Executive Summary

This issue of General ReView starts off with the highlights of the statutory operating and investment results and trends of the U.S. Life insurance industry for the last 10 years. The Portfolio Details’ section then focuses on fixed income sector trends and market statistics (durations, spreads, NRSO ratings, etc.). These historical market statistics are maintained by GR–NEAM in a proprietary database and are not publicly available.

2013 proved to be satisfactory for the U.S. Life insurance industry, which continued to post favorable statutory operating results for yet another year. Despite the challenging and competitive environment, the industry managed to produce improved underwriting and investment results.

The U.S. Life industry continued to extend duration while also simultaneously reducing the credit quality of the fixed income portfolio, in order to enhance overall investment returns. However, the industry has cautiously sought to limit the extent of this additional interest rate and credit risk by primarily extending the durations of only highly rated (AAA and AA) bonds in their portfolio. Allocations to alternative investments also continued to rise but remained highly concentrated among large insurance companies.

Financial Statement Summary

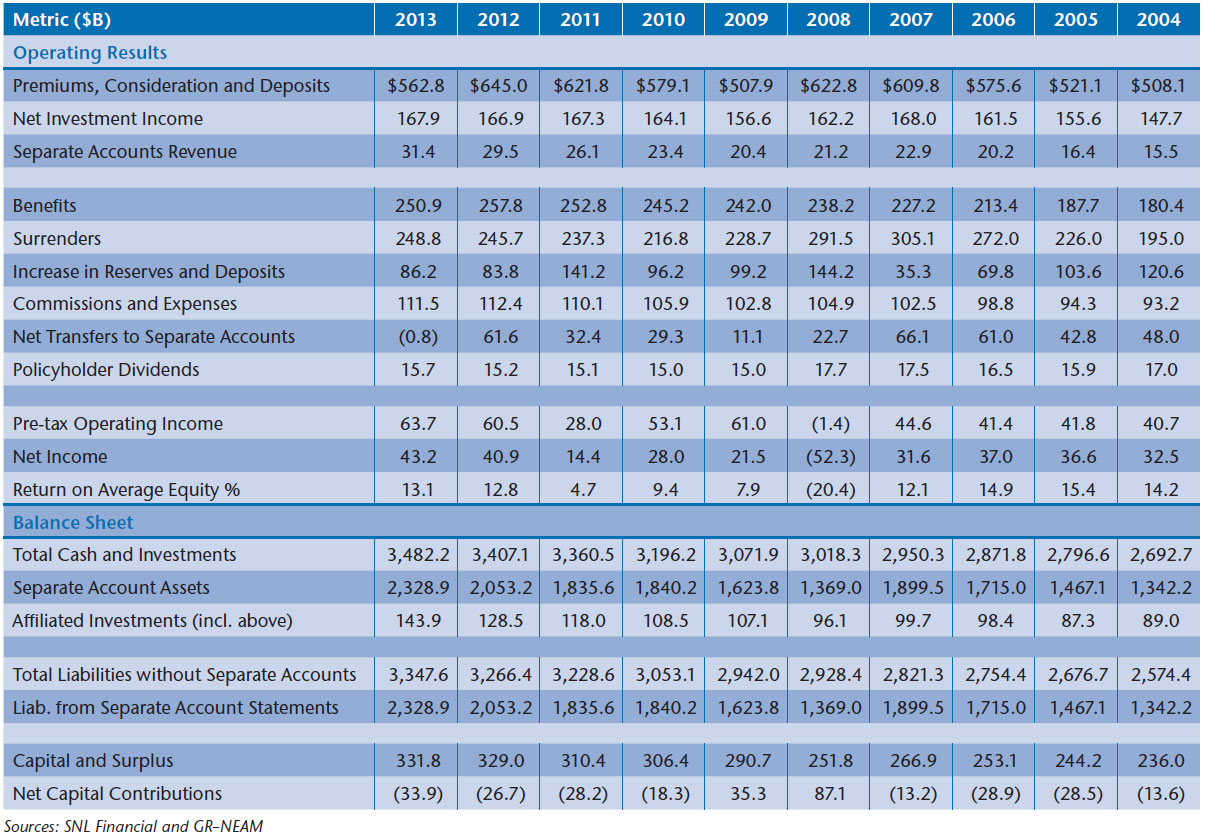

Table 1 provides a 10-year history of select statutory metrics for the U.S. Life insurance industry. Although overall premiums and deposits declined by 13%, the industry’s total net income increased by 6% in 2013 as compared to a year ago. The revenue reduction in 2013 was driven by reduced premiums from life, annuity, and accident and health businesses. The overall premium reduction in group annuity business can particularly be attributed to the two large pension risk-transfer transactions (of about $30 billion) executed by Prudential Financial in 2012.

The favorable benefits reduction in 2013 was partially offset by the minor increases resulting from surrenders and reserve changes, while net transfers to separate accounts reduced significantly to negative $0.8 billion in 2013, from $61.6 billion in 2012. However, 2012’s large positive transfer was particularly skewed by Prudential Financial’s pension risk transfer transactions. The negative transfer in 2013 was primarily driven by the annuity line of business in which the individual annuity segment experienced lower than average transfer to separate accounts while the group annuity segment underwent significant negative transfers. These negative transfers to separate account and favorable underwriting results more than mitigated the impact of revenue reductions. As a result, the overall industry’s total reported net income in 2013 reached its highest level over the last decade, and its return on equity reached a new high of 13.1%—its highest level since the 2008 financial crisis.

General account assets marginally increased last year, while separate account assets, thanks to stellar U.S. equity market performance, increased more than 13% in 2013. Overall, total assets for the industry increased by about 45% over the past decade (2004 to 2013).

Table 1. Life Industry Highlights ($ Billions except Return on Equity)

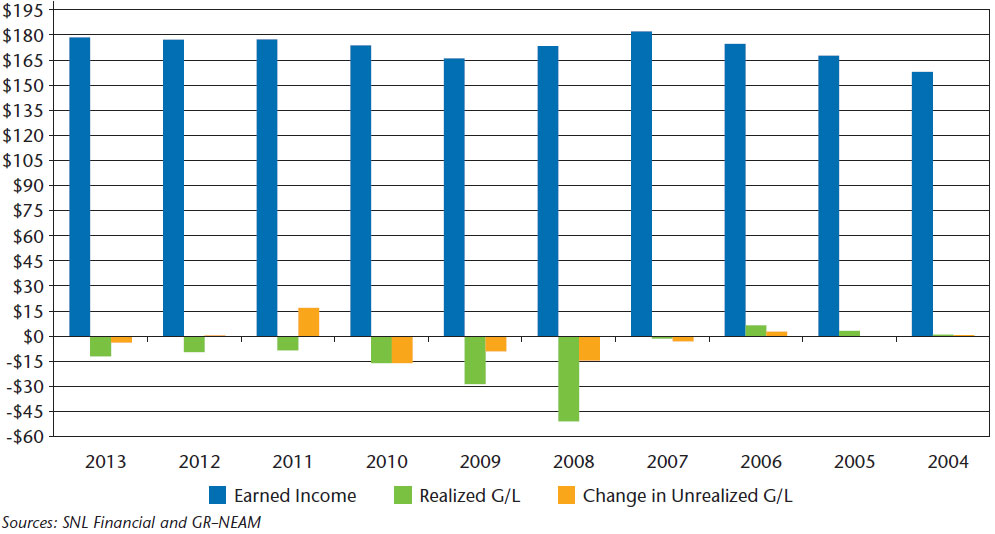

Chart 1 shows the composition of statutory investment results by their key components: earned investment income, realized gains/losses and change in unrealized gains/losses. The earned investment income remained relatively stable for the last three years; however, the income reduction from Bonds have primarily been offset by increased income from “All Other” (see Table 2 below). In 2013 the realized losses of $12 billion and change in unrealized losses of $3.9 billion resulted primarily from derivatives positions.

Chart 1. Statutory Investment Results before Taxes and Expenses ($ Billions)

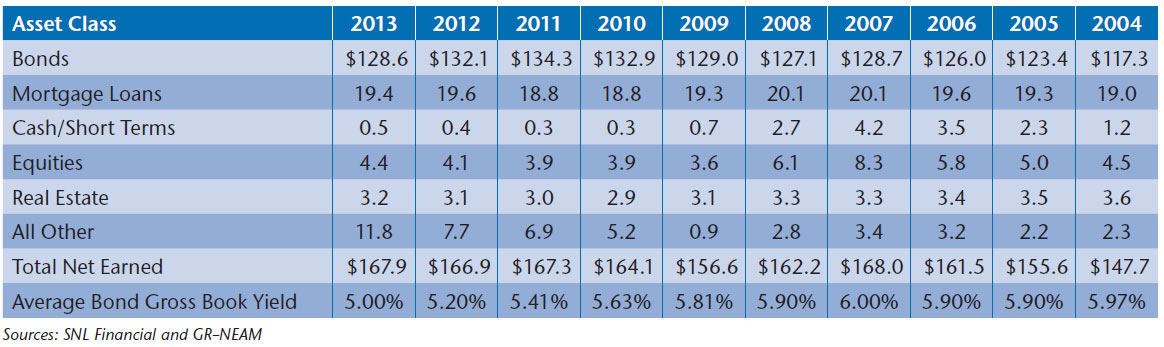

Table 2 shows earned investment income by broad asset classes. Total investment income (net of expenses) increased by $1 billion as compared to 2012 due to the $4.1 billion increase from “All Other” sector and marginal increase of $0.5 billion from Cash/Short-term, Equities and Real Estate combined. The increase was largely offset by the decline in income from Bonds and Mortgage Loans. The average book yields have declined by roughly 20 basis points annually since 2009 following the U.S. financial crisis.

Table 2. Earned Investment Income by Broad Asset Class ($ Billions) and Fixed Income Gross Book Yield

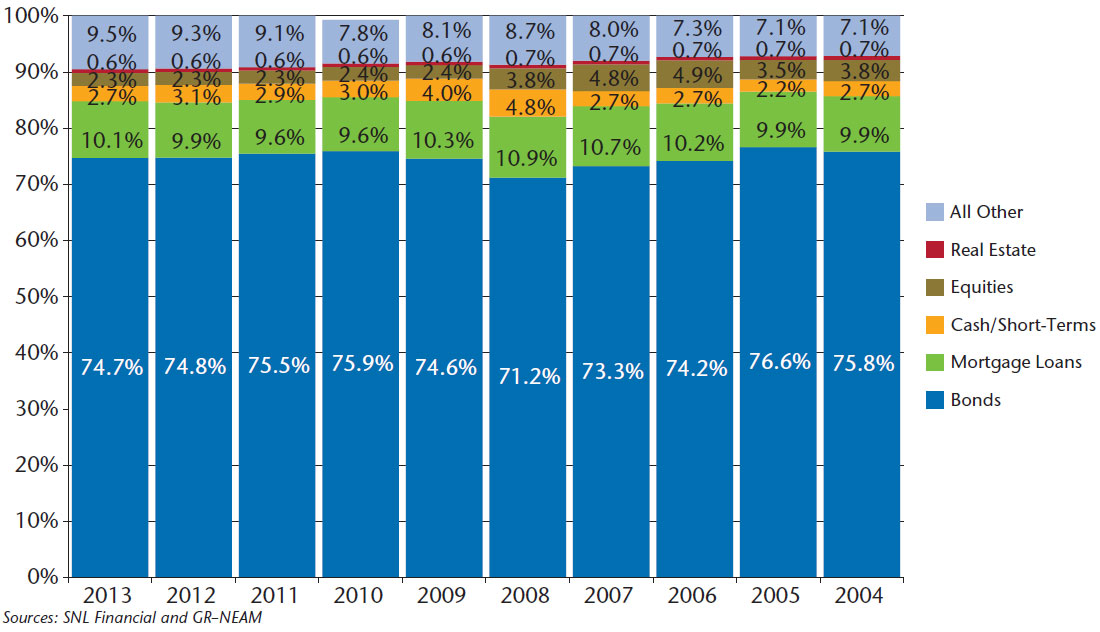

Chart 2 shows that statutory allocations across broad asset classes remained essentially unchanged. In 2013 Life insurance companies slightly decreased their Cash/Short Terms allocation in favor of Mortgage Loans and All Other allocations, which consist of Contract Loans, Derivatives and Other Investments (alternatives). Allocation to “Other Investments (alternatives)” continued to increase but varied widely by companies. These alternatives investments (Schedule BA assets) encompass a wide range of long-term assets and are concentrated amongst the large companies.1

Chart 2. Life Broad Sector Asset Allocation

Portfolio Details

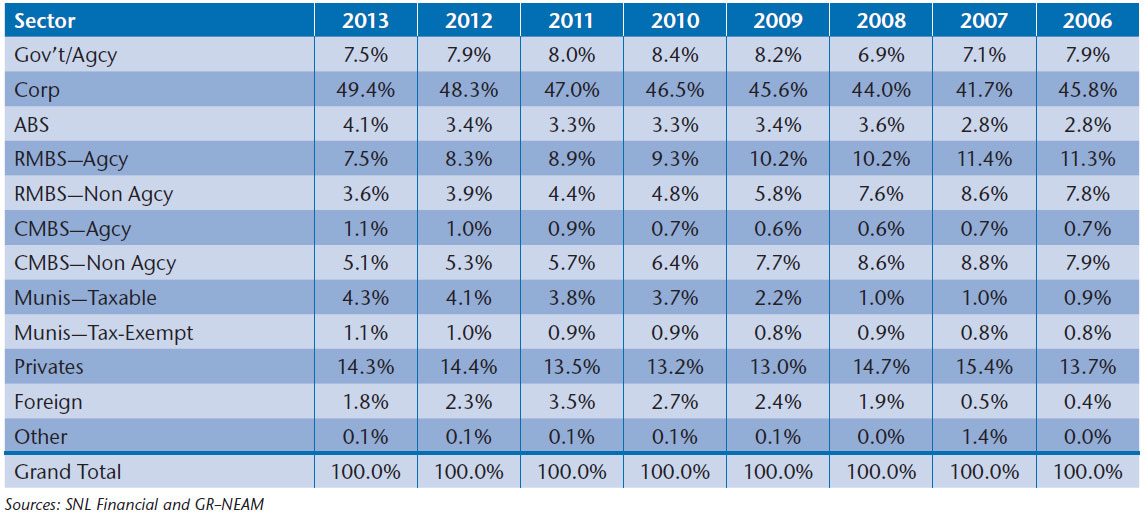

Table 3 displays fixed income sector allocations. We find that the historical trends continued to persist: Corporate bond allocations continued to increase, while RMBS and CMBS allocations continued to decline since the financial crisis, except for agency CMBS. The rise in agency CMBS coincides with a tenfold rise in the sector as Government-Sponsored Enterprise (GSE) guaranteed issuance ramped up to fill the void left by the CMBS conduit market after the financial crisis.

The allocation to municipal bonds, both taxable and tax-exempt, although still relatively small, has increased from shy of 2% in 2008 to more than 5% in 2013. The increased allocation to taxable municipal bonds began in 2009. The passage of the “American Recovery and Reinvestment Act” led to the creation of “Build America Bonds,” which allowed municipalities and municipal authorities to raise debt with the federal government providing a direct subsidy for 35% (or more) of the interest cost.

The minor increase in the tax-exempt municipal allocation was potentially due to the relative attractiveness of long-dated municipal bonds versus other asset classes. In mid-2013, tax-exempt municipal bonds suffered material losses as a result of a significant interest rate increase. Moreover, credit quality issues such as Detroit,

Puerto Rico, etc. placed additional downward price pressure on this sector. Thus, market participants engaged in “crossover trading” to capture the then-prevailing relative value within the tax-exempt municipal bonds.

The allocation to Privates has remained unchanged for the last two years and the ownership of private placement securities remained very concentrated. As noted in our prior editions of General ReView, unlike the statutory Schedule D Part 1A reporting, our “Privates” category excludes any 144A securities that are publicly traded.

The “Foreign” category continued to be dominated by one group, which owned 74% of the industry’s total as of 2013.

Table 3. Fixed Income Sector Allocation

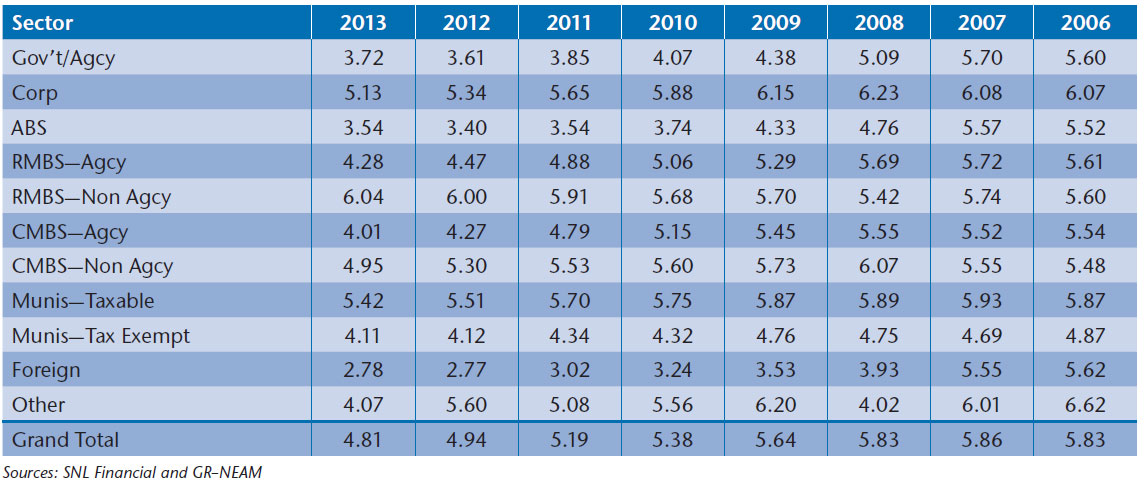

Table 4 displays the option-adjusted durations (OAD) by fixed income sector. To stretch for yield, the industry’s aggregate OAD has lengthened by more than 1.9 years since its lowest level seen in 2008.

The notable jump for agency RMBS reflects the OAD extension in mortgage-backed securities as the 10-year Treasury rate rose by 128 basis points from year-end 2012 to year-end 2013. Similarly, the OAD for the Merrill Lynch Mortgage Master Index increased from 2.15 to 5.53 over the same period. For non-agency RMBS, the lower OAD is likely due to a combination of factors, including higher prepayment speeds, both voluntary and involuntary, and the trading activity aimed at shortening duration within the sector.

The OADs of municipal securities are on average higher than the combined OADs of the overall fixed income sector as long-duration securities within this sector offer more attractive relative value than other sectors.

The “Foreign” category’s relatively high — 14.3 OAD was primarily driven by one group that owned a large amount of long-duration foreign bonds. The OAD statistics are based upon CUSIP level holdings extracted from Schedule D statutory filings and exclude any Bonds held at the holding company level, Derivatives, and “true” Private Placement securities.

Table 4. Fixed Income Sector Option Adjusted Duration (Years)

Table 5 displays book yields by fixed income sector. Across all sectors, the aggregate yield declined by 15 basis points, with Agency and Non-Agency CMBS posting the largest declines at around 30 basis points. The trend of increasing yields, together with the shortening OADs (see Table 4) exhibited in Non-Agency RMBS indicate that the industry has been limiting interest rate risk while taking on additional credit risk in this sector.

The book yield increase in the Government/Agency is partially due to the increase in Treasury rates seen in 2013, particularly during the second half of the year. “True” private placement securities were excluded from the overall book yield calculations.

Table 5. Fixed Income Sector Book Yield (%)—Exclude Non-Rated

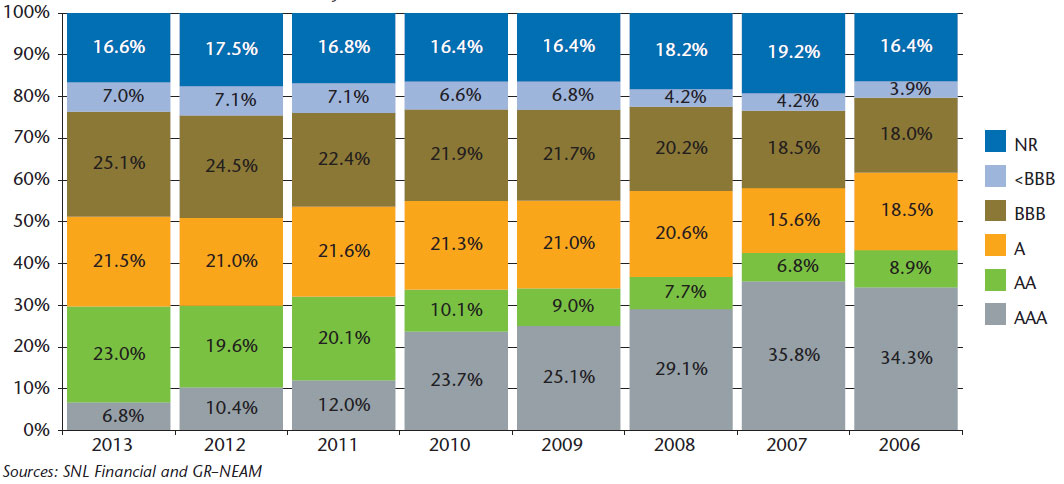

Chart 3 displays trends in fixed income credit quality. Since 2007, the year prior to the financial crisis, allocation to investment-grade securities remained largely unchanged. The High Yield (<BBB) allocation continued to grow from under 4% in 2006 to 7% last year. The Triple-B securities allocation reached 25.1% in 2013, the highest level over the eight-year period. “NR” category is primarily driven by “true” private placement securities, which accounted for 14.3% (see Table 3) of total fixed income holdings in 2013.

As readers might recall in the previous edition of General ReView, June 2013, the 2008 allocation to Triple-A securities reduction was due to corporate and structured securities’ downgrades, whereas the reduction in 2011 reflected Standards & Poor’s downgrade of U.S. government securities. The changeover between the proportion of AAA and AA seen in 2013 was due to migration of AAA to lower-rated securities.

Chart 3. Fixed Income Credit Quality

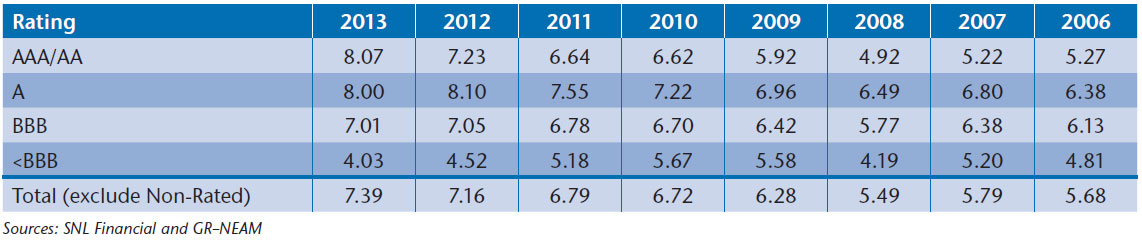

Table 6 displays the option-adjusted durations (OAD) for fixed income securities by credit rating categories. In view of the pressure from rising interest rates, as a result of Fed tapering, the overall bond duration increased marginally from 7.16 to 7.39 in 2013, with the AAA/AA category primarily contributing to the duration expansion. The industry appears to have cautiously managed its interest rate risk and credit risk by selectively extending the duration for bonds in the AAA/AA rating category. Non-rated securities, which accounted for 16.6% of the fixed income holdings in 2013, were not included in the aggregate OAD calculations.

Table 6. Fixed Income Duration by Credit Rating Category (Years)

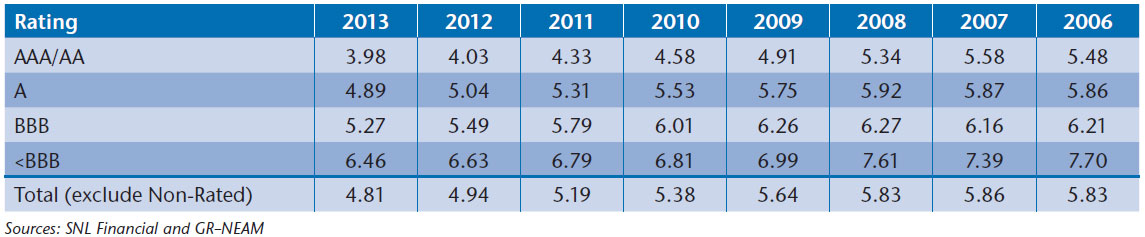

Table 7 displays the book yields for fixed income securities by credit rating categories. Total bond book yields declined by 5 to 22 basis points across all rating categories with an aggregated decline of 13 basis points. Since the 2008 financial crisis, the Life industry has experienced yield declines of around 100 basis points with AAA/AA rating category exhibiting the largest reduction of 135 basis points.

Table 7. Fixed Income Book Yields by Credit Rating Category

Summary

The U.S. Life insurance industry had another year of favorable statutory operating results in 2013 and the overall return on its equity holdings reached a new high since the 2008 financial crisis.

The broad sector asset allocations of the industry have largely remained unchanged. The overall industry has continued to reduce its exposure to RMBS/CMBS and increase its allocation to corporate bonds and municipal bonds, with respect to its fixed income portfolio. The allocation to municipal bonds, both taxable and tax-exempt, although still relatively small, has more than doubled from under 2% in 2008 to more than 5% in 2013.

To cope with the challenging low interest rate environment, the Life industry has invested in longer duration and lower credit quality fixed income securities. Even with a duration extension of 1.9 years, the book yield for the industry still dropped by 100 bps since 2008. The Triple-B securities allocation reached a new high in 2013 while High Yield (<BBB) allocations has stayed level for the past three years. While the overall bond portfolio duration has increased, durations of single A and lower-rated fixed income securities continued to fall as the industry has sought to limit interest rate risk on lower rated securities.

Allocation to “Other Investments (alternatives)” has continued to increase. In 2013 the reduced earned investment income from bonds was primarily offset by the increased investment income from this “alternatives” category. However, the results did vary widely among individual companies.

In a future issue of General ReView, we will present findings from an in-depth investment analysis by Life industry segments (Life, Annuity, and Diversified), Health industry, and fixed income securities transactions summaries. We welcome your feedback and comments. In particular, if you would like to receive a comparative review, please do contact us.

Endnote

1 Please see General ReView Issue 59—Alternative Investments: Who Owns What?