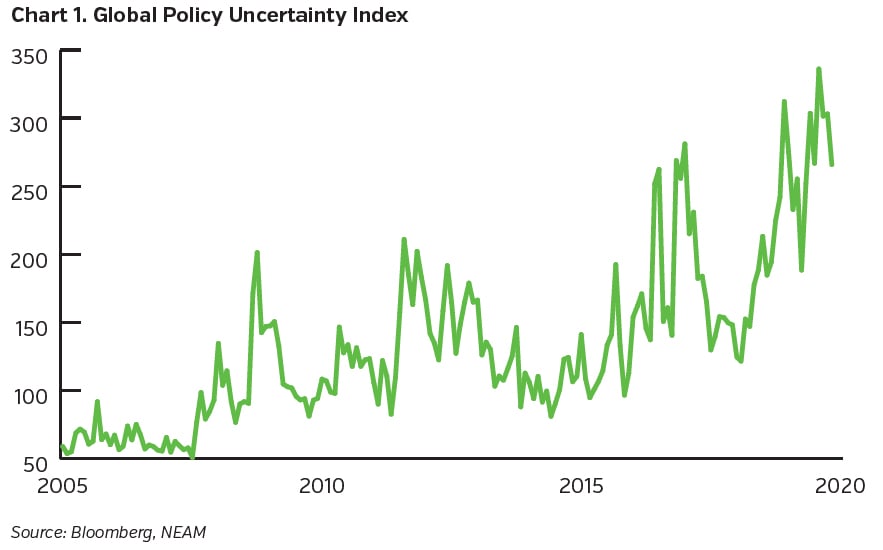

As we turn the calendar to a new decade it took all of 2 days for the geopolitical risk meter to spike higher with the assassination of an Iranian military leader. The global capital markets are currently being confronted by a number of geopolitical and macro factors: What will be the long-term impact of the China/U.S. trade issue on global trade? Will the UK be able to negotiate a trade deal with the EU by the end of 2020 for a smooth exit? Will military conflict with Iran escalate further? Will a spike in oil prices be the catalyst for the start of the next recession? Last but not least, 2020 brings an election year in the U.S. In other words, uncertainty reigns. The Global Policy Uncertainty Index (Chart 1) has spiked to levels not seen in prior crises such as 9/11, the 2008 financial crisis and the 2013 U.S. government shutdown. Uncertainty on issues such as trade impacts investment decisions and freezes business activity. Companies invest less and hire less. The question becomes how best to position insurance portfolios for these uncertain times? Let’s start by looking at the hard facts.

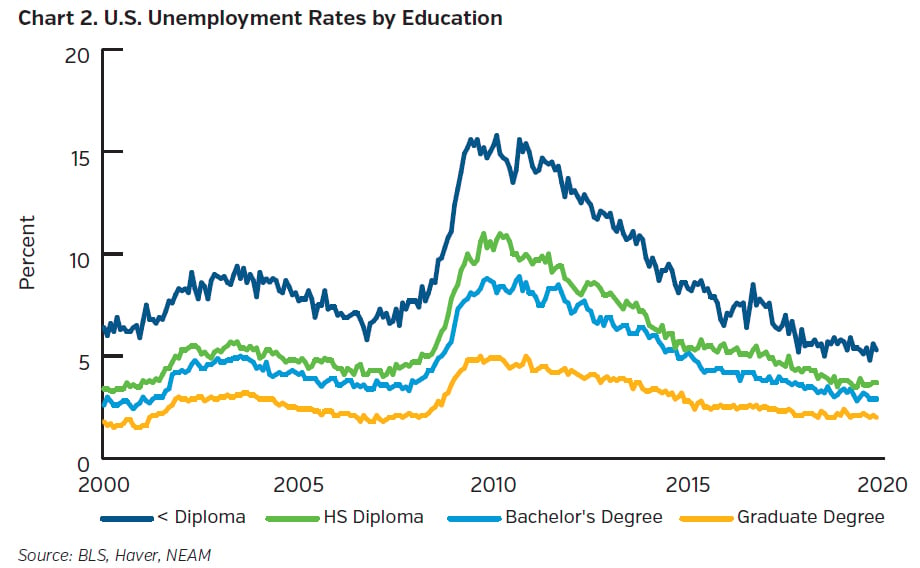

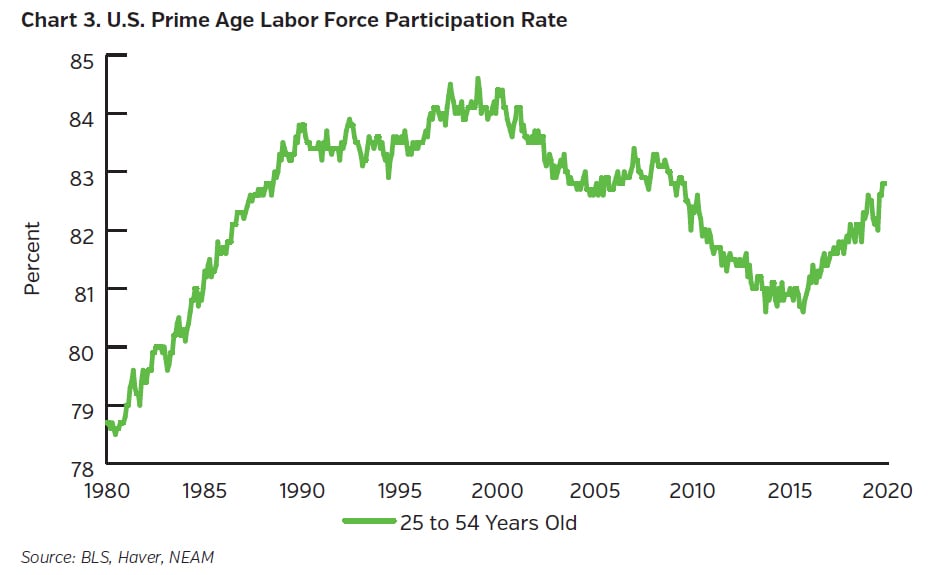

2020 begins with a U.S. economy that is growing real GDP at about 2% with record low levels of unemployment across all educational cohorts (Chart 2). The further development of the service sector in the U.S. has driven job openings to record levels for those with limited educational backgrounds. Today, if you truly want to work you should be able to find a job. It might not be your dream job but it will come with a paycheck. In addition, the U.S. Prime Age (25-54) Labor Force Participation rate is at a decade high of close to 83% (Chart 3) which has the effect of keeping wage gains only slightly higher than the rate of inflation. We would not expect this to change in the near-term. With a U.S. economy driven two-thirds by consumer spending, employment, wage gains and a healthy household balance sheet are significant drivers of overall growth.

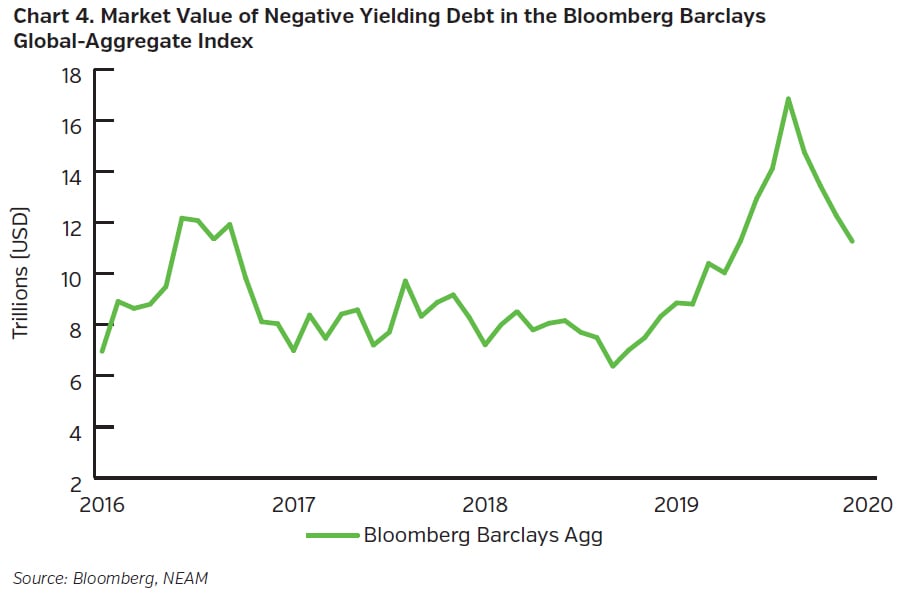

Another key driver of interest rates and capital markets’ behavior is global monetary policy. Unlike the past, today’s central bankers make a strong effort to be transparent about the future path of interest rates. Should inflation remain well behaved, we would expect monetary policy to continue to be accommodative across all major central banks for the foreseeable future. Although spreads in Europe on sovereign bonds have recently been narrowing to Treasuries, the era of negative rates will continue. Policies that were once considered unconventional have become the status quo, distorting asset prices and pushing investors to less liquid and riskier investments. One quarter of the world’s sovereign debt is trading at negative market yields (Chart 4). This will continue to drive foreign investors to the U.S. capital markets in the search for yield. We expect corporate bond spreads in the U.S. investment grade market to remain well anchored this year. Unlike the corporate sector, investment policy restrictions and general product knowledge preclude many foreign investors from investing in the U.S. structured securities market. We believe this sector should provide opportunities to generate attractive book yield and risk adjusted total returns for our insurance company clients.

Lastly, as we enter year 11 of this economic expansion (now the longest on record), the thoughts of recession are on every investor’s mind. Historically the catalysts for a recession have fallen in to three areas: a spike in commodity prices (typically oil), excesses (“bubbles”) in financial or real assets and monetary policy misjudgments. We see few signs that the U.S. is headed for a recession in the near-term. Although corporate debt levels are elevated and oil prices could spike around increased geopolitical risks, there are mitigating factors to each. Interest rates are low so debt service coverage levels are more manageable despite elevated overall debt levels. With the U.S. now a net exporter of oil, we are far less dependent on the Middle East for our oil supplies. As mentioned earlier, monetary policy both in the U.S. and abroad appear to be accommodative for the foreseeable future. Our base case probabilities for a recession this year are in the 25% area, driven largely by the longevity of the current expansion.

Key Takeaways

- The levels of uncertainty in global capital markets should remain high in 2020.

- Maintain liquidity to take advantage of any market dislocations driven by heightened political and policy uncertainty.

- Interest rates should remain fairly well anchored with a slight upward bias from today’s levels. Maintain duration position close to benchmark.

- Demand for yield and spread product should remain strong.

- Our probability of recession this year remains about 25%.