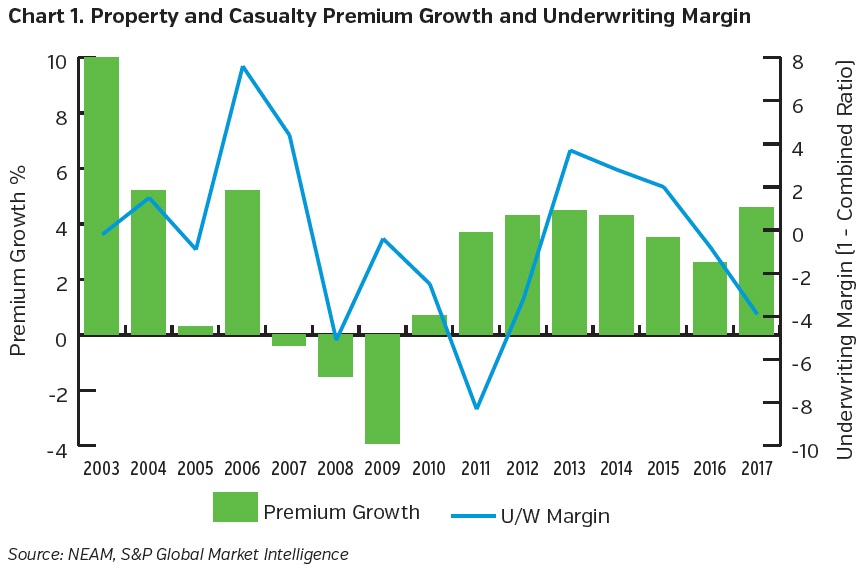

Insurance executives know it’s axiomatic that underwriting results are volatile, reflecting fortuitous events, competitive practices and even misjudgments. Although premium income has recovered from immediate post-financial crisis contractions, underwriting margins once again have turned negative. When combined with low investment income, the industry has netted low single digit returns on equity – potentially less than the cost of capital for some insurance companies. While there are underwriting market leaders, even those that outperform face challenges to their investment operations similar to other industry participants.

CHALLENGES FACED BY INSURERS

There are several changes to the investment environment that will challenge the traditional mindset of insurance investment professionals. These define the New World Order. First, although the reduction in corporate tax rates provided a boon to after-tax earnings calculations, it did little to offset the vagaries of insurance economics. Further, it has almost completely eliminated the after tax return advantages of municipal securities for insurers. For the industry’s previously largest asset class, the tax rate change has hastened the industry’s already declining allocation to municipals from 2008 historic highs.

Rising interest rates, while a panacea to an eventual improvement of earned investment income, might well be the bane of total return fixed-income managers, as the eroding market values which follow will likely test the clients’ bull market induced belief in a “buy and hold” fixed income investing mentality.

Many have championed alternative investments as a cure to the return malaise of traditional or core assets. Further analysis of Schedule BA, the principal depository of alternative investments, shows “unaffiliated” assets’ share of total assets actually declined over the last 15 years. Affiliated investments, requiring more intense active management, drive the reported growth of alternatives on insurers’ balance sheets.

WHAT’S NEXT?

Turning an eye toward the future, insurers are faced with the reality of tax law changes and rising rates. These alone create a need for a municipal bond replacement solution. As capital market credit options lessen, what is your plan for the future? Do you know how that plan will square with your firm’s risk appetite and tolerances, insurance outcomes and stake holder expectations

Visit www.neamgroup.com/insights/highlights to learn more and get access to our full report on industry data. We hope this data will help guide the conversation around your future enterprise approach as you prepare to prosper in a new world order.