Borrowing from Patches O’Houlihan in the 2004 comedy, Dodgeball, an adage comes to mind when considering corporate defaults: “if you can dodge a wrench, you can dodge a default.” This message applies in the wake of the recent high profile bank failures at institutions such as Silicon Valley Bank, Credit Suisse and First Republic, and are a vivid reminder about the importance of maintaining a disciplined approach to credit to dodge the potential pitfalls of the market. While insurance company investors may be seduced by attractive yields in riskier assets when spreads are tight, credit is widely available, and economic growth seems like a formality, the market turmoil in 2023 is a stark reminder that investment grade bonds do behave badly at times. Insurance company investors need to stay true to their principles to avoid material underperformance when times of stress and dislocation occur. After all, while the five D's of dodgeball (dodge, duck, dip, dive and dodge) are effective for the game, dodging distress in the market is best achieved by consistently maintaining discipline – especially during benign market conditions.

Bond Returns are Asymmetric

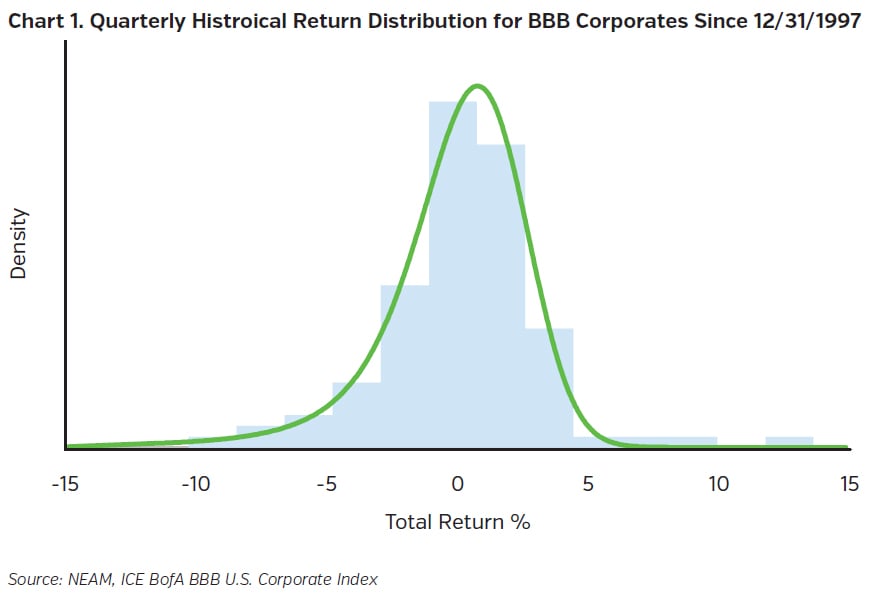

With defaults in mind, one of the basic characteristics of bonds is that their returns are asymmetric. Unlike equities, where risk and return expectations are highly positively correlated, the fixed coupons on bonds and negative convexity for those without call protection limit the upside potential from a total return standpoint. Like equities, however, the downside can be a complete loss of principal in the event of a default, making a bond’s return profile asymmetric. Chart 1 displays quarterly returns for BBB-rated corporate bonds going back to 1997 and illustrates that the tail risk for negative returns is much greater than the tail risk for positive returns, which is partly explained by the potential for default.

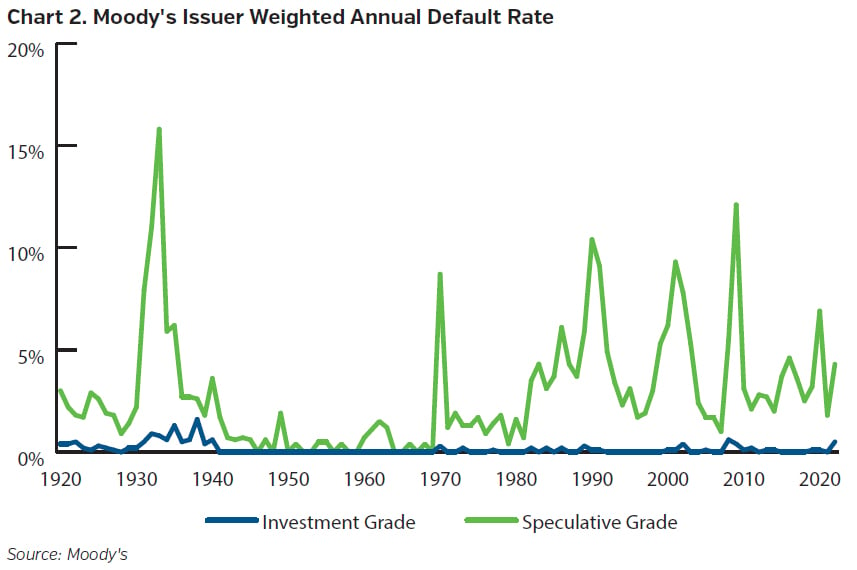

While the risk of default is extremely low for investment grade bonds, defaults do occur from time to time. Since 1999, five investment grade corporate bond issuers have defaulted without entering the U.S. high yield index,¹ with Silicon Valley Bank being the most recent.

Investor Risk Appetite Grew as Yields Fell

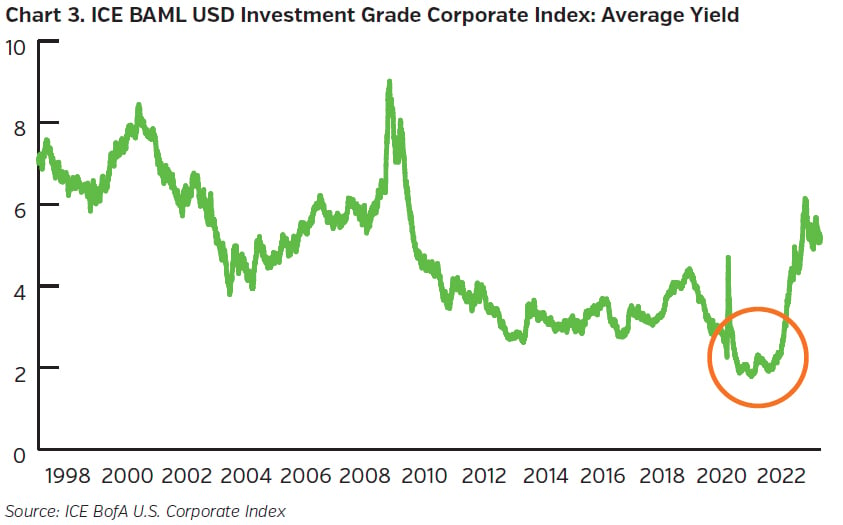

Despite the asymmetry of returns for bonds, the market demonstrated an increasing appetite for risk during the recent period of record low yields. During the COVID-19 pandemic, yields in the investment grade corporate market hit record lows following the Federal Reserve’s decision to cut the funds rate to the 0% to 0.25% target range and massive quantitative easing measures flooded the market with liquidity.

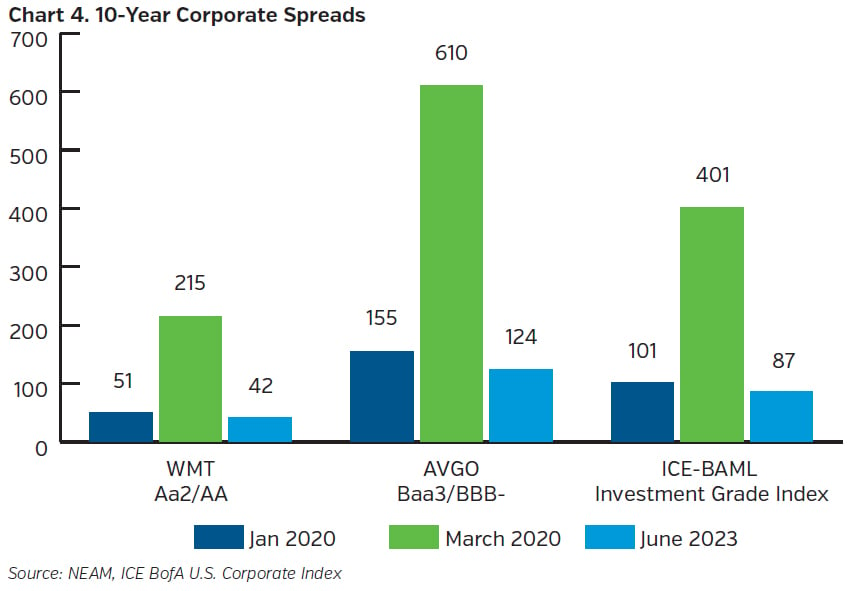

The environment of anemic yields pushed many investors to increase their risk-taking behavior to meet their return bogeys, spurring an increase in demand for lower rated, less liquid, and weaker credit profile securities. Given the historically benign spread environment, this meant that investors were in many cases not being adequately compensated for the risks they were assuming. For example, consider Walmart (WMT), a high-quality double-A rated company, and Broadcom (AVGO), a highly cyclical, low-BBB rated semiconductor company, as two entities representative of the opposite ends of the investment grade quality spectrum. As the following chart indicates, the spread pickup by investing in AVGO relative to WMT was around 100 bps prior to the start of the pandemic. At the recent peak in spreads in March 2020, that spread pickup widened to almost 400 bps. However, as investors reached for yield and spreads for the overall market troughed in the summer of 2021, that basis declined to just an 82 bp differential between the two names, highlighting the declining relative value of the lower rated name.

Although spreads for AVGO were very volatile during this period, the risks to the credit stayed the same. The company remained a highly acquisitive and cyclical company with meaningful geographic exposure to China and customer concentration to Apple. The only thing that changed was how much investors were requiring to be compensated for that risk. This example emphasizes not only the importance of understanding the risks of a credit, but also being adequately compensated for those risks by analyzing the relative value.

Assessing relative value is a two-pronged approach. It starts with a sound fundamental evaluation of each credit and a full understanding of the possible risks, and then incorporates the spread relative to other potential investments. When investors experience defaults, particularly in the investment grade market, it is often a misunderstanding of the risks, or a minimization of the potential risks that doom them. At its core, fundamental credit analysis is an intensive process that utilizes both qualitative and quantitative analysis to truly understand the strengths and risks of a particular investment. In the corporate bond market, this analysis includes core tenants of credit evaluation:

- A detailed look at financial performance, including key credit ratios and expectations for future performance

- An understanding of business fundamentals, including a company’s position within their industry and the overall competitive landscape

- An analysis of the company’s management team, including their overall strategy and other governance factors

- Rating agency opinions and potential for upgrades/downgrades

- Structural considerations such as covenants or location within the capital structure

- While this list of credit considerations isn’t exhaustive, a full understanding of the credit is essential when assessing relative value and determining whether or not an investor is being adequately compensated for the attendant risks.

Credit Risks Beginning to Rise

With the Fed nearing the end of its monetary tightening program, which has seen an increase in the Fed Funds rate of 500 bps, cracks in the economy are starting to appear with investors fearing recession as we reach the later stages of the economic cycle. Given the increased risk taking of many bond investors during the troughs in spreads, there will undoubtedly be many who will feel the negative effects of their heightened risk tolerance as the economy turns. This will likely include a combination of performance deterioration and widening spreads at levels in excess of the overall market.

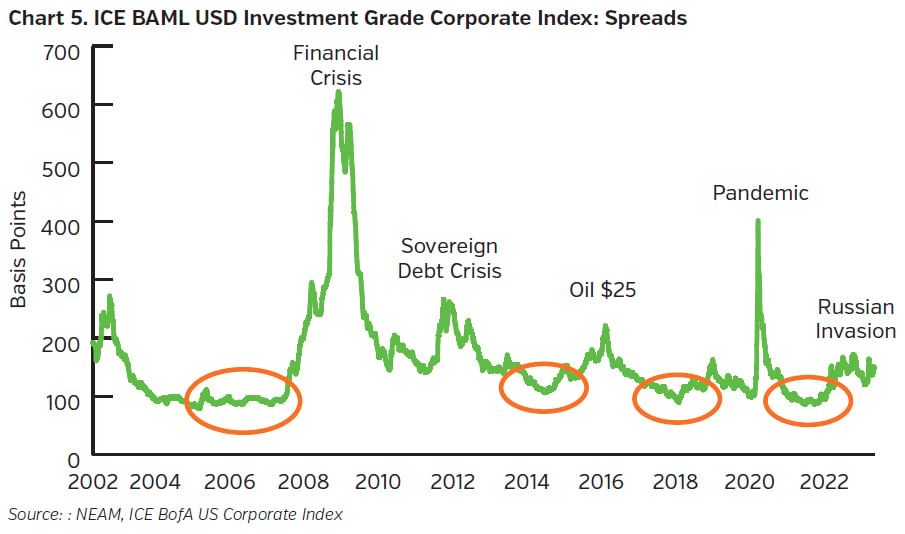

While low spread levels may tempt investors to reach for yield, maintaining a disciplined approach to credit is paramount to avoiding some of the pitfalls in the market. As Chart 5 demonstrates, the market provides opportunities to take advantage of dislocation as spreads gap out. Perhaps even more important however, is how investors are positioned when spreads trough. Excessive risk taking when spreads bottom leaves bond investors vulnerable to changes in the economic climate and rarely compensates them for the asymmetric risks they are taking.

Patience is Key

While Patches O’Houlihan touted the importance of the five D’s of dodgeball for dodging a ball, dodging defaults and avoiding material underperformance through excessive risk taking is a much more disciplined process rooted in the importance of fundamental credit analysis and adequate compensation for risk. During times of benign market conditions, it may be tempting to reach for yield, but exercising patience is often the best strategy, as the market will likely provide a better entry point down the road. After all, when you fail to avoid a default due to a lack of discipline, it hurts much more than when you fail to dodge a ball.

Key Takeaways

- The return profile for bonds is asymmetrical, as the upside is capped by the combination of the bond’s coupon, interest rate environment and convexity, but the potential downside to a default is still a complete loss of principal.

- Investors began increasing their risk tolerance during the pandemic, rushing into higher yielding securities amid declining spreads and overall yields.

- As the economy turns, many investors that increased their risk tolerance during the period of low rates and spreads will be impacted negatively. This highlights the importance of an intensive credit process to understand the risks associated with a potential investment.

- Investors should ensure they are being adequately compensated for the risks that they are assuming. At NEAM, we seek to remain patient, avoid reaching for incremental yield during periods of tight credit spreads and stay disciplined within our preferred sub-sectors and capital structure posturing. In our view, adhering to a disciplined approach while remaining nimble and opportunistic when credit spreads widen increases the likelihood of outperformance over long periods of time.

References

1 Mikkesen, H, Seliger, Y, and Zhang, Y. January 14, 2019. Situation Room Failing Angels.

The Walmart and Broadcom security examples herein were presented for illustrative purposes only and are not intended to portray a security recommendation or holding of any client account.