In short, 2020 proved to be an intense and surreal year. The world faced a global pandemic which infected nearly 82 million people and led to 1.8 million associated fatalities at last count.1 Global economic activity fell by nearly 20% by April, and the U.S. economy experienced its fastest and deepest recession in post war history. The level of economic disruption induced by the pandemic necessitated a massive and swift policy response, the magnitude of which more than fully offset the sacrificed income and goosed the U.S. savings rate to a record 34%. This liquidity stabilized risk asset prices and enabled the 2020 stock market to rally off the lows to be the greatest of all time, further fueled by the reopening of the economy and successful development of compellingly effective vaccines.2

A Unique Paradox

The pandemic forced an abrupt end to the longest expansion in U.S. history which had lasted 128 months. More traditionally, the business cycle ends when preemptive tightening of financial conditions short circuit economic growth and causes an economic recession and lower prices for stocks, and other risk assets. Instead, the pandemic proved more akin to a natural disaster with a massive triage response. Rates were cut to zero in the U.S. and the U.K., while rates remained negative in both the EU and Japan. Combined with unlimited quantitative easing in the U.S. and myriad taxpayer backed lending programs to support credit markets, the Fed rapidly put a cap on credit spreads and a floor under equity markets.

The year also featured a round trip, one with both a bull and bear market, defined by 20% price changes up and down respectively, representing a very compressed market cycle relative to historical patterns. The speed and scope of monetary and fiscal policy actions helped truncate the depth and duration of the recession. As a result, the earnings recovery unfolded much faster than in past recessionary periods and revealed tremendous resilience in the digitally anchored parts of the economy. Earnings significantly outpaced analyst forecasts, further paving the path for a V shaped recovery in risk assets.

Despite the worrisome virus headlines and the structural weaknesses exposed within the U.S. economy, the S&P 500 closed the year at a record high having advanced 18%, a rate above both the long-term recessionary and non-recessionary medians.3 The Nasdaq fared even better returning 45%, its best year since 2009. The difference in 2020, however, was that the run up in stock prices, a continuation from 2019, was not preceded by material drawdowns in the previous year or years. It was not a “recovery” so much as a continuation of the upward momentum fueled by the Fed (and other central banks) flooding the financial system with many times the amount of liquidity than would actually be required based on economic activity.

Tech Stocks are More Risky, Right?

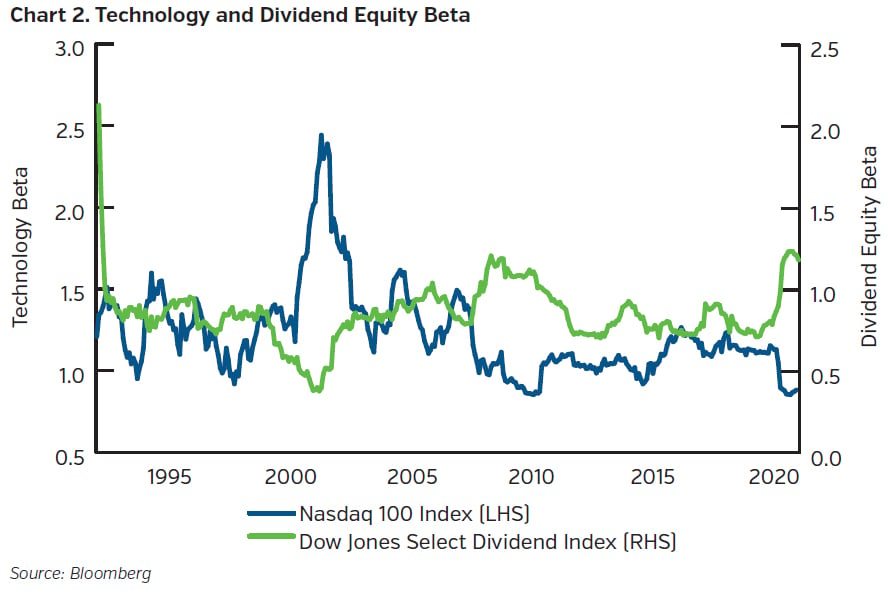

In yet another affront to conventional wisdom, the pandemic redefined beta – a measure of a specific company’s risk/volatility relative to the market. Historically, lower volatility sectors like utilities or consumer staples and dividend equities outperform at the end of a business cycle. Conversely, technology stocks, traditionally deemed higher beta as the range of outcomes is wider, underperform as volatility rises going into a recession. The pandemic flipped this relationship on its head as the durability of the income stream for dividend-oriented stocks became tenuous as revenue and liquidity contracted, while technology stocks had strategic and economic visibility in the pandemic induced work from home environment. When all was said and done, U.S. equity indices – with tech leading the way – benefited from the pandemic despite the significant human and economic toll.

Return of the Day Trader

Retail market participation also played an influential role in the faster than average resurgence in equity prices. Armed with ubiquitous access, time at home, and possibly stimulus money, a new generation of investors emerged. The rise of commission-less trading, fractional shares and the Robinhood streamlined app and web trading platform helped engage these newer investors.

This retail cohort impacted trading volumes as trading in individual names spiked – both distressed companies and healthier ones. At the market level, a record $120 trillion of stock changed hands on U.S. stock exchanges during 2020, up 50% from 2019.4 Retail traders now comprise roughly 20% of stock volume which is double the level seen in the last financial crisis. This generation of “day traders” benefits from the digital age as technology has made the market more accessible while providing the plumbing for potentially exaggerated price action. This momentum begets momentum, and in turn, retail participation aided in the market’s record recovery.

A Nod to the Scientists

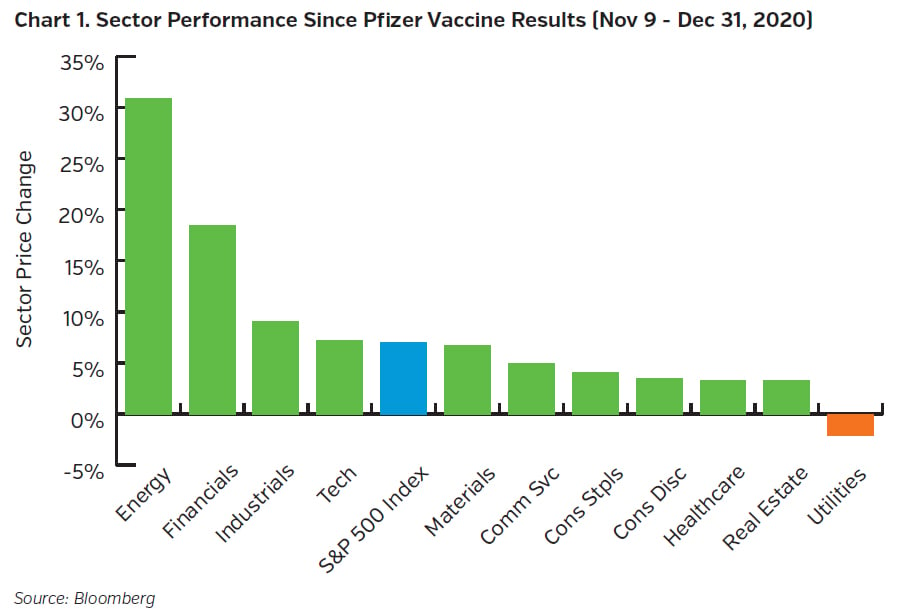

Science deserves credit for containing the risk of open-ended economic scarring. Worldwide researchers endeavored to produce a safe and effective vaccine with more than 125 candidates in development by mid-summer. Rarely are vaccines commercialized in less than five years, so odds favored a multi-year staging at best. However, technological advances, most notably the Messenger Ribonucleic Acid (or mRNA) platform, helped compress timing to less than one year for multiple approved vaccines. When efficacy statistics started being announced in early November, the market rotation was palpable as cyclical sectors held back by Covid-19 rallied sharply and recouped some of their significant losses for the year (Chart 1).

Market Imprint

With the Federal Reserve backing corporate credit, the “cleanse” that typically accompanies a recession did not occur, and the market troughed at a much higher price-to-earnings multiple this time around. Additionally, market concentration became even more lopsided. The pandemic strengthened the earnings fundamentals of a handful of mega caps who became the biggest beneficiaries of the digital first environment. While their stature had been increasing in prior years due to their secular growth, these companies peaked in relative importance near 30% of the S&P 500 index given their mission critical role in the work from home backdrop.

Moreover, their earnings resilience drove prices substantially higher supporting the market’s faster than typical recovery off the nadir given their comparative size within the index. Per data compiled by Charles Schwab, this cohort peaked on September 2nd with a 65% year-to-date advance while the rest of the market of 495 names had advanced 3%.5 This cohort avoided any reversion to the mean typically experienced when a business cycle ends in a more normal recessionary period.

Lastly, beta rose markedly for traditionally defensive sectors. Utilities, known for predictable results and resilient dividends, lagged the market for the first time during a recession. Meanwhile technology beta fell below 1, indicating it had less risk than the market as the sector became the backbone of existence (Chart 2). Retail investors sought momentum and gravitated toward technology rather than durable dividend payors. While the valuation of the overall equity market reached elevated levels, dividend-oriented equities broadly cheapened versus the market, a distinction that currently remains.

Implications for Risk Assets

The strange end to the business cycle did not hinder risk appetite as evidenced by the healthy overall returns for the S&P 500 index in 2020. This occurred on top of robust returns achieved in 2019, amassing over a 55% cumulative two-year total return, an outsized performance especially when compared to the underlying rate of economic growth. This is dwarfed by the 94% two-year surge for the Nasdaq. This illustrates the power of monetary policy to trump fundamentals, and hints that complacency and speculation abound, propelled by the view that central bank policy will prevent stocks from ever going down. The market’s addiction to accommodative policy heightens the risk of a growing asset bubble by further divorcing the economy from the market.

As we enter the new year, the risk/reward profile of the U.S. equity market, given current valuations, is suspect. Yet the firepower of consumer savings and pent up demand argue for a strong cyclical rebound in 2021. Much of the rebound is increasingly discounted. Interest rates remain low though and with central banks anchoring the front end of the yield curve for the foreseeable future, equities will continue to benefit from a low discount rate used to value future cash flows. While valuation is elevated at 22x forward EPS, equity performance in 2021 should be primarily driven by the sizable earnings recovery. Accordingly, NEAM foresees positive annual gains, likely in the single digits, accompanied by volatility over the coming year.

As the U.S. economy strengthens, the Fed’s job will become more challenging. Inflation could surprise leading rates higher and tighten financial conditions. More likely, however, since unlimited liquidity has been the dominant market influence, risk assets will be negatively impacted when monetary policy eventually changes. The rate of change in liquidity should organically diminish in 2021, providing the first litmus test to this surreal end to the business cycle.

Key Takeaways

- Despite worrisome virus headlines and economic imbalances, S&P 500 index total return was well above average in 2020, a lucrative and unexpected end to the longest business cycle on record

- Policy, science and retail market participation acted as key underpinnings to the market’s record recovery

- The truncated market cycle, extreme market concentration and redefined beta resulted from the uniqueness of the backdrop

- Cyclical upswing argues for positive equity returns in 2021 despite the robust gains over the last two years and elevated valuation

- Dividend-oriented equities remain attractively valued versus the broad market and interest rates at this time

- NEAM maintains that dividend income-oriented equities remain an attractive risk adjusted option for insurance entities to maintain equity exposure over the long-term

Endnotes

1 Michelle Fay Cortez, Bloomberg, “U.K.’s Mutated Coronavirus Found for First Time in U.S.,” December 29, 2020.

2 Michael Harnett, The Flow Show: Frankenbull, Bank of America Investment Strategy, December 10, 2020.

3 Dennis DeBusschere, Evercore ISI Head of Portfolio Strategy quoted in “The S&P 500 Close Out 2020 at Fresh Record with Most Sectors Up,’ by Crystal Kim, Bloomberg, December 31, 2020.

4 Gearoid Reidy, Ishika Mookerjee, Sarah Ponczek and Jan-Patrick Barnert, “Day Traders Put Stamp on Market with Unprecedented Stock Frenzy”, Bloomberg, December 31, 2020.

5 Sarah Max, “Here’s How to Prepare Your Portfolio for the New Year, According to Liz Ann Sonders,” Barron’s, December 30, 2020.