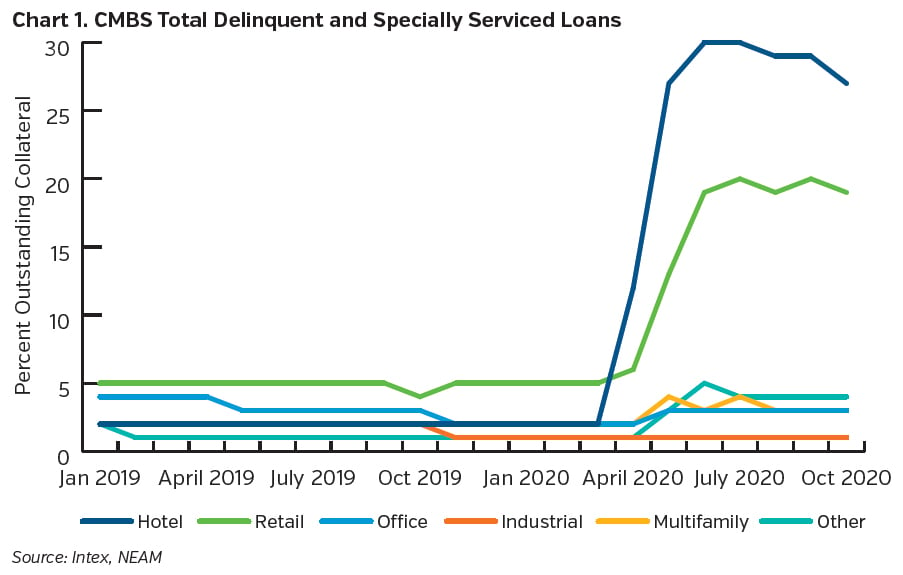

As we enter our ninth month of the COVID-19 pandemic, the negative effects of the coronavirus on commercial real estate are becoming evident. One of the most visible indicators has been the elevated CMBS delinquency rate which reached a record level in June 2020. Though that number has started to decline over the last several months, the rate of loans in special servicing remains at recent peak levels. Performance, however, has varied significantly across property types, and the timing of COVID-19 presents a unique challenge to the market as it coincides with several structural shifts taking place. While the pandemic has the potential to accelerate these trends, there is a high level of uncertainty as to what extent commercial real estate will be affected longer-term.

Outsized Impact on Hotel

Traditionally, hospitality has been one of the first sectors to suffer during a downturn given its highly cyclical nature coupled with short lease terms. From the onset of COVID-19, the effect on hotel revenue per available room (RevPAR) was devastating, posting year-over-year declines of 79.9% in April 2020.1 This has been reflected in CMBS performance, as 26.9% of hotel loans are currently in some stage of delinquency or special servicing. Urban markets have underperformed the broader sector as business demand dried up and travelers sought more rural locations. Currently, the overall hotel delinquency rate for CMBS loans in the top 10 markets by population is 33.4%, whereas the rate for all other markets is 20.1%.

Prior to the pandemic, the hotel industry had already been grappling with competition from short-term vacation rentals as concepts like VRBO and Airbnb gained popularity. During the pandemic, the short-term rental market has outperformed the traditional hotel market (short-term rental occupancies declined 46% from year prior levels versus a 77% decline for hotels2) as it offers travelers the ability to socially distance with larger spaces in less urban locations. Short-term vacation rentals represent 12.2% of the overall hospitality market3 and remain an ongoing threat to the hotel industry. In an encouraging sign, hotel occupancy and RevPAR have started to rebound from the lows amid a slow economic reopening, increasing to 48.3% and $47.87, respectively, in September4 (up from 24.5% and $17.93 in April5).

Online Retail Trend Accelerating

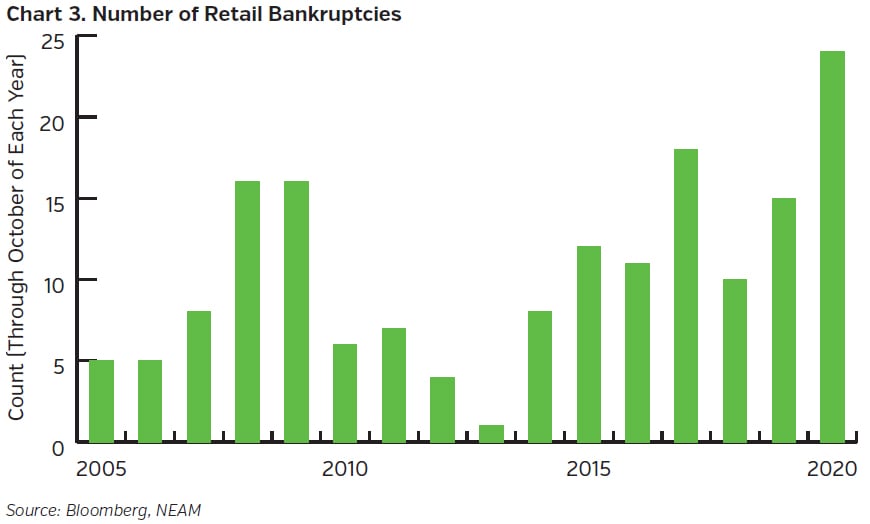

On the retail front, the pandemic is accelerating the well-established transition away from traditional brick and mortar locations. Retail properties now have the second highest delinquent and specially serviced rate in CMBS at 18.9%. As expected, regional and super-regional malls are underperforming with a delinquency rate of 29.1%; nearly twice as high as the 14.7% rate for all other non-mall retail locations. Additionally, retail bankruptcies have hit an all-time high with 24 filings in 2020 through October, exceeding levels seen in 2008 and 2009 during the Great Financial Crisis. As a result, some mall owners in CMBS are beginning to hand the keys back to lenders. Meanwhile, industrial properties have benefited from the strong demand for warehouse space. For example, though they are a much smaller part of the CMBS universe, industrial properties have one of the lowest delinquent and specially serviced rates at just 1.1%. For years, mall operators have been searching for ways to diversify away from traditional department stores and in order to stay relevant in the age of online retail, may seek to reposition anchor space into fulfillment centers. Amazon has reportedly been in talks with Simon Properties to backfill several vacant Sears and J.C. Penney boxes with last-mile distribution centers. Similarly, Macy’s recently announced that it will be closing two of its anchor spaces and transitioning them to fulfillment centers for the coming holiday season. Though there is still a large amount of retail space that will require transitioning and/or repricing, these developments are beneficial for properties at the margin.

Long-Term Impact on Office Uncertain

The future role of office properties is perhaps the biggest question facing the commercial real estate industry. While the number of employees working remotely had been trending upward even prior to COVID-19, it was estimated that only 5% of the workforce in the U.S. was permanently working from home (WFH).6 That number quickly grew, however, as the virus spread and organizations shifted employees to work remotely. Some companies such as Facebook and Twitter now offer a more permanent WFH option for their employees. A recent survey of real estate executives performed by CBRE revealed that 63% of respondents did not offer a work from home option prior to the pandemic, whereas 90% now expect to offer one in the future.7 Over the next 10 years, it is estimated that the number of employees with permanent WFH arrangements may double to 10% in the U.S.8 Social distancing could put upward pressure on space requirements causing a reversal of the densification trend where it’s estimated that a 50% increase in space per employee could erase the excess supply caused by WFH.9 To date, the negative impact on office performance has been swift and meaningful as the overall vacancy rate in the U.S. has increased to 14.4%.10 However, given longer lease terms in the office sector, it is too early to tell how much the WFH trend will weigh on the market as the effects of any structural shift will be delayed until current leases expire.

Shifting CMBS Issuance

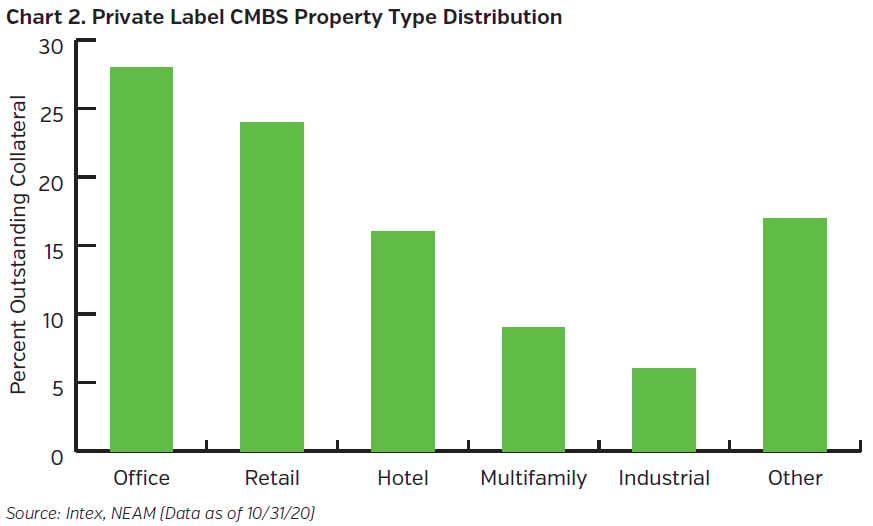

While the CMBS primary market has reopened since the onset of the pandemic, overall private label supply has declined significantly. Year-to-date issuance through October 2020 totaled $53.5 billion, down 37% from 2019 levels. Total projected issuance for 2020 is roughly $65 billion, well below the $114 billion issued in 2019. The disparate impact across property types has also affected the composition of recent deals. Prior to the pandemic, retail and hotel properties represented the second and third largest sectors at 24.6% and 16.4%, respectively. Given the elevated uncertainty around both property types, their share of post-pandemic collateral dropped to just 3.7% and 7.6%, respectively. The concentration of office properties, which prior to the pandemic represented 27.5% of outstanding collateral, jumped to 40.6% for deals issued after March 2020. Until there is more clarity on the path to recovery, hotel and retail properties will continue to face difficulty obtaining financing and will comprise a smaller presence in the primary market.

While the effects of COVID-19 on commercial real estate have started to manifest, we are still relatively early in the cycle and expect it will take some time to play out. Any significant distressed sales are unlikely to occur in the imminent future as the foreclosure and liquidation process can often be lengthy. Additionally, transaction activity has slowed significantly as the bid-ask spread for many property owners is currently too wide, leaving clearing levels uncertain. Despite the disruption caused by COVID-19, we continue to believe credit enhancement at the highest level of the capital structure in CMBS offers strong protection against future losses. For example, the AAA rated super senior tranche can withstand over 60% collateral defaults (assuming a historical loss severity of 46.6%11) before suffering a loss. Maintaining an up in structure bias with the benefit of robust credit protection can insulate insurance companies from the uncertainties surrounding commercial real estate in this environment.

Key Takeaways

- The effects of COVID-19 on commercial real estate are becoming evident but the impact varies widely by property type. Underlying trends that were already in place prior to the pandemic have been accelerated.

- The cyclical nature of hotel properties combined with short lease terms makes them the most vulnerable to near-term revenue declines. A rising preference towards short-term rentals may further weigh on hospitality.

- The pandemic has likely accelerated the transition away from traditional brick and mortar to online retail. Industrial properties, however, have benefitted from the increased demand for warehouse space and some mall locations are also able to capitalize on this trend.

- The future role of office properties is an enormous unknown at this point. There is a high degree of uncertainty around how much companies will permanently embrace the work from home model. On the flip side, incremental space requirements per employee could reverse the densification trend and potentially offset some of the negative effects from working remotely.

- This commercial real estate cycle will take an extended period of time to play out. Despite near-term disruptions, we believe CMBS credit enhancement at the top of the structure offers significant protection from credit losses. We maintain an up in structure bias for our insurance company clients and look to opportunistically take advantage of any dislocation should it arise.

Endnotes

1 “STR: U.S. hotel performance for April 2020.” Smith Travel Research, May 20, 2020.

2 Sanford, Will and Dillon DuBois. “COVID-19 impact on hotels and short-term rentals.” Smith Travel Research, Aug. 10, 2020.

3 “Short-Term Rentals: A Maturing U.S. Market & Its Impact on Traditional Hotels.” CBRE, Inc., 2020.

4 “STR: U.S. hotel performance for September 2020.” Smith Travel Research, Sept. 20, 2020.

5 “STR: U.S. hotel performance for Apr. 2020.” Smith Travel Research, Apr. 2020.

6 Rockey, Rebecca, et al. “Global Office Impact Study & Recovery Timing.” Cushman & Wakefield, Sept. 2020.

7 Beudoin, Lenny, et al. “2020 Global Occupier Sentiment Survey: The Future of the Office.” CBRE, Inc., 2020

8 Rockey, Rebecca, et al. “Global Office Impact Study & Recovery Timing.”

9 Rockey, Rebecca, et al. “Global Office Impact Study & Recovery Timing.”

10 “Marketbeat: U.S. National Office: Q3 2020.” Cushman & Wakefield, 2020.

11 Dias, Arshia, et al. “U.S. CMBS 2019 Loan Loss Study.” Fitch Ratings, June 22, 2020.