The need for investment income has never been more important or relevant for insurers than in today’s capital market environment, where reinvestment rates continue to be constrained by low rates and an abundance of liquidity keeping credit spreads tight. Portions of the insurance industry have recently experienced pricing improvements which have helped alleviate operating results for certain underperforming lines of business. Despite these near and medium-term underwriting gains, we believe that investment income will continue to be a critical factor in an insurance company’s overall operating performance.

The high yield sector is one area of the fixed income market where insurers can find potential income enhancement opportunities. There are many different options to consider within high yield and as a “risk asset” for insurers, it can potentially offer attractive risk-adjusted performance as an alternative to equities. Additionally, it can provide portfolio diversification due to lower correlation with other asset classes. We believe high yield can provide a complementary investment income stream which, when compounded over multiple market cycles, helps to develop valuable surplus capital and provide relief to the depressed reinvestment rates insurance companies’ investment grade fixed income portfolios currently face.

INSURANCE INDUSTRY’S CURRENT AND HISTORICAL ALLOCATION TO HIGH YIELD

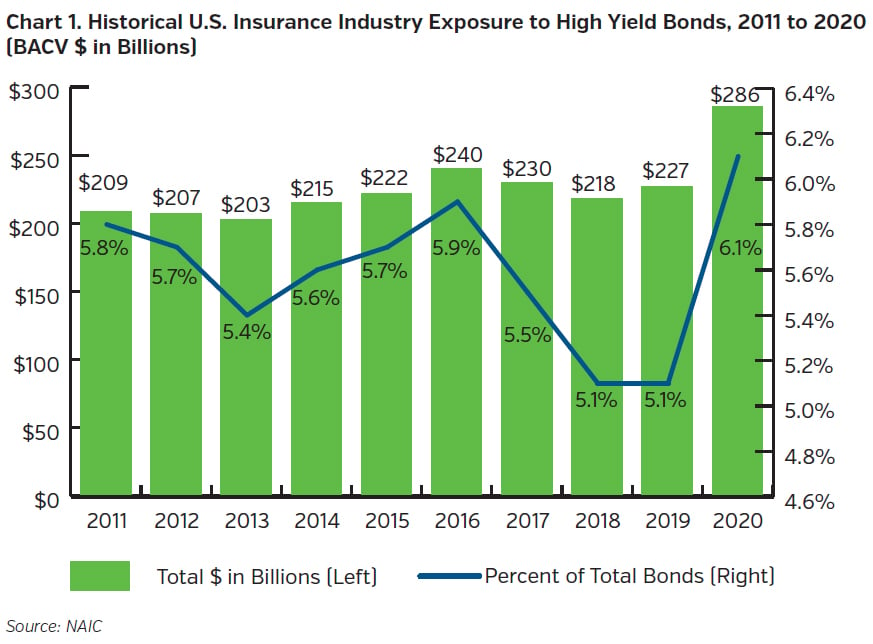

According to data from the NAIC, U.S. insurers’ exposure to high yield bonds reached a new all-time high in 2020, totaling $286 billion at year-end 2020, or approximately 6.1% of total fixed income investments. As a percentage of fixed income investments, U.S. insurers have historically held around 5% to 6% of their total fixed income portfolio in high yield bonds.

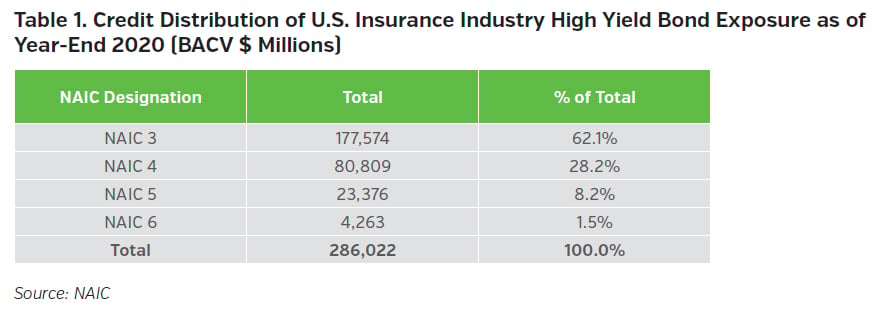

Within the high yield fixed income universe, U.S. insurers have tended to favor the “higher quality” portion of the high yield market. As of year-end 2020, over 60% of high yield holdings for U.S. insurers were in NAIC 3 or “BB” rated bonds. NAIC 4 or “B” rated bonds accounted for nearly 30% of high yield holdings and NAIC 5 or “CCC” rated bonds accounted for roughly 8% of high yield exposure for U.S insurers.

Not All High Yield is Created Equal

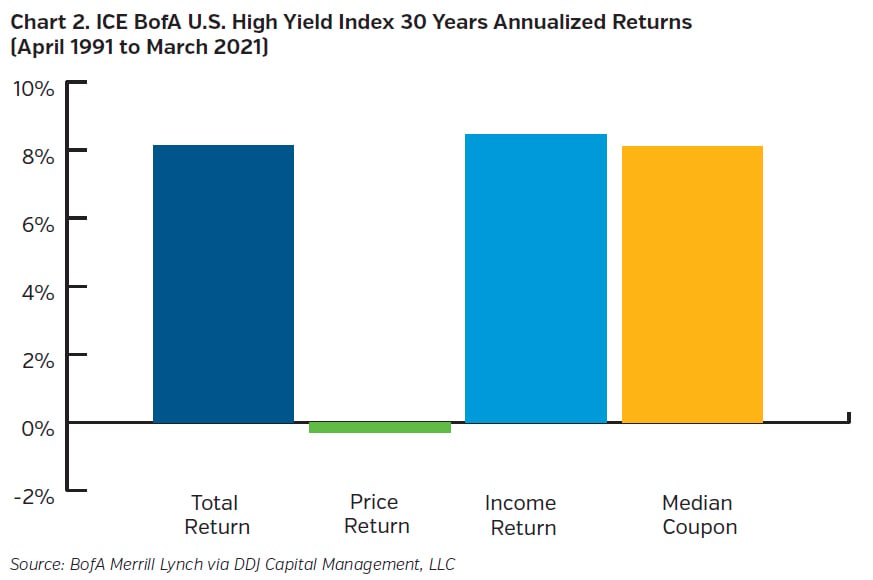

High yield bonds and their subsequent investment returns tend to be generated by the relatively high coupon payments embedded within their structure. Seen in the 30-year time series chart below, most of the high yield market’s returns have been generated by coupon income relative to that of bond security price returns. This high coupon income, when compounded year-over-year, can produce competitive risk-adjusted long-term returns. We believe insurers are well positioned to potentially generate attractive, recurring investment income through this consistent compounding of high yield bond income as they have sufficiently long-term time horizons to allow compounding to work in their favor.

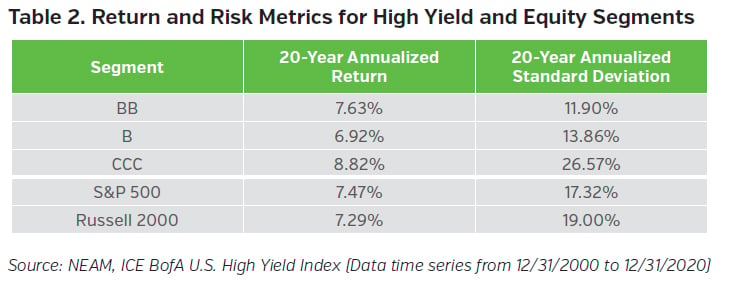

In addition, from its infancy in the 1970s and 1980s, the high yield marketplace has developed into a mature market with significant depth and breadth. The chart below outlines performance across various ratings cohorts within the broad high yield market:

Given the level of dispersion across returns and volatility metrics, and the capital charge implications of investing in risk asset classes (outlined later in this document), we believe it is crucial for insurers to partner with an investment firm that specializes in high yield and has the historical expertise and capabilities to seek to exploit the inefficiencies across all high yield market segments. With comprehensive coverage of the high yield market, insurance companies can potentially exploit the inefficiencies that exist within the various high yield segments, help maximize their risk/return objectives and not settle for index level returns and volatility.

One sub-segment of the high yield market is bank loans or “leveraged loans.” Some high yield strategies may incorporate bank loans as part of a diversified high yield strategy while other strategies can be solely dedicated to bank loan investing. Similar high yield risks apply to bank loan investments but a few notable benefits to bank loans are: (i) most loans are secured debt and higher in the capital structure relative to high yield bonds, and (ii) most are structured with “floating interest rates,” so as market interest rates adjust, so does the interest paid by the loans, which in a rising rate environment is a positive for bank loan investments.

Lastly, due to the relatively shorter maturity profile of most high yield securities and the floating rate nature of most leveraged loans, interest rate risk isn’t a meaningful risk inherent to high yield investing. For insurers with significant long-dated liabilities who might be wary of investing in shorter-duration high yield, the duration mismatch can be addressed within the context of a holistic strategic portfolio framework, thereby allowing insurers to potentially benefit from the advantageous income and yield benefits of high yield.

CAPITAL CHARGE IMPLICATIONS

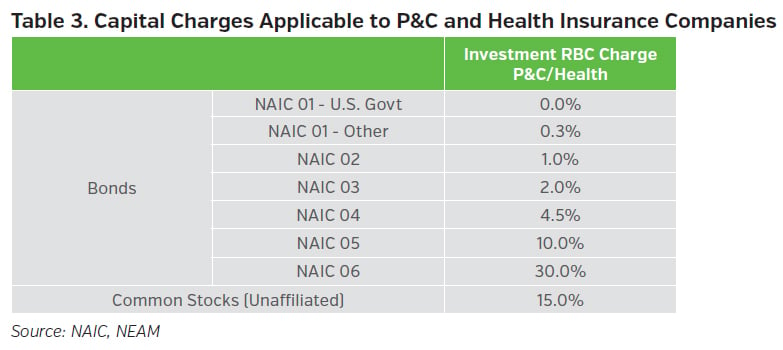

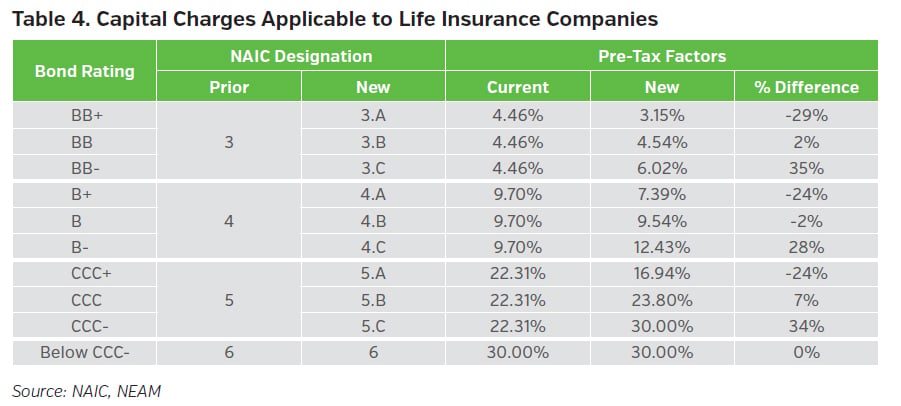

Under the regulated U.S. statutory framework, risk-based capital (RBC) requirements vary by insurance company and security rating (i.e., securities of lower quality or higher risk require increased capital amounts to be held by the insurer). For those insurance companies contemplating an initial allocation to high yield, they should consider the capital impact that such an allocation would have on their portfolio and the company’s balance sheet (see table below). NEAM’s Enterprise Based Asset Allocation™ (EBAA™) framework can help insurers understand what risk asset capacity may be available to them and the subsequent capital implications.

Important to note, the National Association of Insurance Commissioners (NAIC) adopted new Risk Based Capital (RBC) C1 investment risk charges in June 2021. These factors are being implemented for year-end 2021 filing for life insurers. For health, and property and casualty insurers, their current RBC investment factors continue to apply until further guidance from the NAIC. Please see NEAM’s Quick Takes titled “Latest NAIC RBC C1 for Life Insurers: Time to Reposition Your Portfolio?” if interested in learning more about these capital charge changes affecting life insurers.

PORTFOLIO DIVERSIFICATION

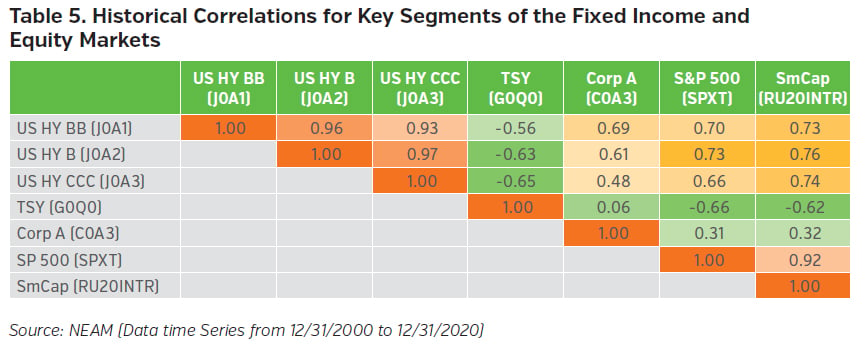

As evidenced by the index data below, various segments of the high yield market have varying degrees of correlation to key segments of the insurance investment universe. When structured appropriately within a holistic, strategic asset allocation framework, diversification benefits can accrue to investors over market cycles. The long-term historical strength of high yield income and returns relative to other risk asset classes makes high yield a compelling risk asset for consideration within an insurance company portfolio.

KEY TAKEAWAYS

- The current and unrelenting low-yield environment is forcing insurers to re-evaluate their investment portfolio positioning and strategic asset allocation framework.

- For those insurers with the surplus capacity and risk appetite, high yield can potentially be an attractive, long-term, strategic risk asset investment option with competitive risk adjusted returns that can offer diversification benefits due to their lack of correlation with other fixed income alternatives.

- As a complement to NEAM’s core fixed income investment philosophy of a “yield-driven, total return” investment approach, we believe insurance companies should also employ a value-driven approach to high yield investing relative to more broad-based high yield investment strategies. In today’s world, every basis point matters.

- Given the inherent higher risk nature of high yield and the capital/risk implications that high yield can have on insurer portfolios and balance sheets, we believe insurers should partner with an investment firm that specializes in high yield and has the comprehensive capabilities to seek to exploit the inefficiencies across all high yield market segments.

- Insurance companies should consider revisiting their Enterprise Based Asset Allocation™ (EBAA™) framework to understand what risk asset capacity, in particular high yield assets, may be available to them to potentially enhance the risk-adjusted returns of their portfolio. To learn more about the potential benefits of NEAM’s EBAA™ process, please visit our website, www.neamgroup.com.