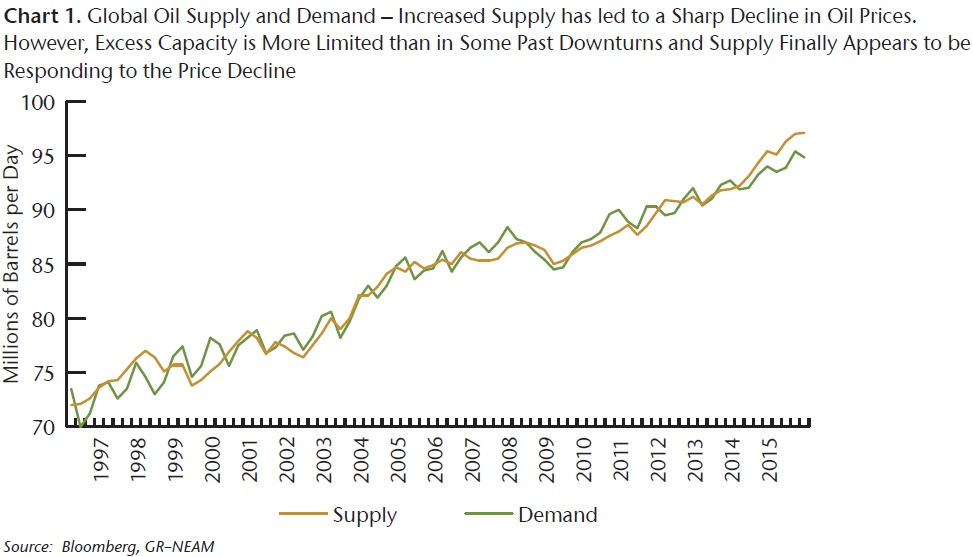

We believe that many factors that contributed to the precipitous decline in oil prices over the last several quarters will likely constrain any upside over the coming quarters as well. Most importantly, Saudi Arabia has abdicated its traditional role as the swing producer, in an attempt to defend market share and support longer term oil prices; having come this far, we would not expect Saudi Arabia to relent now. Other countries would like to see higher oil prices, but are unwilling (or unable) to give up market share and revenue by cutting production. With sanctions lifted, Iranian supply is increasing. U.S. oil companies have substantially reduced costs and increased efficiencies, maintaining production in 2015 despite lower capital spending and operating costs. Demand has increased, but not as quickly as supply, with modest global GDP growth (and a warm winter in the U.S.) slowing the pace of demand growth. With supply outpacing demand, inventories of crude oil in storage have built.

We expect, absent a geopolitical event, that the above factors will limit any near term upside in oil prices (and could even lead to further downside in the coming weeks). However, despite increased efficiencies, we believe that producers will struggle to cover cash costs at higher cost fields in the current price environment. More advantaged producers, while able to cover cash costs, will struggle to generate sufficient cash flow to fund the capital spending needed to maintain production. Development projects are being cancelled or delayed, as companies seek to conserve cash and hesitate to commit to expensive projects (with long lead times) that would require a material increase in oil prices to produce attractive returns. Eventually, we expect that slowly rising demand, depletion, and reduced capital spending should lead to a balance in supply and demand and an increase in oil prices to levels that not only cover cash costs but facilitate investment.

While an eventual recovery in oil prices will benefit the energy industry, not all companies will be able to survive the downturn and enjoy the recovery. Many high yield energy companies have defaulted, a trend that we expect will continue. The prolonged price decline is also pressuring companies that entered the downturn with investment grade ratings. Exploration and production companies (the upstream segment of the energy sector) are directly impacted by lower price realizations on the oil and gas that they produce. Service companies (the oil field service segment) can be severely impacted as exploration and production companies slash capital spending and seek to reduce operating costs. While all pipeline operators (the midstream segment) are affected by lower oil and gas prices, the nature and extent of the exposure varies significantly, from direct exposure to natural gas liquids pricing to indirect exposure via upstream counterparties who may temper growth plans or be unable to fulfill contractual commitments. Finally, refining companies (the downstream segment) are exposed to pricing differentials between various types of crude oil and refined products, but may benefit at the margin from lower oil and gasoline prices to the extent that these lower prices lead to increased demand and thus increased refinery utilization.

While risks have clearly increased for all energy companies, we believe that some issuers are well positioned to weather this downturn. Lower oil and gas prices, as well as continued commitments to generous dividend payments, are weakening credit metrics for the integrated oil majors. Nevertheless, these companies benefit not only from scale and diversification within the upstream segment, but also from varying degrees of diversification across midstream, refining, marketing, and chemical operations. Some independent exploration and production companies also boast considerable scale and diversity, have reasonable cost structures, and (perhaps most importantly) have ample liquidity that should allow them to endure a period of limited cash flow. A number of midstream companies have limited direct commodity price exposure, enjoy scale and diversification that should blunt the impact on the overall company of counterparty risk or lower values for particular assets, and have demonstrated a strong commitment to investment grade ratings.

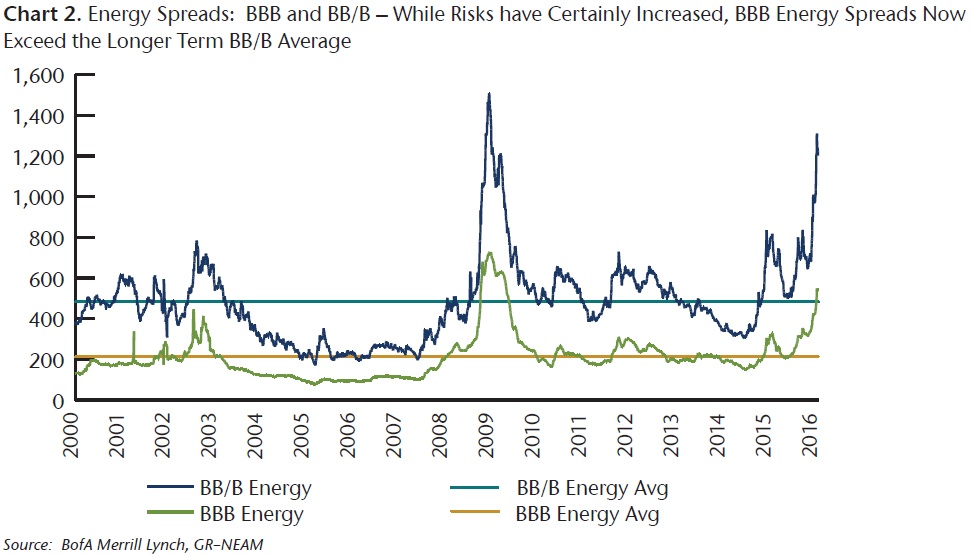

While a continued period of low oil and gas prices may lead to further declines in bond prices and ratings within the energy sector, we believe that valuations already reflect the increased risks facing many of these companies. For instance, BBB rated energy companies are, as one would expect given the markedly changed oil price environment, trading considerably wider than their own historical levels. However, we would also highlight that BBB rated energy companies are trading wider than the average spread of the universe of BB and B rated energy companies over the last 15 years. Spreads for energy issuers with higher ratings, including the integrated oil majors, have also moved considerably wider. We continue to find value in select securities within the energy sector. While spreads may widen further in the near term and further downgrades are certainly possible, we believe that valuations for some securities represent attractive levels, from a longer term perspective, at which to accumulate exposure.

KEY TAKEAWAYS

- The decline in oil and gas prices has clearly increased credit risk in the energy sector.

Absent an unexpected supply shock (geopolitical event, production cut), oil prices will likely remain low in the near term. - However, we expect more balanced supply and demand to result in gradually rising prices in the intermediate term.

- We believe that some energy companies, with more resilient business models and stronger liquidity, are positioned to weather this downturn.

- We also believe that valuations for some of these issuers reflect the likelihood of further price volatility and rating downgrades.

- An imminent rise in oil prices or an increase in M&A activity, though not expected, offer potential upside.

- While the near term outlook is uncertain, we believe there are opportunities to accumulate exposure to certain energy credits at valuations that we consider attractive from a longer term perspective.