A Global Problem

It’s no secret that developed nations around the world are collectively wrestling with the unenviable dilemma of aging populations, rising entitlement costs, and paltry economic growth. Amidst this, government pensions have come under increased focus as central banks around the world suppress interest rates. A study by Citi estimates that the “total value of unfunded or underfunded pension liabilities for twenty OECD countries is a staggering $78 trillion.”1 State and local governments (SLGs) in the U.S. are also party to this global quandary. In this issue of Quick Takes, we will put into context the pension funding challenge facing SLGs, most of which also issue municipal bond debt. Why does this matter? Because pension liabilities are pragmatically as high a priority as any other claim on state and local tax revenues.

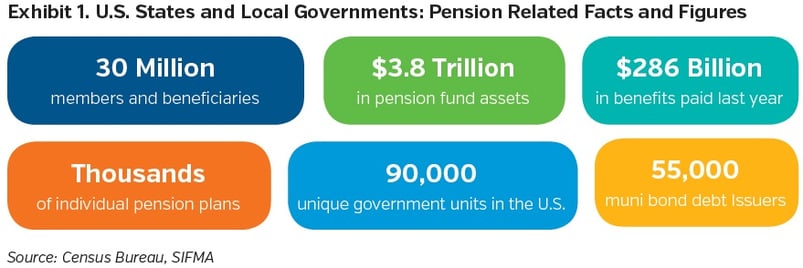

Unlike a single-payer retirement scheme such as Social Security, the pension landscape at the SLG level is far more fragmented (Exhibit 1), and funding conditions are highly heterogeneous (despite perceptions to the contrary). As such, it would be a disservice to paint the entire sector with the same brush, so we will focus SLG pensions in the aggregate. (We will defer conversation on other arguably “softer” SLG obligations, such as retiree healthcare, capital improvement needs, contingent liabilities, etc.)

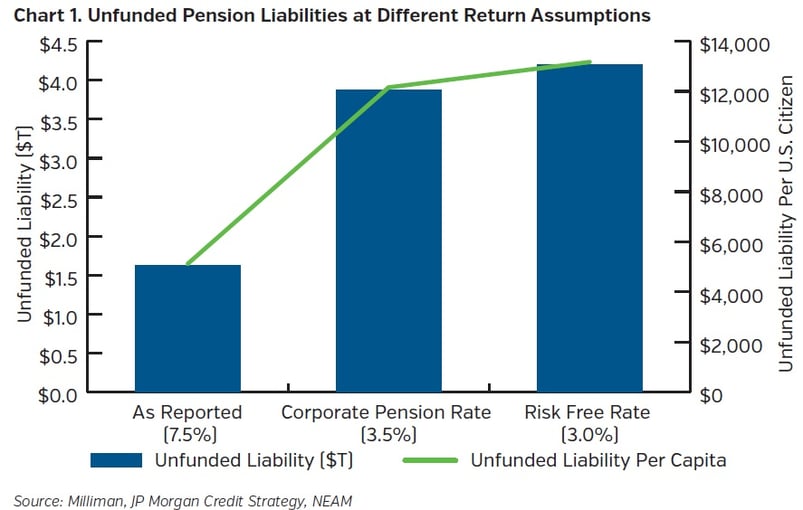

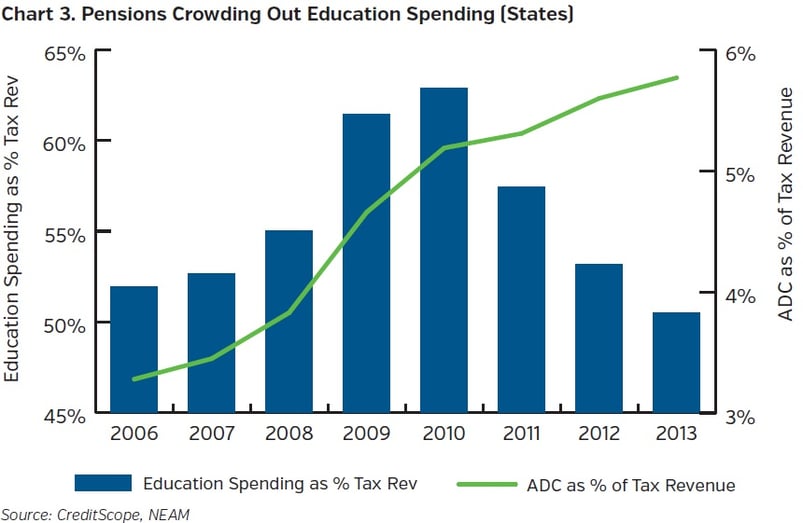

A leading subject of debate in the public pension space is the discount rate (investment return assumption). The median discount rate for the largest public pension plans is currently about 7.5%,2 which is about equal to trailing 20-year average returns.3 This puts SLG pensions at a 70% funded ratio in the aggregate, with a range of 22% to 117%.2 Some argue, however, that 7.5% return assumptions are too high given the backdrop of slow global growth, elevated financial asset valuations, and depressed bond yields. In fact, one could argue that public pension plans should use a risk-free discount rate because the benefit is perceived to be risk-free. Either way, the appropriate discount rate is a matter of public policy, but most observers agree that current assumptions are too optimistic. Reducing the discount rate, however, is easier said than done. For every 1% reduction in investment return assumptions, liabilities climb 9% to 12%,2 which results in increased annual costs and “crowding out” of other SLG expenditures.

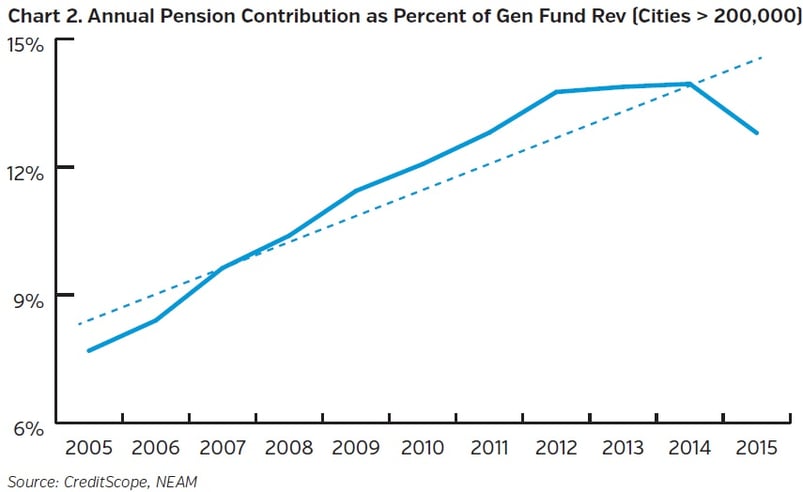

Actuarially Determined Contributions (ADCs) for municipalities are akin to credit card payments for consumers, with a few more moving parts. Holding all other factors constant (mortality tables, investment returns, etc.), meeting the ADC payment consistently should improve funded ratios over time. For the past decade ADC costs have risen at a rate faster than overall revenue growth, resulting in cuts to other programs. For example, over the past ten years, ADCs have risen from 7.5% of own-source government revenues to 13% for large cities.4 ADC costs vary greatly as well, from 5% to 45% own-source government revenues.5 In most cases, ADC costs are not overly burdensome, but stakeholders (lawmakers, taxpayers, pensioners, investors, et al.) should recognize the trajectory is unsustainable in the long-term, and seek out reasonable solutions.

Nothing Disinfects Like Sunshine

SLG pensions got far less airtime just 10 to 15 years ago, but progressively higher costs and lower funded ratios have since grabbed the public’s attention. Stakeholders, however, are arguably as tuned in to the issue as ever before. Investors are penalizing weak issuers, credit rating agencies have become more critical, and GASB pension reporting standards have been overhauled, finally. Policymakers too are keenly aware of the issue and are adjusting accordingly. In fact, there have been literally thousands of pieces of legislation floated in recent years6 to put SLG pensions on better footing. Things move slowly in government however, and absent a crisis, change doesn’t come quickly or easily. We expect the SLG pension topic to remain front and center in coming years, which should force more difficult decision making.

As the debate continues to evolve, we remain vigilant in terms of managing SLG pension-related risk in managed municipal bond portfolios. We continue to put stock in the durability of the defined revenue bond pledge (i.e. essential service revenue bonds) while deemphasizing the most at-risk corners of the market. However, pension risk cannot be outright avoided in the municipal bond market, nor should it be. As always, we view pensions as a component of an overall credit profile, along with a universe of other dynamic factors. Accordingly, we are willing to assume a degree of pension risk, so long as we are being adequately compensated.

- Underfunded pensions are a global issue

- SLG pensions consuming more resources

- Return assumptions arguably too high

- Stakeholders aware of the issue and progress being made (albeit slowly)

- Participation in the muni market involves an assumption of pension risk

- Risk can be mitigated through diligent credit work and proper sector selection

- Pension risk varies considerably between cities, states, et al.

Endnotes

- Boyle, Kathleen. "Citi GPS: The Coming Pensions Crisis." Citi, Mar. 2016.

- Sielman, Rebecca A. "2016 Public Pension Funding Study." Milliman, Inc., Sept. 2016.

- Martin, Timothy W. "Why Pensions' Last Defense Is Eroding." The Wall Street Journal. N.p., 25 July 2016. Web.

- CreditScope Data, Cities with populations > 200,000

- Munnell, Alicia H., and Jean-Pierre Aubry. "An Overview of the Pension/OPEB Landscape." Center for Retirement Research of Boston College, Oct. 2016.

- "Pensions and Retirement State Legislation Database." National Conference of State Legislation. N.p., 7 Mar. 2016. Web.