Union? It may be a straightforward question but the implications of the vote for the UK, Europe and the rest of the world are enormous – economically and politically. The prospect for Brexit – British exit from the EU – is an issue all investors and corporations need to be aware of this year. The UK currency, the British Pound, has recently weakened against the US Dollar and the Euro. UK credit has underperformed and foreign demand for UK Government bonds has been weaker. This weaker pricing of UK assets is likely to continue until the referendum takes place.

Prior to announcing the referendum date, PM Cameron had reached agreement with the EU on a series of changes the UK was seeking in terms of its relationship with the EU. In addition to assurances on economic governance and an exemption from any moves towards a more federal Europe, the key concession sought by the UK was with regard to altering social benefit payments to non-UK EU citizens resident in the UK.

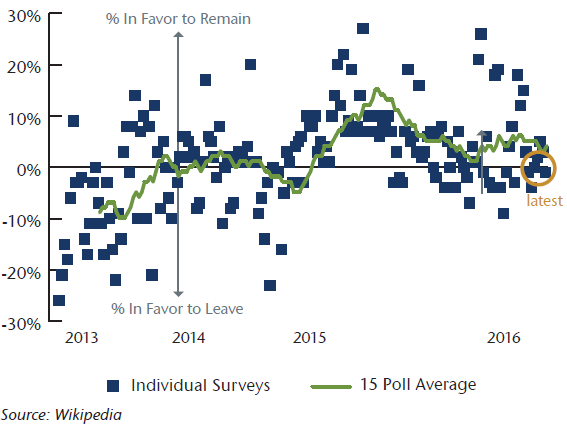

Chart 2. UK Public Opinion Polls: Brexit

After the referendum date was announced, members of the UK government were free to state their opinion on remaining in the EU. To date, six members of PM Cameron’s government have announced that they will oppose the PM and back the Leave Campaign. The most noteworthy declaration in favour of leaving the EU, however, has been the Mayor of London, Boris Johnson. His decision to support the Leave Campaign has given it a boost as he is probably the most popular politician in the UK and a serious rival to PM Cameron. Public opinion polls are tight and older voters, more likely to vote, show a strong preference to leave the EU (Figure 1). Financial markets have recently begun to address the risk of Brexit through a weakening of the British Pound;this bears watching in the context of a UK

economy with a 4% current account deficit.

The EU is founded on four essential freedoms: the free movement of goods, services, labour and capital. Together they form the Single Market whereby EU companies, investors and citizens are free to trade with, work or invest in other EU countries. The founding idea of the EU was that through trade and greater economic integration the calamitous results of nationalism in Europe during the first half of the 20th century could be avoided in future. These four freedoms are currently under threat from Brexit as well as other factors. The migrant crisis has led to unilateral closing of borders in Austria and elsewhere – placing pressure on the principle of free movement. The Euro crisis caused a north/south division in the EU and the response of newer EU countries to the migrant crisis is placing a strain on the EU in the east/west as the liberal democracies of Western Europe must deal with countries in the EU with more extreme political systems, such as Hungary.

If the UK votes to leave the EU, it will take two years after the notification of its intention to leave for it to no longer be a member of the EU. Therefore, the UK would have two years to renegotiate access to European markets in the above mentioned four categories. In addition, the UK would also need to renegotiate with the 55 countries with which the EU has existing trade agreements and the 87 countries with which the EU is in the process of agreeing trade agreements. For example, the current negotiation of a free trade agreement between the US and the EU – the Transatlantic Trade and Investment Partnership (TTIP) – would no longer include the UK. US Trade Representative Michael Forman has stated that negotiating trade partnerships with individual countries is not a priority for the US and the UK would likely have to continue to trade with the US without a trade agreement. Renegotiating existing trade agreements and new ones would likely be a drag on UK economic growth. It is estimated that UK growth could be 1% to 1.5% lower for several years given the uncertainty arising from Brexit and the reduced flow of EU workers, leading to a slower potential growth rate for the UK economy.

Restricted or uncertain access to Europe’s Single Market would likely be negative for the insurance industry in the UK which currently generates GBP 6 billion of premium income from the EU annually. In addition, non-European companies that rely on a UK or London presence to provide services throughout the EU would be likely to reduce further investment in the UK and divert investment to other EU countries. The UK has USD 1.5 trillion of Foreign Direct Investment and its success in attracting FDI is likely to decrease due to the uncertainty of Brexit.

From an EU perspective, Brexit would likely be very damaging. It would represent the first departure from the EU of any member country. Further, the UK is the EU’s second largest economy, it advocates for free trade and competitiveness in the EU and is an important contributor to the EU in terms of diplomacy, security and external affairs. Brexit would likely be followed by demands in other EU countries for renegotiation of their terms of membership and in some instances, extreme political movements may push for EU exit in countries such as France or the Netherlands. This is particularly the case in the context of Europe’s migrant crisis. Brexit would represent a major challenge to Europe’s post-War direction of travel.

Key Takeaways

It’s difficult to estimate the exact consequences of a UK vote to leave the EU. The British Pound, however, would likely weaken further, possibly up to 20%. Economic growth would be weaker and the ability of the Bank of England to ease policy could be constrained by currency weakness as the UK attempted to fund its current account deficit.

The G20 statement from Shanghai in late February referred to Brexit as a potential shock to the world economy. From a USD perspective, it’s likely that the uncertainty caused by Brexit would lead to further overseas flows into the US Dollar, Treasuries and other US assets. The uncertainty regarding the whole future of the EU would likely weaken global growth and when combined with a stronger US Dollar, it would be likely to make the Federal Reserve even more circumspect in terms of further interest rate hikes.