The S&P 500 was pacing for a relatively uneventful second quarter until the final weeks of Q2 when history was made. Unexpectedly, the people of the United Kingdom voted to leave the European Union and uncertainty rippled through the market. Initially, the British pound collapsed and European equities dropped sharply, led by Italy and Spain. European bank values fell dramatically discounting a drop in earnings power from lower implied economic activity, reduced transaction volumes and net interest margin compression. U.S. equity prices followed a shallower path downward, anticipating downward pressure on the global economy and potential contagion. As uncertainty rose, U.S. safe haven assets attracted capital flows as investors sought safety driving the U.S. 10-Year Treasury yield lower by 30 bps. As bond yields fell to near record lows, the appeal of income oriented equities, already evident through much of the year-to-date period, strengthened further. Subsequently, the mindset broadened throughout the equity market to the positives of lower rates for longer and the corresponding benefit to the discount rate used to determine the equity risk premium. Brexit, a hallmark event, originally deemed to be a bearish game changer, proved to be oddly supportive of equity risk assets, given the valuation benefit from lower sustained rates. As such, the S&P 500 returned 2.5% for the 2Q.

Our attention is now focused on the upcoming earnings season as an important determinant of future stock price behavior. Much debate has surfaced about the eroding quality of earnings, both its underlying message about the health of corporate America and its relevance to forward equity returns. The deterioration in earnings quality is, in part, derived from commodity related businesses, especially energy and materials companies. Additionally, the prevalence of non-operating adjustments has increasingly characterized earnings and contributed to the erosion in quality. The reason for this is twofold: the M&A cycle derived acquisition charges and non-recurring turned recurring add-backs to earnings. Additionally, quality also appears to be inversely correlated with the age of the business cycle; as the business cycle ages, quality worsens, portending a recession. An examination of earnings quality, both its genesis and its implications for equity returns, provides valuable insight for investors.

It is well understood that companies report their financials using Generally Accepted Accounting Principles (“GAAP”) based on standard accounting principles, including accrual accounting, revenue recognition and expense matching. Additionally, many companies supplement their GAAP earnings with Non-GAAP information compiled using alternative ways of representing the company’s performance. This adjusted profit pool, also referred to as proforma earnings, includes subjective adjustments for non-recurring charges, impairments and potential reclassifications. We believe the differential between these two earnings measures serves as the best proxy for earnings quality. When quality is high, proforma (or Non-GAAP) earnings will generally show little variance to GAAP earnings, implying there are few adjustments or write downs occurring. Conversely, earnings quality is generally weaker as the disparity increases.

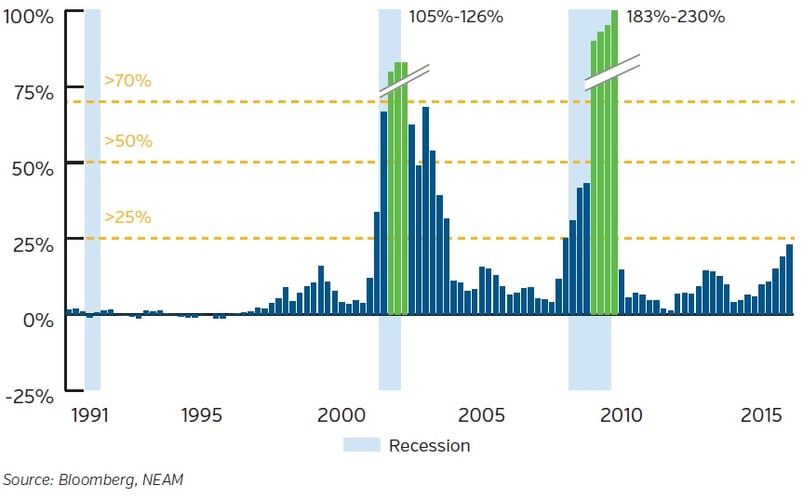

As depicted in Chart 1, the differential has been rising over the last few years, signaling that earnings quality is weakening. In more normalized times, the differential remains relatively well behaved, typically trending well below the 25% level of difference. There are historical periods where the difference rises only to recede a short period later. This suggests that there are natural ebbs and flows, but history does indicate, however, that once the differential surpasses 25%, the deterioration in quality typically accelerates. It is not a coincidence that this has historically coincided with periods of economic recession as stresses build. Today, we are resting just underneath this critical juncture.

Chart 1. Earnings Quality Trends for S&P 500

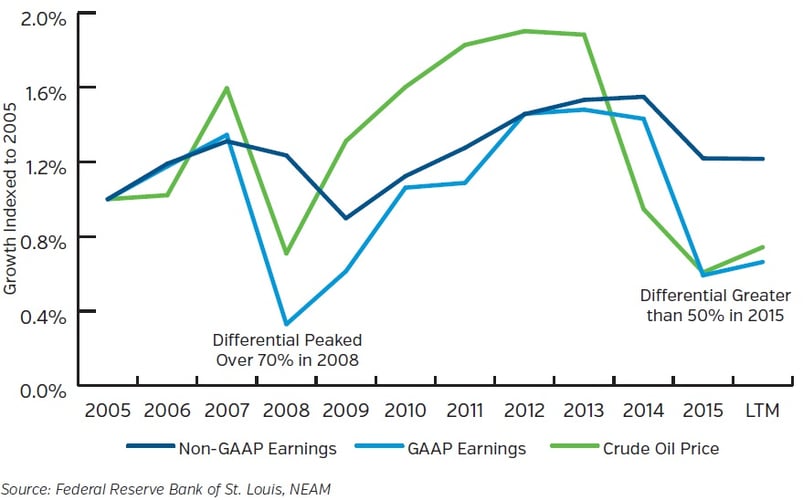

The underlying reasons for the differential merit attention. One significant driver of the current differential is due to commodity volatility and earnings trends for the energy subsector within the S&P 500. Given the sharp contraction in the price of oil, profits from the energy patch are notably lower. Correspondingly, impairments have risen as certain projects are no longer economically viable, and operations have been discontinued. As such, Non-GAAP earnings have skyrocketed for the energy constituents of the S&P 500, diverging greatly from GAAP earnings for this subsector. These trends are captured in Chart 2, which highlights the lower levels of overall profitability on both measures and the wide discrepancy that began to manifest itself in 2014. The widening differential mirrors the deterioration in quality evident in aggregate statistics for the S&P 500 (Chart 1) reflecting the negative effect from the energy sector.

Chart 2. S&P 500 Energy Sector Exhibiting Large Earnings Differential

Another contributing cause is the expanding definition of “one-time adjustments” to include more than truly non- recurring events. In a study conducted on earnings quality encompassing the fifty largest offenders, Morgan Stanley estimated that as many as half of adjustments consist of non-traditional and persistent items including stock-based compensation expense and amortization of intangibles.1 For example, many technology companies use stock based compensation as a foundational element to their business practices, akin to an operating expense, yet classify these charges as non-recurring adjustments. The Healthcare sector, likewise, embodies earnings quality distortion stemming from the impact of non-cash acquisition charges, a legacy of its ongoing merger and acquisition binge.

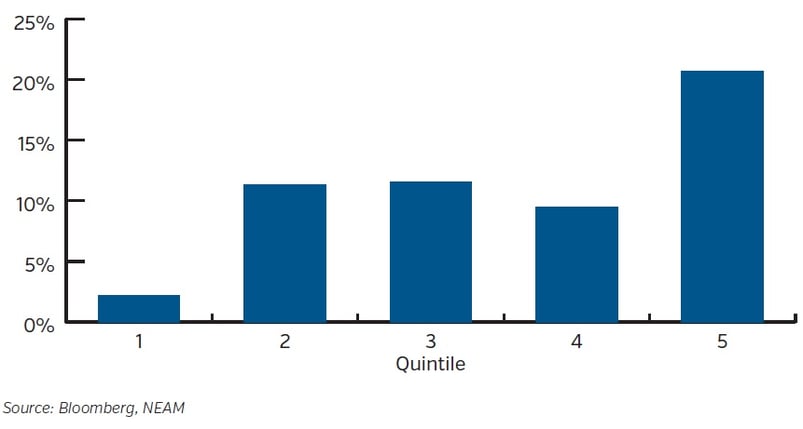

Earnings quality certainly impacts forward equity returns in a normalized environment as shown in Chart 3. When divided into quintiles ranked by earnings quality, the higher quality earnings have corresponded to the best 12 month forward total returns (e.g. Quintile 1 has largest disparity between proforma and GAAP earnings while Quintile 5 has the smallest differential). Conversely, the lowest quality earnings quintile posted a much lower level of positive returns. Suffice it to say, investors typically pay more for quality influencing stock returns. Given the current starting point, this may be a headwind for equity prices. As noted earlier, the current backdrop is far from normalized so other factors could be similarly deterministic in the short to intermediate term. However, as fundamental investors, the linkage between earnings quality and stock price performance is paramount over the long run, in our view.

Chart 3. Earnings Quality and Subsequent Annual Total Return

Earnings quality may also provide informational value within the context of the business cycle. Revisiting Chart 1, over the time period studied, earnings quality deterioration typically leads recessionary periods by roughly one year and the proforma to GAAP difference gaps higher as the recession takes hold. Interestingly, the current degradation appeared well in advance of this typical rhythm but has yet to lead to a corresponding economic contraction. That said, this expansion is already the second largest on record and exhibiting aging characteristics (see Outlook: First Quarter 2016: Equity Review “The Aging Cycle”).

Conclusion

We continue to assert that the market resides in a maturing economic cycle with elevated valuations. As Brexit exhibited, there is also growing political uncertainty that is difficult to price into the market. A rise in populism may only intensify deflationary pressures, and the populist mindset may not allow leaders to enact policies to address structural issues. Concurrently, low global growth and high leverage characterize the cyclical environment. Thus, the tug of war between structural and cyclical factors will continue to influence the pricing of risk assets on a macro level. Against this backdrop, we are keen to remain focused on fundamentals such as earnings quality as detailed. We believe quality matters and holds relevance for forward equity returns. While “lower for longer” rates may well have benefits, we believe the quality of the earnings stream matters even more, especially with heightened uncertainty. Overall, we think the environment of low nominal growth, low interest rates and choppy equity markets will continue. As earnings quality becomes more dubious, stock selection matters all the more.

1 Morgan Stanley, U.S. Equity Strategy, April 20, 2016 - “N. America Insight: The GAAP Gap – Does it Matter?”